Share

Spending on turning machines, especially turn-mill machines, is projected to increase, bringing flexibility and reduced setups to machining processes. Photo: Nakamura-Tome

Forced closures. Socially distanced shop floors. Supply chains disrupted and geographically shifted. Orders and production stopped and restarted. Staffs reduced.

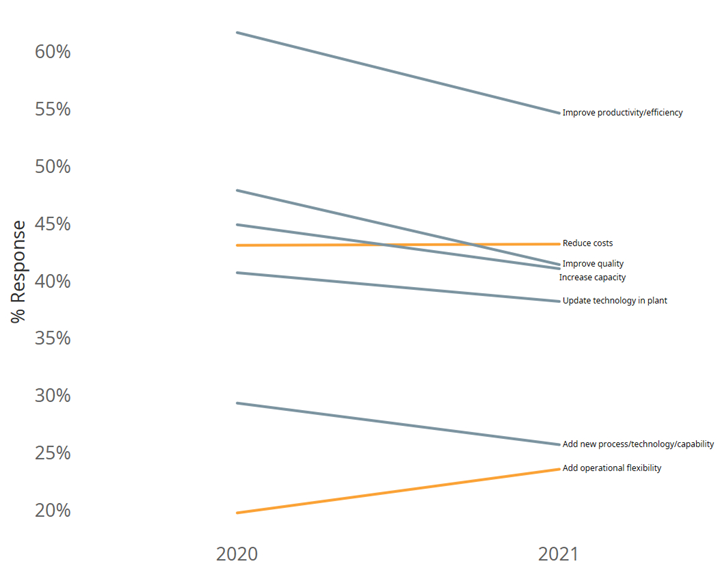

The unprecedented impact of the global pandemic is affecting the motivations of machine tool buyers as well as their plans for which types of machine tools they are likely to purchase in 2021, according to our most recent survey of machine shops’ equipment purchasing expectations. The 2021 Metalworking Capital Spending Survey, conducted by Gardner Intelligence, is the latest edition of an annual survey that has now been conducted for more than three decades. This year, the survey findings indicate that reducing cost and adding operational flexibility are two important reasons why machining facilities will be purchasing machine tools in 2021. Indeed, these are the only two motivations for purchasing machine tools that show an increase for 2021 buying compared with 2020.

Metalworking Capital Spending Survey Challenges This Year

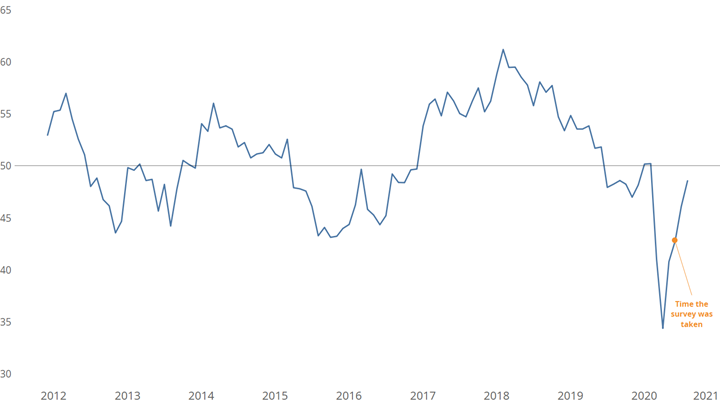

The global pandemic has also unavoidably had an impact on the reliability of our survey this year, a point we must acknowledge. An annual survey is a snapshot of a moment in time. In a fast-moving year, the timing of an annual survey can color its forecast results. We saw this in 2001, for example. Our survey predictions for buying in 2002 proved to be far too optimistic, because the survey was conducted before the 9/11 terrorist attacks later that year changed outlooks, affected markets and caused purchasing plans to be delayed.

It has been a disrupted year. The GBI:Metalworking survey's measure of business activity was near its all-time low when the Metalworking Capital Spending Survey was taken. That timing, and how respondents were feeling then, likely affects the survey findings.

This year, our survey findings likely have the opposite problem, as the survey period happened to coincide with what we later discovered to be a low moment for manufacturing business conditions. A different, ongoing survey called Gardner Business Index: Metalworking found that business conditions during the month that the Capital Spending Survey was taken were not far up from the low for the year. At this point in time, conditions were significantly lower than earlier and later in 2020. Our projections of machine tool investment for 2021 are probably too pessimistic as a result. That is the giant asterisk hanging over these findings, and it is one we have faced before. Years that are particularly disrupted increase the uncertainty of our efforts to predict the year that is to come.

With that caveat in mind, here is what the 2021 Metalworking Capital Spending Survey predicts. That is, here is what we expect of the buying activity of U.S. machining facilities in terms of their machine tool investments in the coming year.

Decline Largely in “Other” Category

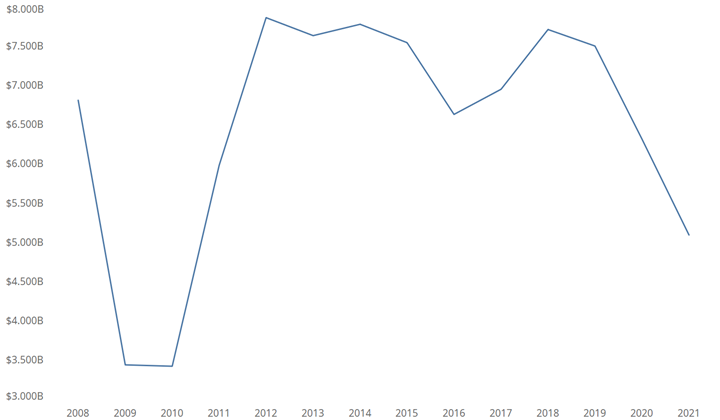

The pandemic is affecting the volume of machine tools that shops plan to buy. According to the survey, machining facilities are projected to spend $5.092 billion on machine tools in 2021. This is a decline of 19% from the latest estimate for 2020, and it would be the third year in a row of declining machine tool purchases.

Overall survey findings: U.S. machine tool spending for 2021 is projected to be just over $5 billion, down 19% from 2020. Much of the decline was found to be in niche or ancillary machines.

Where the decline is being seen is notable. The 2021 projection is lower than the latest estimate for 2020 in large part because of planned spending on what our survey has to call “other machine tools.” This category includes ancillary machines such as drills or niche machines such as gear cutting machine tools. Planned spending on “other machine tools” is $0.757 billion, which is down $0.884 billion from the estimate for 2020. The projected decline of more than 50% in this area accounts for nearly 75% of the total projected decline in machine tool spending.

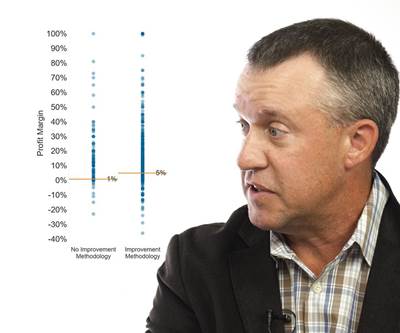

Meanwhile, spending on certain machine categories is projected to increase. For the shops planning to invest in equipment, what drives them? The graph shows this. Out of various motivations for buying capital equipment, all decreased in importance except for two: reducing cost and increasing flexibility.

Shops stated two reasons for buying machine tools that have increased in importance: reducing cost and increasing operational flexibility.

Strong Increase in Projected Spending on Turn-Mill Machines

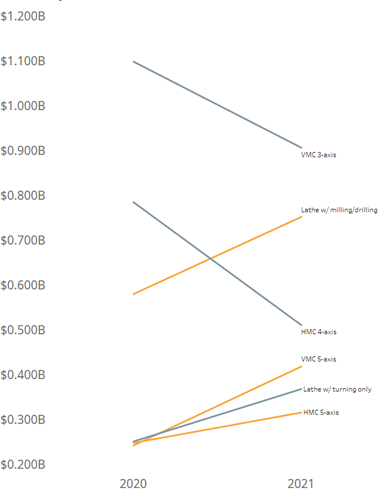

Spending on lathes/turning centers is projected to increase by 36% to $1.269 billion, which would be the most spent on lathes/turning centers since 2014. However, it is the type of lathes/turning centers shops plan to purchase that really shows the desire for reduced cost and greater flexibility. Spending on lathes/turning centers with milling/drilling capability is projected to be $0.752 billion, an increase of 30% from 2020 and likely the most ever spent on this type of machine. This compares with planned spending of $0.368 billion on lathes that are turning only, which is just half of the projection of multi-function lathes/turning centers. This is in stark contrast to two years ago, when spending on lathes with turning-only capability was twice as much as spending on lathes/turning centers with milling/drilling capability. Multi-function machines meet both motivations: They reduce cost by reducing setup and allow a wider variety of parts to be machined on one machine tool compared to lathes that can only do turning.

Five-axis machining centers and lathes with milling/drilling capability are two growing areas of spending.

Spending on Machining Centers Is Down but Five-Axis Spending Is Up

Unlike lathes/turning centers, spending on machining centers is projected to decline by 11% to $2.236 billion. Despite the decline, there is a similar shift in planned spending toward machines that can reduce costs and add operational flexibility by reducing setups and allowing a greater variety of parts to be machined. Spending on three-axis vertical machining centers (VMCs) is projected to decline by 18% to $0.906 billion, the third consecutive year of decreased spending on three-axis VMCs. However, spending on five-axis VMCs is projected to increase 73% to $0.419 billion.

The same pattern is seen in horizontal machining centers (HMCs). Three-axis HMC spending is projected to decline 35% to $0.511 billion. Like three-axis VMCs, this would be the third consecutive year of decreased spending in three-axis HMCs. However, spending on five-axis HMCs is projected to increase 27% to $0.316 billion.

One other survey we run, ’s Top Shops Survey,Modern Machine Shop benchmarks machine shop performance. More than 3,000 shops have participated in the survey since 2010. Our research shows that five-axis machining is more correlated with higher gross revenue per employee than other machining strategies. Further, higher gross revenue per employee is strongly correlated to higher profit margin. While higher revenue per employee and higher profit margin can be achieved without reducing costs or adding operational flexibility, there is a logical connection that can be drawn between these concepts that the statistical data is illuminating.

Are Supply Chains Changing?

Projected spending data in the 2021 Metalworking Capital Spending Survey may also reveal that supply chains are being disrupted and shifted.

Most of the industry segments we survey are projected to decline in 2021. However, job shops are planning to increase spending on machine tools by 6% to $1.864 billion. This could indicate that original equipment manufacturers (OEMs) are sourcing more work to U.S. job shops, perhaps to reduce their own costs, or perhaps because of reshoring work to bring their supply base closer.

Custom processors, generally companies that injection-mold plastic parts, are projected to increase spending on machine tools by 77% to $0.101 billion. Typically, custom processors are buying machine tools to make molds. The plastics market was relatively stronger during the pandemic than other manufacturing industries. The strength of the plastics market combined with the increased spending on machine tools by custom processors could be another indication of shifting supply chains, domestically and globally.

In addition to increasing machine tool spending at contract manufacturers and decreasing machine tool spending at OEMs, the survey indicates a shift in spending by plant size. Machine shops with fewer than 20 employees are projected to spend $1.341 billion on machine tools, an increase of 39%. The projected spending would be very close to the all-time high spending by these smaller facilities. However, facilities with more than 250 employees are projected to spend $0.820 billion on machine tools, which is a decrease of 51% and near the lowest level since at least 2008. Also, these large facilities have decreased their spending every year except one since 2014. This shift in machine tool spending seems to suggest a change in where metalcutting work is done, shifting from larger OEM facilities to smaller U.S. contract manufacturers or job shops.

Related Content

How to Successfully Adopt Five-Axis Machining

While there are many changes to adopt when moving to five-axis, they all compliment the overall goal of better parts through less operations.

Read More6 Machine Shop Essentials to Stay Competitive

If you want to streamline production and be competitive in the industry, you will need far more than a standard three-axis CNC mill or two-axis CNC lathe and a few measuring tools.

Read MoreQuick-Change Tool Heads Reduce Setup on Swiss-Type Turning Centers

This new quick-change tooling system enables shops to get more production from their Swiss turning centers through reduced tool setup time and matches the performance of a solid tool.

Read MoreHigh RPM Spindles: 5 Advantages for 5-axis CNC Machines

Explore five crucial ways equipping 5-axis CNC machines with Air Turbine Spindles® can achieve the speeds necessary to overcome manufacturing challenges.

Read MoreRead Next

IMTS spark: Drivers of Revenue and Profit Margin at Top Shops

Gardner Business Media's Chief Data Officer Steve Kline shares insights and trends from over a decade of the Top Shops benchmarking program.

Read MoreVideo: How to Succeed at Lights-Out Machining — Findings from Top Shops Data

Differences in machine shops’ profit margins suggest the value of improvement methodology, unattended machining and machine tool monitoring, as well as the effective combination of all three of these.

Read MoreMultitasking Machining Equipment: Now the New Normal

Equipment that can turn, mill and more is quickly becoming the standard in metalworking technology. These machines can produce increasingly complex parts in a single setup yet are easier operate than ever before.

Read More

.JPG;width=70;height=70;mode=crop)