Metalworking Index Plateaus After Blistering First Quarter

Expansion of the Metalworking Index slowed in April, falling slightly to 62.2. Every component reported expanding activity, with the exception of exports.

Share

The metalworking manufacturing industry reported slowing expansion during April as the Metalworking Index fell slightly to 62.2. Every component of the Index except exports reported expanding activity. The supplier delivery reading rose three points to establish a new all-time high reading. During each of the last four months ending with April, the supplier delivery reading has established new all-time high readings. Supplier delivery readings rise when a growing proportion of surveyed metalworking manufacturers signal slowing order-to-delivery times from upstream suppliers. The current combination of strong orders and production coupled with slow supply chains has resulted in nearly all survey respondents reporting rising material input prices in recent months.

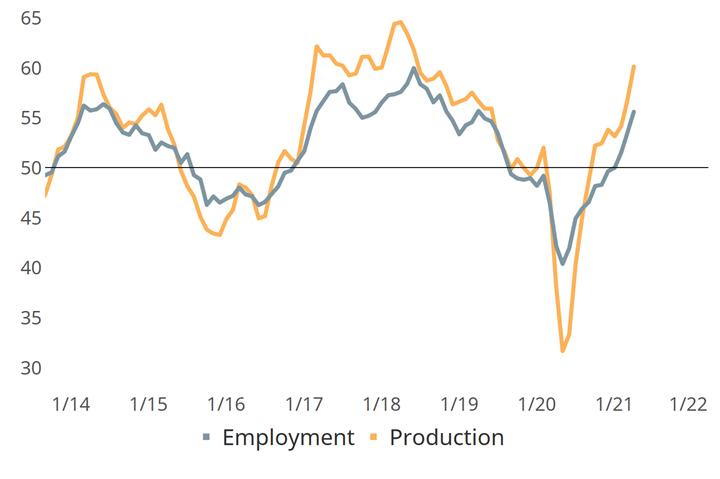

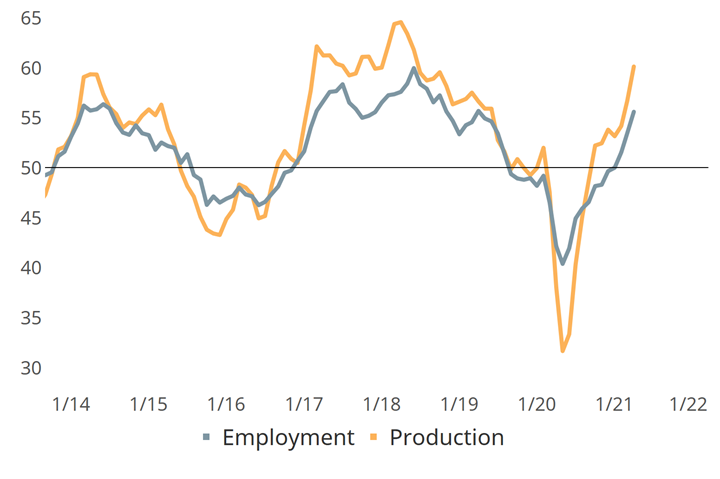

April reported a combination of slowing new orders and accelerating production activity, narrowing the activity spread between measures which had caused backlog levels to rapidly expand. The combination of an expansionary total new orders reading and contracting export orders reading implies that April’s expanding new orders activity was driven by domestic orders. Further, rising production levels suggest that employment activity has further room to rise. During the peak of the 2018 business cycle, production expansion peaked four months before employment activity.

The Metalworking Index fell slightly to 62.2 in April. The Index reported slowing expansion in new orders, backlogs, employment and exports activity.

At the peak of the 2017-2018 business cycle, production activity led employment activity by 4 months.

Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Metalworking Index serves as a great tool for making data-driven decisions. Thank you to everyone who has previously completed our GBI surveys. Your participation helped increased response counts by 15 percent in 2020, making the GBI better than ever because of your involvement.

Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

Related Content

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)