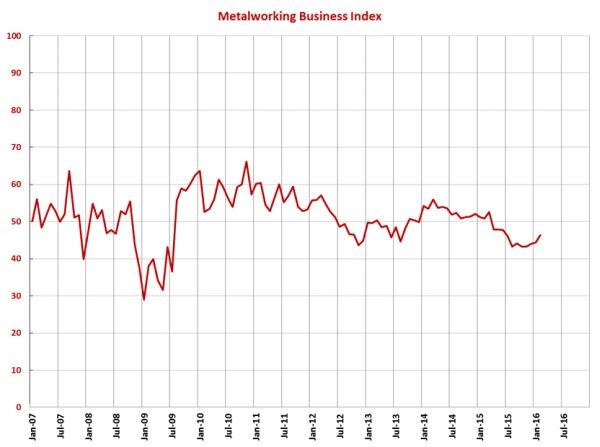

GBI: Metalworking February 2016 – 46.3

Industry shows improvement for the third consecutive month.

Share

With a reading of 46.3, the Gardner Business Index showed that the metalworking industry, even though it has continued to contract, improved in February for the third month in a row. The index was at its highest level since June 2015, and every subindex contributed positively to its improvement.

New orders contracted for the 11th month in a row, but this subindex jumped sharply in February, reaching its highest level since May 2015. Production contracted for the eighth month in a row, but the rate of contraction was unchanged from January. With the new orders index catching up to the production index, the backlog index has improved for three months as well. Even though backlogs were still contracting, this subindex was at its highest level since June 2015. Employment contracted for the seventh straight month, although this subindex, too, has improved since August. The export index contracted at its slowest rate since May 2015, and although supplier deliveries have shortened since November, in February they shortened at a slower rate.

The material prices index decreased for the sixth consecutive month, however this subindex decreased at a noticeably slower rate in February. Prices received have decreased since June, and their rate of decrease has been relatively constant for the last four months. Future business expectations improved from January, but they were still below their level of the second half of 2015.

While they are still well below the historical average, future capital spending plans increased in February to their second highest level since March 2015. Compared with one year earlier, planned spending was down 17.8 percent. That was one of the slower rates of contraction since January 2015. While the annual rate of contraction continued to accelerate, it should be nearing its peak rate of contraction.

Related Content

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)