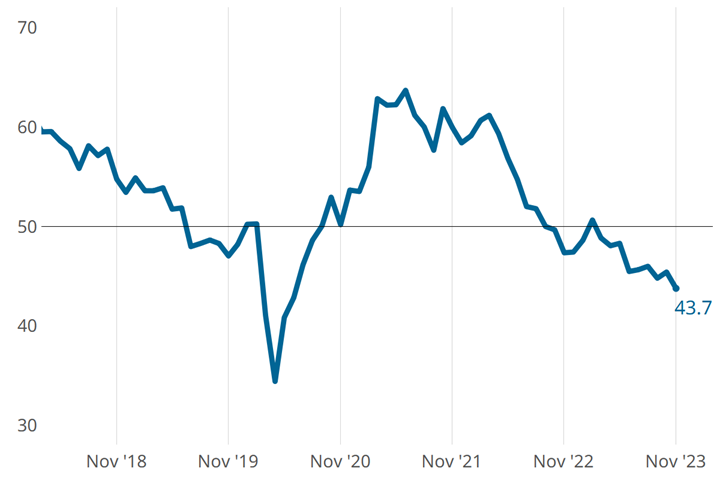

Metalworking Activity Remained on a Path of Contraction

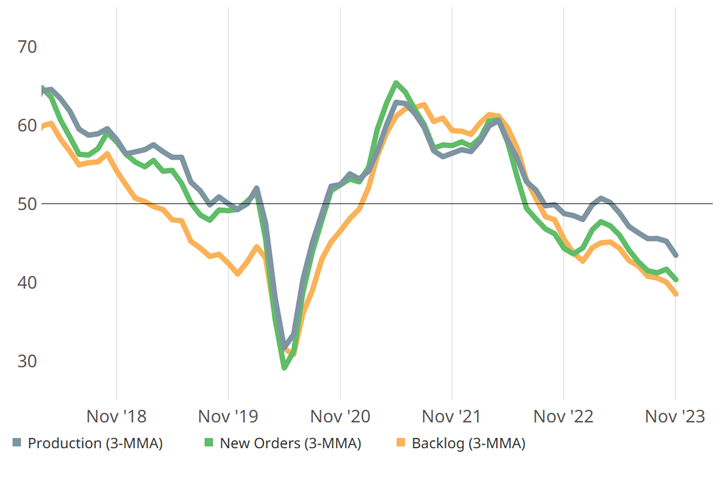

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

Share

The path has not been direct, but the trend is consistent, with metalworking activity contracting since March of this year. November was no different, closing at 43.7, down 1.7 points relative to October.

Steady contraction of three closely connected components — production, new orders and backlog — drove accelerated contraction. Employment held its own, contracting at the same level since its first real contraction in August, still to a lesser degree than all the other components. Exports were similarly steady state in contracting, and supplier deliveries lengthened again in November, but at a slower rate.

The three most direct drivers of metalworking activity posted accelerated contraction in November, which they have done fairly consistently since March of this year (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.