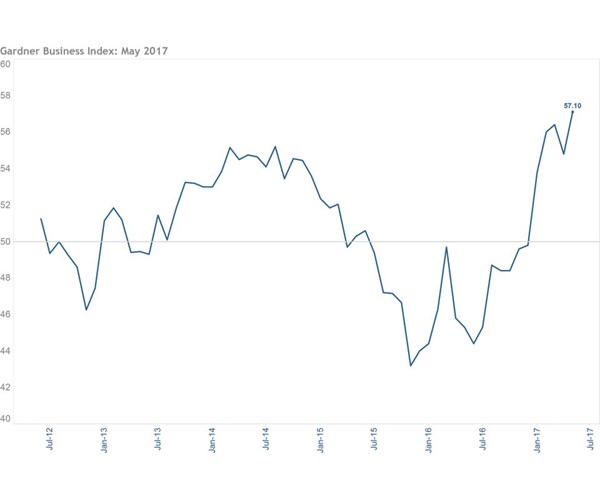

Gardner Business Index: Metalworking May 2017 – 57.1

Production drives the overall industry to its highest point in more than five years.

Share

Registering 57.1 in May, the Gardner Business Index for metalworking recorded its highest value yet in 2017, a value that has not been surpassed in more than five years. The production subcomponent, a primary driver of the overall index, jumped at the beginning of the year and recorded another strong month, sustaining its 2017 average value of greater than 60. This component has increased by more than 50 percent over the last 12 months.

The new orders component of the index increased by 20 percent between October 2016 and April 2017, and it is one of the strongest indicators of a strengthening metalworking market. In the first four months of this year, the new orders subindex recorded an average value of more than 59. This is consistent with our separate index of business expectations, which notched another month of elevated results in May.

The exports and material prices components are dampening some of the overall index’s optimism. Exports, which have consistently been below 50 since 2014, essentially remained unchanged, having recorded a value of 49.6 in April. Gardner Business Intelligence will be watching currency markets very closely in 2017 for a multitude of reasons, including the progression of Brexit, America’s changing stance on free-trade and trade agreements, and the government’s involvement to make markets fairer for American companies. Any and all of these political factors could generate unexpected shocks to currencies, and thus import and export dynamics and volumes.

Sharp annual increases in material prices have been observed in both the metalworking index and U.S. Producer Price Indexes (PPI) data. The U.S. Producer Price Index for Metalworking Machinery Manufacturing shows prices are moving slowly upward (+0.3 percent in the year ending April 2017) but much more slowly than the rising costs of the inputs to produce machine tools. Increases in labor and metal are currently rising far faster than the price of machine tools. When these increased costs are finally passed through to machine tool consumers, expect to see price increases of several percent.

Our view of the future for the machine tool Industry is very bright. A recent study by the Congressional Budget Office indicates that between 20 and 40 percent of future GDP growth in the U.S. will come from workforce growth, with the remaining 60 to 80 percent coming from productivity growth. This productivity growth will result from better, smarter and more capable machines, computers and other tools that enhance the abilities and productivity of workers. As increasing wages and a limited labor supply being to make themselves felt in the economy, machine tool consumers should consider working closely with equipment makers to find ways to meet their growth objectives. Now is truly an important time for both pre-existing, and new machine and machine tool consumers to be collaborating with manufacturers to create the next generation of machine tools to power the nation’s economic growth in an ever-growing number of industries.

Related Content

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.jpg;width=70;height=70;mode=crop)