Metalworking Expansion Slows Slightly in April

Many components of metalworking activity stayed the same in April, with some expanding faster and others slightly slower for at least a second.

Share

Autodesk, Inc.

Featured Content

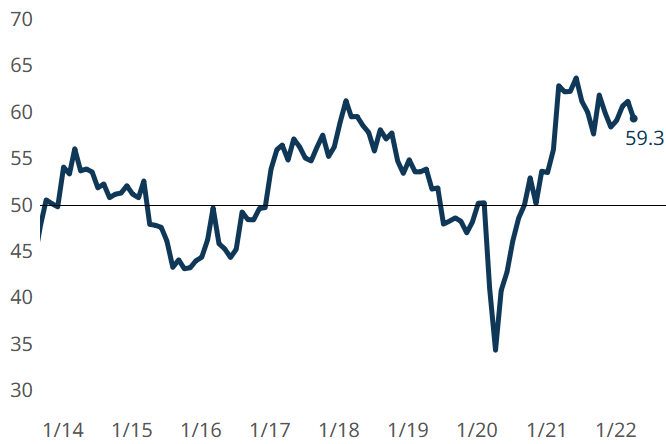

View MoreApril 2022 saw slightly slowed expansion in metalworking activity, closing at 59.3. These readings paved the way for March to be the five-month-peak in metalworking activity.

Gardner Business Index: Metalworking Shows Slowed Expansion

Readings for new orders, production and backlogs in metalworking essentially stayed the same in April. April’s employment reading followed March’s slightly faster expansion with another increase.

April shows a slowing of metalworking expansion, which was last seen October to November, 2021.

Photo Credit: Gardner Intelligence

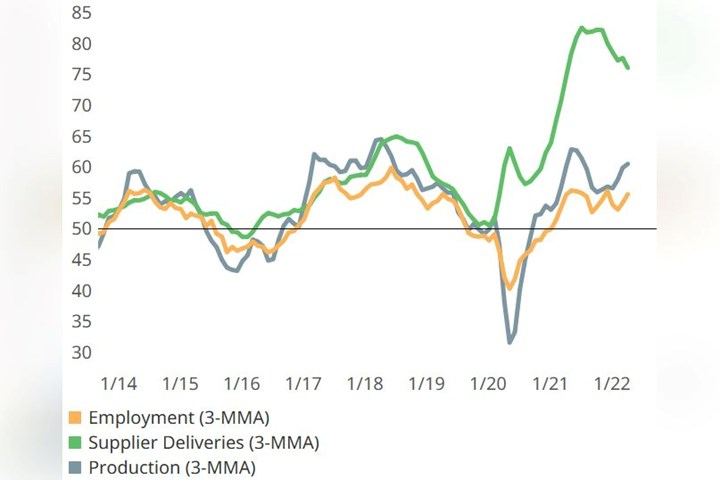

April Metalworking Employment, Delivery and Production Activity

New orders and backlog readings are not charted in the interest of a clearer graph, but they essentially overlay production. Employment shows an uptick and supplier deliveries are falling back in the right direction, perhaps a sign of getting out from under some of the worst of the supply chain disruption. Readings based on a three-month moving average.

Lengthened supplier deliveries continued to slow for the fifth month in a row. Export activity contracted for the eighth month in succession, suggesting contraction may become ‘business as usual.’

Related Content

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)