Published

Metalworking GBI Contracted in March After One-Month Reprieve

February’s call for cautious optimism was well placed…market dynamics in March put a damper on what had been metalworking activity’s modest re-entry to growth mode in February.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

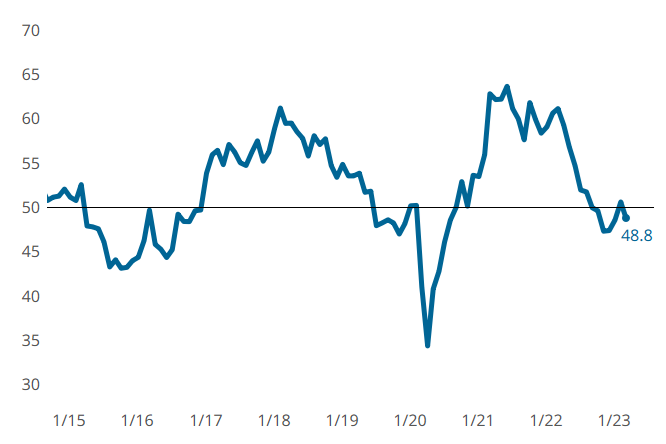

- The March index closed at 48.8, down almost two points, posting about the same index as January.

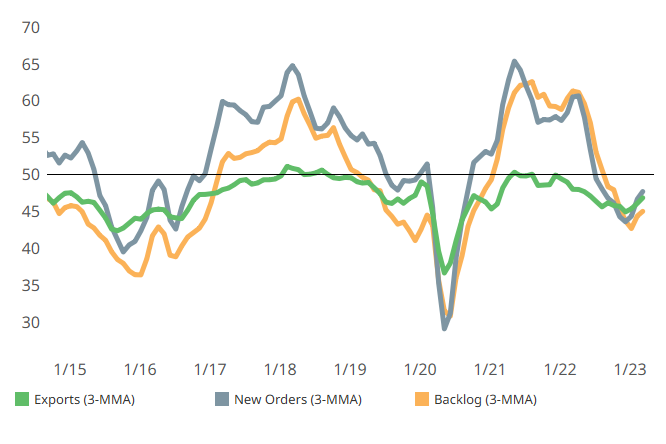

- Five of six components continued to move in directions of contracting slower or growing faster (employment) on a three-month moving average.

- The same types of movement in the same components were associated with a GBI that had tiptoed out of the (contraction) woods last month. Caution appears to have crept back in March.

- Additional evidence of caution comes from the future business metric (separate from GBI calculation.) It had been expanding, reflecting growing optimism each month since December 2022, but leveled off in March.

- Production slid into growth mode (just barely…) in March for the first time since August 2022.

- New orders, exports, and backlog still contracted in March, again at a slower pace.

- Supplier deliveries continued to lengthen more slowly as supply chain woes wane.

- It appears that while optimism was tempered in March, pessimism was kept at bay to net a month of solid metalworking activity.

Metalworking GBI contracted again in March after a one-month reprieve.

More of the same (slowing contraction) for components, new orders, exports, and backlog is associated with metalworking’s modest GBI downturn in March.

More of the same (slowing contraction) for components, new orders, exports, and backlog is associated with metalworking’s modest GBI downturn in March.Related Content

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.