Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

Share

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View More.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

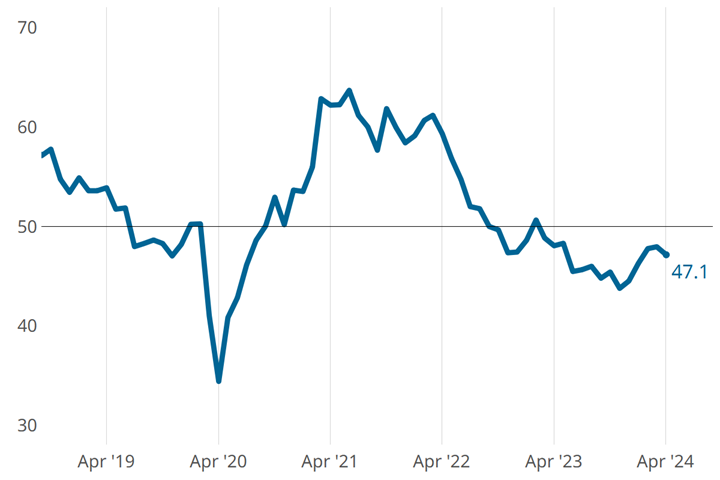

View MoreGBI: Metalworking activity contracted at a slightly faster rate in April after stalling its upward movement in March. April closed at 47.1, almost a full point lower than one year ago (48.0) and down 0.8 points relative to March’s 47.9.

Ups and downs in metalworking activity are typical for the past year, but the interruption after what had been three straight months of slowing contraction merits monitoring, potentially indicating growing conservatism as interest rates and inflation fail to come down.

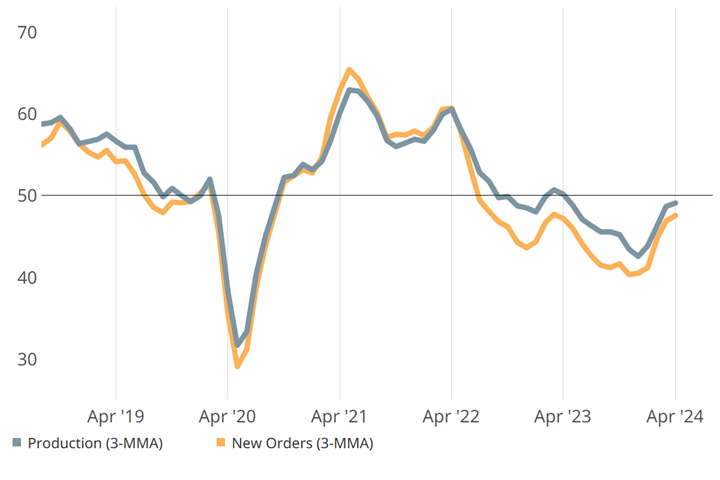

Component-wise, three key ones — new orders, production, and backlog —continued to slow contraction in April, but at slightly slower rates. Production is still within striking distance of 50. Backlog remains significantly more contracted than production and new orders, which is not surprising given the nature of the metric (i.e., new orders have to build up for backlog to trend up.) Employment contracted about the same in April as March, while exports took a little jog down. Supplier deliveries continued to lengthen at a steadily, slightly increasing rate in April. Expectations regarding future business remained positive despite a slight downturn for the first time since October 2023.

The Metalworking GBI contracted a little faster in April than in March. Source: Gardner Intelligence

New orders and production continued to contract more slowly again in April (3-MMA = three-month moving averages). Source: Gardner Intelligence

Related Content

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

.png;maxWidth=150)