January 2015 Metalworking Business Index Holds Steady

With a reading of 51.2, the Gardner Business Index showed that the metalworking industry grew for the 13th consecutive month and the 15th time in 16 months.

Share

With a reading of 51.2, the Gardner Business Index showed that the metalworking industry grew for the 13th consecutive month and the 15th time in 16 months. The index has indicated a fairly constant rate of growth since October. While the index shows continued growth in the industry, the month-over-month rate contracted 5.5 percent, which was the first month of contraction compared to one year ago since August 2013. The annual rate of growth decelerated for the fourth month in a row.

Both new orders and production increased for the 16th month in a row. The new orders index has been somewhat range bound since July. However, the production index has increased noticeably over that same time period. Therefore, backlogs continued to contract but at a somewhat slower rate than previous months. Compared to the same month one year ago, backlogs decreased 11.4 percent. That was the third time in four months that have contracted month-over-month. While it was still growing quickly, the annual rate of growth has decelerated for five months in a row. This indicates that capacity utilization will likely see its peak rate of growth in the first quarter of 2015. Employment continued to expand but did so at its slowest rate of 2014. The rate of contraction in exports accelerated due to the strengthening dollar. Supplier deliveries continued to lengthen, increasing at their slowest rate of 2014.

Material prices increased at a slower rate once again. The material price index was at its lowest level since August 2012. Prices received have increased the last nine months. The rate of increase has been fairly constant since October. This is the strongest period of sustained price increases by metalworking facilities since the summer of 2012. Future business expectations decreased somewhat but remained at about the average level since the end of 2013.

Plants with more than 250 employees grew at a much faster rate in January. In fact, the index was its highest level since September. The index at facilities with 100 to 249 employees remained strong. Plants with 50 to 99 employees recorded their fastest expansion since August. While shops with fewer than 50 employees saw minimal growth last month, they contracted this month. Generally, the smaller the plant, the faster the contraction.

Thanks to the falling oil price, the index for the South Central has fallen off a cliff the last three months. The South Central in January was the only time any region has recorded an index below 40. The North Central – East was the fastest growing region, and it was closely followed by the North Central – West. Also expanding was the Southeast. Joining the South Central in contraction were the West and Northeast regions.

Future capital spending plans contracted 24.0 percent compared to January 2014. This was the fastest month-over-month contraction since June 2012. The annual rate of growth contracted 3.9 percent, which was the second month in a row of annual contraction.

More economic news from Gardner Business media can be found here.

Related Content

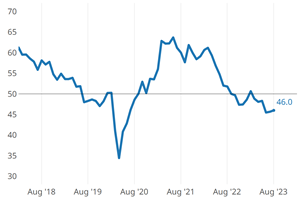

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

Read MoreMetalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

Read MoreMetalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

Read MoreMetalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

Read MoreRead Next

Setting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.JPG;width=70;height=70;mode=crop)