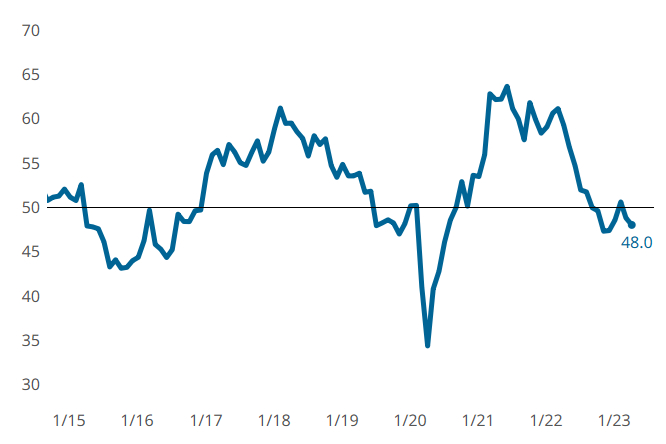

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

Share

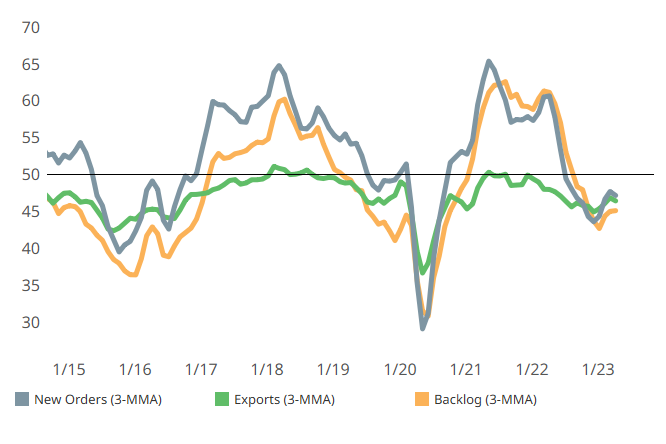

The Metalworking Index closed at 48.0 in April, down almost one point versus March. Similarly, components minimally strayed from March readings in April, with three of the six — new orders, exports and backlog — contracting at the same pace or a bit faster versus last month.

Production, which had crept into expansion in March, was flat in April. Supplier deliveries continued to lengthen more slowly and employment continued to expand more quickly in April. Both are potentially holdovers from Covid-inspired supply chain issues and labor shortages, respectively.

A separate but related non-GBI metric, future business, still expanded, but at a slower rate in April — in fact, at the slowest rate since July 2022. The brakes appear to have been put on metrics that just recently had been moving in ‘favorable’ directions, which is disappointing. At the same time, it is encouraging that the shift was not more dramatic.

Metalworking GBI in April looks a lot like March, contracting for a second month in a row. Photo Credit: Gardner Intelligence

New orders, backlog and export activities contracted about the same in April as March. (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.