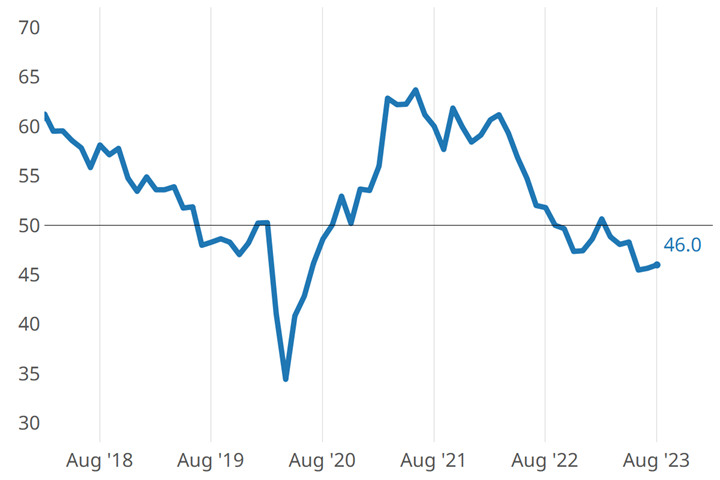

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

Share

Metalworking activity contracted again in August, closing at 46.0, about the same as July’s 45.6 and June’s 45.4. Four of six components contracted faster again in August. The degrees of accelerated contraction are relatively minor, contributing to a mostly stable overall index despite the number of components contracting.

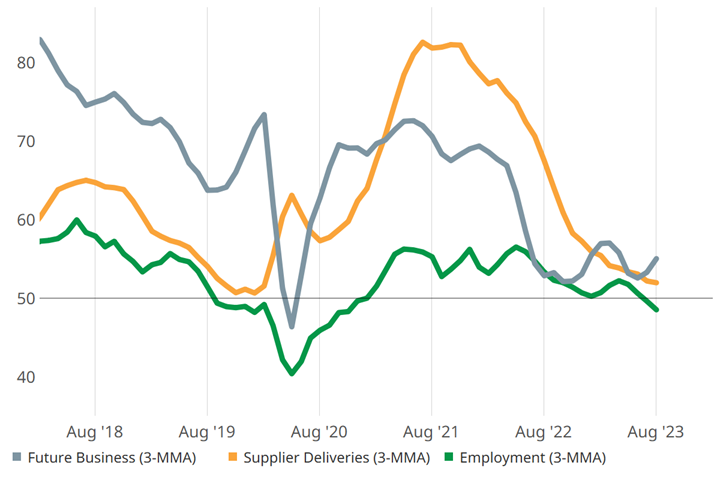

Employment solidly contracted at a faster rate in August, in part correcting for pandemic-inspired shortages that are getting sorted out and reflecting a less bullish economic outlook. Exports are unremarkable, humming along at a consistently contracting rate for four months now. Supplier deliveries were the exception again in August — still lengthening, but at a rate that has been slowing less dramatically each month since March. Future business expectation, a separate but related non-GBI metric, provided encouragement in August, expanding at a faster rate for the second month in a row.

Metalworking GBI in August showed stable contraction. Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

.png;maxWidth=970;quality=90)

.png;maxWidth=300;quality=90)

.png;maxWidth=970;quality=90)