Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

Share

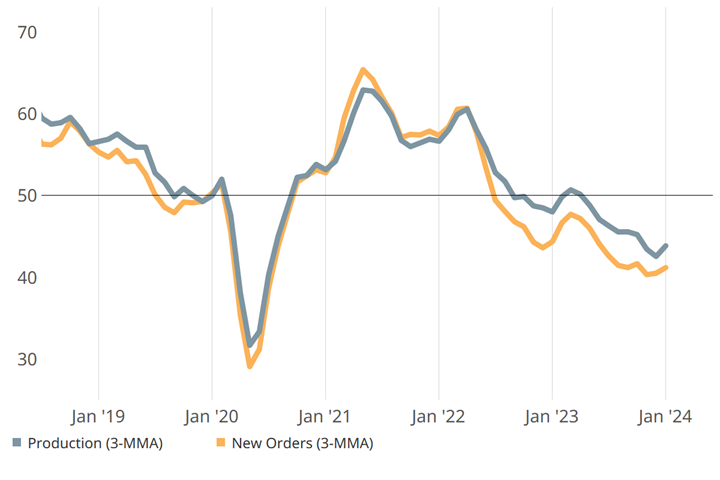

While still contracting, January marks the highest Metalworking Index since May 2023. January closed at 46.3, up 1.8 points relative to December. A month of slowed contraction in new orders and production, along with stable contraction for exports and backlog, drove slowed contraction overall. It has been about one year since metalworking activity saw a similar two-month stretch, ending with a flat index in February 2023 that proceeded to contract every month since.

Future business (not included in GBI calculation) grew increasingly optimistic in January, extending the acceleration seen in December. The same pattern started at the beginning of 2023 and took a downturn in the second quarter.

One difference in 2024 is that supplier deliveries started to lengthen faster in January, another sign that business is picking up.

Slowed contraction in production and new orders drove January’s slowed contraction in metalworking activity (3-MMA = three-month moving averages). Source: Gardner Intelligence

Related Content

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

.jpg;maxWidth=970;quality=90)