Most Metalworking GBI Components Contracted in May

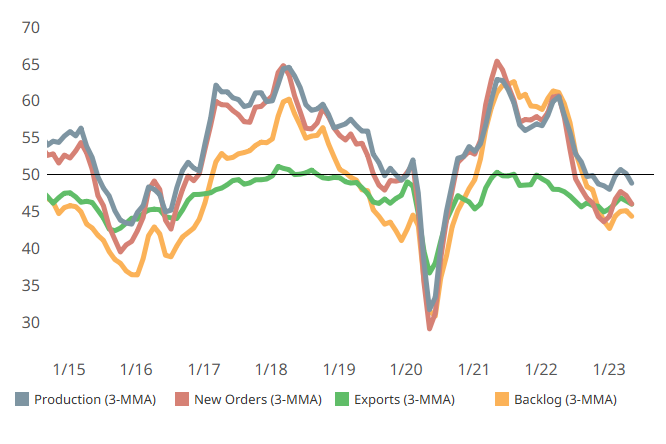

Four components contracted slightly more than in April, including production, new orders, exports and backlogs.

Share

ECi Software Solutions, Inc.

Featured Content

View More.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

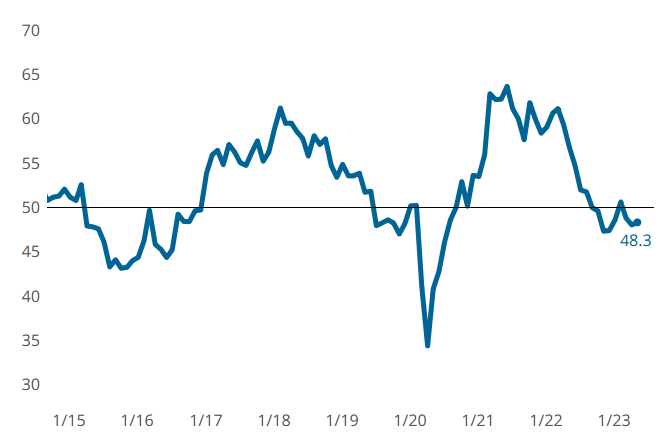

View MoreThe Metalworking GBI closed at 48.3 in May, about the same as April’s 48.0. Overall, Metalworking activity held its own in May despite contraction of most components. Four components contracted slightly more than the month before, including production, new orders, exports and backlog, each nearing a low last seen in December 2022 or January 2023. Supplier deliveries lengthened more slowly again in May while employment expanded again, but at a slightly slower pace.

Separate but related non-GBI metric, future business, expanded again in May, but at a slower rate, similar to that of December 2022.

If April-May trends continue, all components will find their way to contraction in the next three months or so.

Metalworking GBI in May looks a lot like April, contracting for a third month in a row. Photo Credit: Gardner Intelligence.

Production officially contracted in May, along with new orders, exports, and backlog (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence.

Related Content

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

.png;maxWidth=150)