Share

If you’re in the metalworking business you are well aware of the effects of supply chain disruptions, inflation, and labor shortages all ushered in and/or exacerbated by COVID. Even so, for most of the metalworking industry, business has been pretty good for the last two years. That’s been reflected both in the U.S. consumption of machine tools and in the Gardner Business Index, which has shown positive growth since the last half of 2020. Will this momentum carry us through 2023?

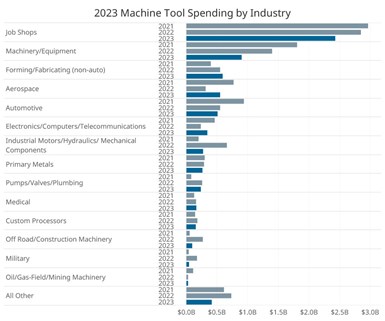

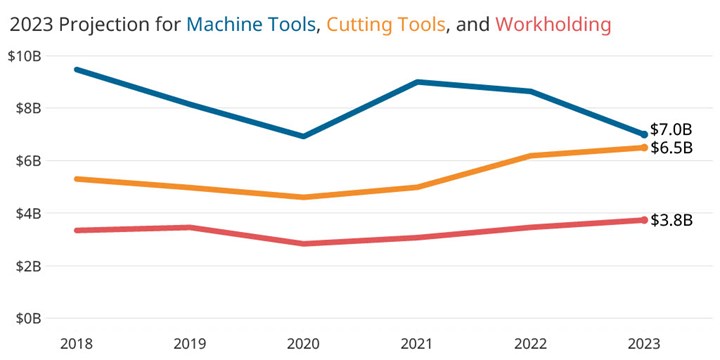

The answer is, it all depends on a variety of economic forces in play and how they could impact your specific business. Economists may disagree on whether there will be a recession next year, but if there is one, most experts concur that it is not likely to be severe, and most industry analysts doubt it will have a major impact on the manufacturing sector, barring extraordinary events. But business in the metalworking sector is slowing and we expect that to continue into next year. According to Gardner Business Media’s Capital Spending Survey, the U.S. market for machine tools will be down some 19 percent in 2023, but that is after a very strong market for the last five years and it will still be at a healthy consumption level of $7 billion. The survey indicates that both the cutting tool and workholding markets will be up next year by 5% and 8% respectively. These markets are important as they help paint a picture of overall metalworking activity beyond capital spending.

We should note that the Capital Spending Survey is not a forecast, but a projection of buyer intent based on responses to a survey conducted in July of this year, a time of significant uncertainty. As testimony to the sentiment during July, a question on the GBI survey that is separate from the index asks about expectations for investing in equipment during the next 12 months. It shows a tick upward in the months since July. Compared to other industry projections, our Capital Spending results are somewhat more conservative on the 2023 outlook, but most industry economists agree that the market will be down next year, if by lesser degrees. Anecdotal evidence from IMTS and other customer and consumer interactions suggest a stronger manufacturing sector than does Capital Spending. According to Pat McGibbon, chief knowledge officer of AMT – the Association for Manufacturing Technology, “Next year we will be down in the first half and likely see modest improvement in the second half of 23 through most of 2024.”

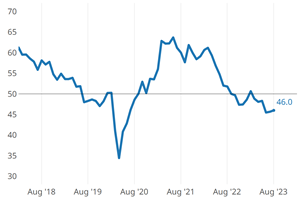

The Gardner Business Index aligns with that general view. The GBI is a diffusion index much like the Purchasing Managers’ Index (PMI) that measures the pace of growth in the metalworking market. A score of 50 indicates a flat market, while scores above 50 signify a growing market and lower scores indicate a shrinking market. The GBI has been in positive territory almost since the beginning of 2017 (with a relatively short drop in the second half of 2019 followed by the COVID drop in 2020) and posted an all-time high in 2021. The growth rate has been slowing for most of this year and currently is hovering near 50.

The Bright Spots

Despite the headwinds of an uncertain general economy, there are significant bright spots in capital spending in 2023. As it has been for the last few years the job shop market will continue to grow and be far and away the largest market for machine tools with almost $2.5 billion in spending. In terms of total spending, the next largest markets will be industrial machinery ($900M), aerospace ($600M), and automotive ($500M). Moreover, smaller plants (<100 employees) collectively will account for a majority of capital investment in many manufacturing categories.

In terms of growth, industries increasing spending next year include:

- Non-auto forming & fabricating

- Aerospace

- Electronics/computers/telecom

- Medical

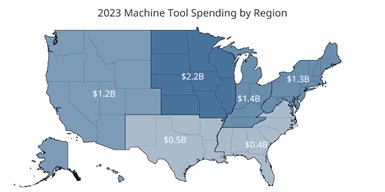

Geographically, the largest regions are north-central states with 31% of spending followed by the Midwest at 20%, the Northeast at 19%, and the West at 17%.

As for what they are buying, machining centers account for nearly 40% of capital spending in 2023. That is followed by turning centers (25%), grinding machines (9%), and EDM and screw machines, both at about 4%. While total spending on lathes and turning centers will be down next year by about 31%, spending on Swiss-type and other screw machines will continue growth trends over the last few years and be up about 33% in 2023.

Other encouraging indicators from the Capital Spending Survey include:

- The percent of planned spending on new machines (vs. used) remains at about 70%.

- The main objective for investing capital, unchanged from the last two years, is to improve productivity/efficiency. Increasing capacity is a growing reason for investing capital, which generally is an indicator of expected growth, particularly in the job shop market. Reducing costs is the one major objective that declined.

- While overall spending will be down, one indication that it may not be as dramatic a decline comes from responses to a sentiment question added to the Capital Spending survey. Specifically, some 45% of respondents said they would increase capital spending next year and another 29% said they’d spend about the same. Only 26% said they’d spend less.

More on the Gardner Business Index

After bouncing back post-pandemic, across metalworking industry segments and key metrics, the GBI has pointed to slowing growth, no growth, and/or contraction for the past 3 – 6 months, with a few of the sub-indices such as new orders and exports falling below 50 in August of this year. A flat metalworking market at this level of activity can be a good thing in the degree to which it provides a little room for long-stretched manufacturing operations to catch their breath. That said, we nonetheless expect the GBI to be back on a strong growth curve in 6 to 9 months.

About the GBI and Capital Spending Survey

The Capital Spending Survey is conducted by Gardner Intelligence every July/August, usually resulting in a new set of reports available in October. It is delivered to a select group of approximately 62,000 total subscribers, primarily in company management positions. The survey asks respondents to provide dollar amounts of anticipated spending on specific items for the next calendar year and includes additional questions covering the motivations for spending and firmographic information. This year’s final results are projected from a survey sample of about 850 respondents.

The Gardner Business Index is based on a monthly survey to metalworking businesses of all types. It is a diffusion index which is an average based on key business indicators such as new orders, backlog, employment, supplier delivery times, and so on. Every month respondents indicate in each category whether the situation is better than the previous month, worse, or about the same. Trends in each category are tracked over time, and the composite index is built on an average of all the sub-indices.

For more information on Gardner Business Media’s reports and services, please visit GardnerIntelligence.com.

Related Content

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

Read MoreMarket Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

Read MoreMetalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

Read MoreMetalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

Read MoreRead Next

Shops Outside the Core Set of Buyers Are Driving Machine Tool Consumption

Spending by the so-called “marginal buyer” (typically a small shop that purchases machines on a discretionary basis) is the dominant factor in today’s market.

Read MoreGardner Business Index: Metalworking August 2017 – 54.7

Modest but consistent backlog growth is an indicator of future machine tool sales.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More