Metalworking Business Activity Reports Additional Slowing Contraction

July data extends the slowing contraction trend initially reported in May.

Share

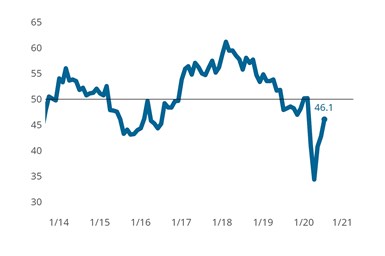

Metalworking Business Index: The Metalworking Index moved higher for a third month as all components moved toward more normal readings except for a small contraction in employment activity. The index has gained almost 12 points since its April 2020 low.

The Gardner Business Index (GBI): Metalworking moved higher during July for a third consecutive month, reaching 46.1. Excluding supplier deliveries due to the disruptive impact that COVID-19 continues to exert on supply chains, the index was supported by rising readings for production, new orders, export and backlog activity. Only the reading for employment activity reported an accelerating contraction during the month. Production and new orders are ranking second- and third-highest components, which is welcome news as these measures frequently act as leading indicators of other measures including backlog, supplier deliveries and employment.

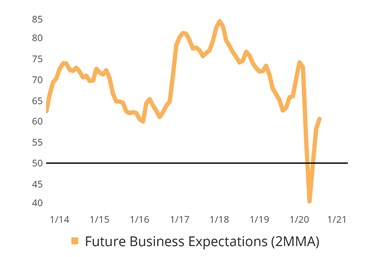

Upticks in Business Sentiment and Operational Activity Suggest a Rebound Is at Hand: The combination of improved business sentiment combined with currently improving business conditions for some classes of metalworking firms suggests that the total impairment from COVID-19 on the metalworking industry could be at or near its limits.

The last three months of index results have implied a probable limit on the total impairment that COVID-19 may have on the metalworking industry. As early as June, some classes of firms had reported seeing month-to-month improvements in business activity. This has been particularly true for larger firms, which have now reported two consecutive months of expanding overall activity. This rebound has been further supported by Gardner Business Intelligence’s future business expectations data, which has strongly rebounded since April and is now well above the “no-change” reading of 50.

Related Content

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)