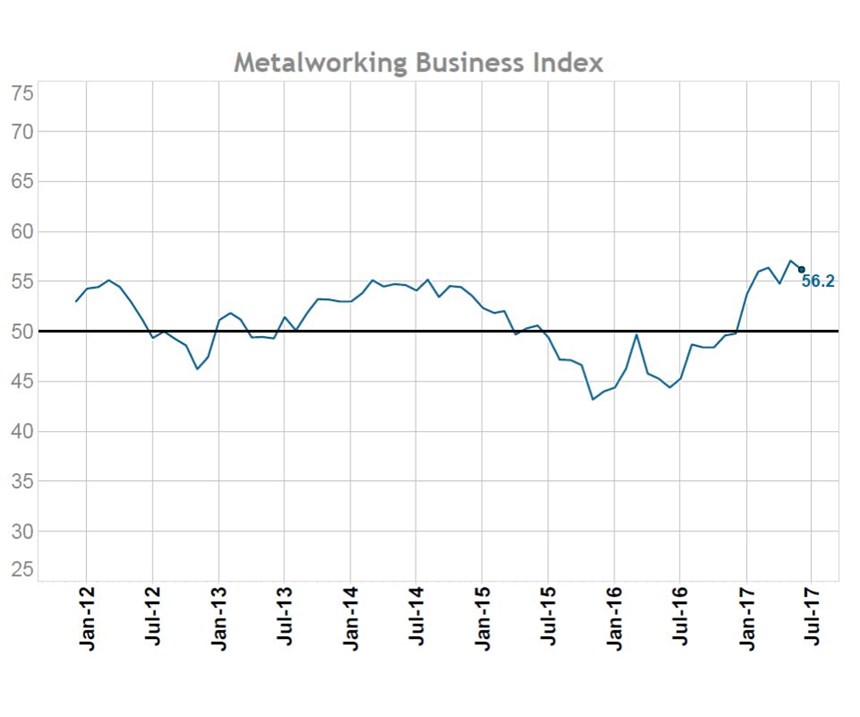

Gardner Business Index: Metalworking June 2017 – 56.2

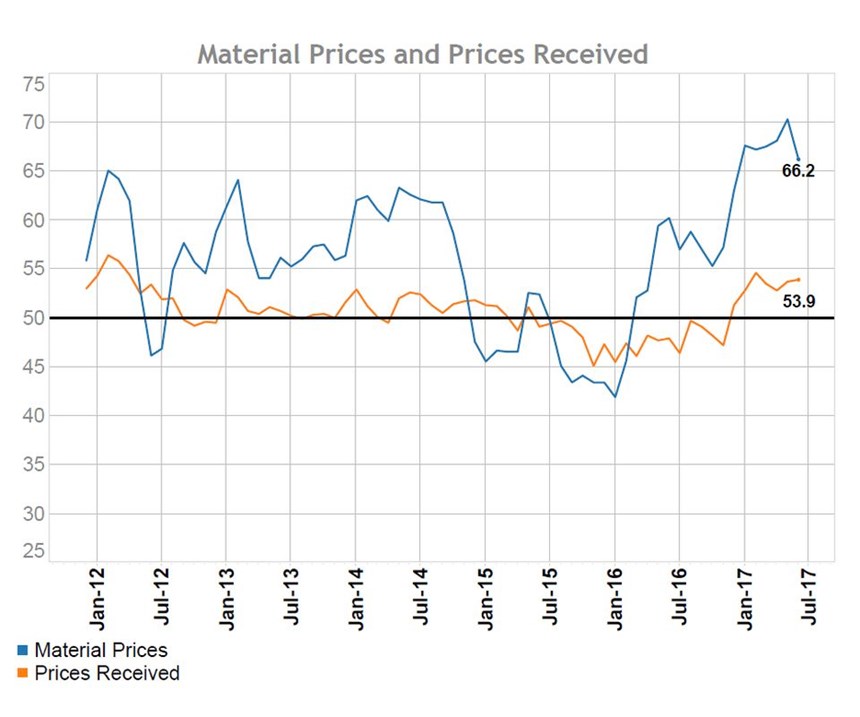

The metalworking industry is closing the gap between costs and prices.

Share

Registering 56.2 in June, the Gardner Business Index for metalworking was down slightly from the previous month, although it remained well above the year-to-date average value of 55.7. This year-to-date performance is an impressive achievement alone and indicative of the turnaround that has been witnessed in the metalworking sector since early 2016, when the index was regularly registering values below 45.

Last month, Gardner Business Intelligence reported on the industry’s growing gap in material prices versus prices received. The data for June show that this gap shrank for the first time since the end of 2016, with material prices falling significantly and prices received holding steady. The historical data show that a similar yet smaller gap also appeared during the years 2012 through 2014 before material prices declined rapidly, allowing operating margins to improve. The prices received index component for June was 53.9, up slightly from its reading one month earlier, while the 12-month rate of change for prices received increased by 8.8 percent.

As inflation generally begins to strengthen across the U.S. economy—largely because of a tightening labor market, which may force wages to rise—we expect that the metalworking industry will find that it has greater ability to pass along more of the material price increases of the recent past to customers.

The production and new orders index components both registered 59.2 in June, indicating continuing industry strength although their readings were down slightly from the prior month. Comparing this month’s results to those from one year earlier highlights the stark difference a year has made in the metalworking industry. The 12-month rate of change for both components was near 25 percent.

Related Content

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.jpg;width=70;height=70;mode=crop)