Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

Share

Metalworking activity still contracted in October, closing at 45.4, one-half the distance to a recent high in August (46.0) and slightly up from September’s 44.8.

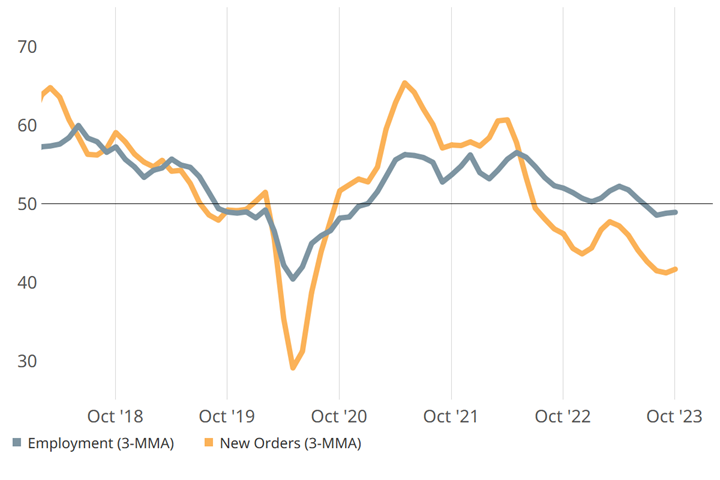

October marks metalworking activity contracting for a full year now, barring just one isolated month of reprieve in February 2023 (flat index = 50). Almost all components contracted again in October, with most of them stabilizing relative to September. Supplier deliveries is the one holdout, but trends suggest it is headed for contraction as well. While still contracting, new orders saw a slight uptick in October which may be related to employment stabilizing, while also residing in a contracting phase.

New orders posted the slightest of upticks in October despite contracting again. A third month of stable employment contraction may be a sign that shops are buying some time to see how orders shake out (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

.jpg;maxWidth=300;quality=90)