Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

Share

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

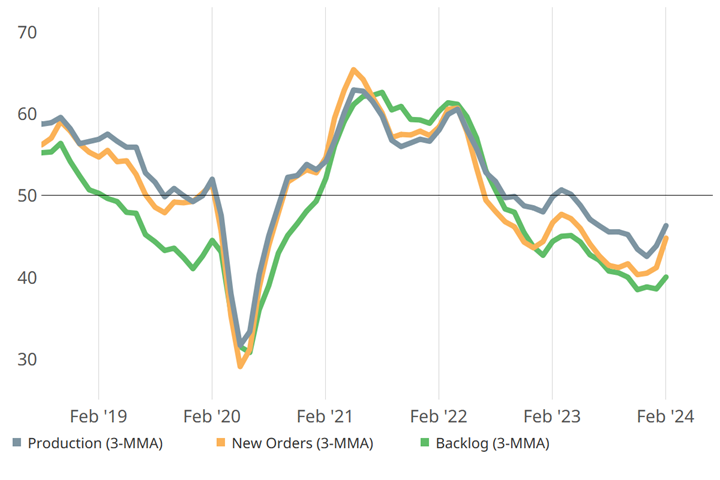

February is the third straight month of slowed contraction (a good thing) in metalworking activity as the index creeps closer to 50. February closed at 47.7, up 1.4 points relative to January. February marked slowing of contraction in new orders to the tune of 3.6 points, along with 2.4 points of slowing contraction in production, drove slowed contraction overall.

February brought backlog into the slowing contraction fold, interrupting its long-standing trend of accelerated contraction in place since September of 2022. Employment and exports contracted at steady rates, the former consistently closer to 50 than the latter, which has changed little since arriving at its current index in August of 2022. Supplier deliveries lengthened at a slow rate that has stayed about the same for the past six months, which is neither particularly encouraging nor discouraging.

Optimism for future business (not included in GBI calculation) grew faster in February for the fourth straight month. The sentiment is at least hopeful — if not encouraging — that real business will follow.

Slowed contraction in new orders, production and backlog drove February’s slowed contraction in metalworking activity (3-MMA = three-month moving averages). Source: Gardner Intelligence

Related Content

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

.png;maxWidth=150)