Economics

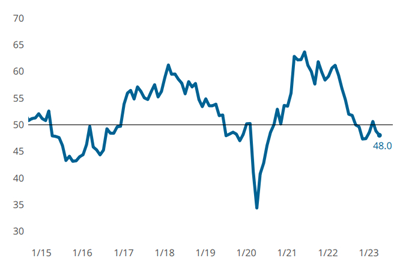

Metalworking Activity Shows Signs of Stabilizing Contraction

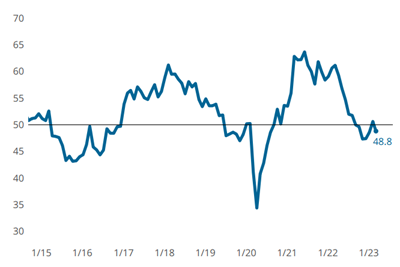

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

Read MoreMetalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

Read MoreMetalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

Read MoreMetalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

Read MoreMetalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

Read MoreMetalworking Activity Stayed Consistent in July

Metalworking activity hung together better in July, with all but one GBI component contracting.

Read MoreMetalworking Activity Contracts With the Components in June

Components that contracted include new orders, backlog and production, landing on low values last seen at the start of 2023.

Read MoreMost Metalworking GBI Components Contracted in May

Four components contracted slightly more than in April, including production, new orders, exports and backlogs.

Read MoreMetalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

Read MoreMetalworking GBI Contracted in March After One-Month Reprieve

February’s call for cautious optimism was well placed…market dynamics in March put a damper on what had been metalworking activity’s modest re-entry to growth mode in February.

Read More

.jpg;maxWidth=300;quality=90)