Machining with the Environment in Mind

It’s safe to assume that most shops recognize the importance of being environmentally responsible. However, benchmarking data suggests that the effort shops put into both recycling and reducing energy consumption varies.

Share

Do shops feel that becoming more environmentally responsible is beneficial to their business as well as the planet? To find out, a portion of our 2011 Top Shops benchmarking survey was devoted to learning more about shops’ environmental attitudes as well as practices they’ve put in place to recycle and conserve energy.

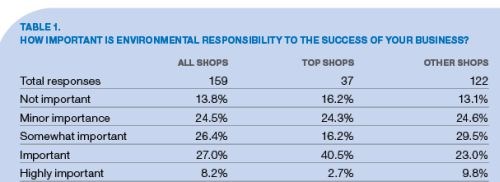

Table 1, which was generated from the survey data, suggests the extent to which shops feel that implementing environmental programs is a helpful strategy. Approximately 43 percent of the Top Shops benchmark group (those shops that ranked in the top 20 percent of all survey participants based on key business and technology metrics) responded that environmental responsibility is either important or highly important to the success of their business. For the rest of the surveyed shops, this value was just 33 percent. Of all the shops surveyed, nearly 14 percent reported that a push to become more environmentally responsible is not a key component to the success of their business. Some of those shops cited added cost as a reason not to integrate technologies or practices to be more environmentally responsible. As evidenced below, however, many of the Top Shops say the benefits they’ve realized after taking such actions ultimately outweighed upfront costs.

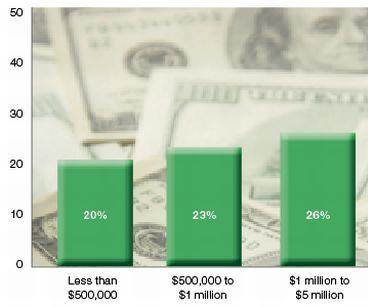

Not surprisingly, the survey data indicates that the Top Shops (especially the large ones with gross sales topping $1 million in 2010) tend to be more proactive about identifying ways to reduce the amount of energy they use to manufacture parts. During the past year, the Top Shops have reduced the amount of energy consumed per unit of product output by an average of 5.1 percent. Because two survey participants reported unusually high percentage reductions for this question, however, the median value for this data sample, 2 percent, might be a more realistic representation of consumption reduction. (The median is not distorted by a couple of extremely high or low values in a given sample; it is the sample’s true mid point.)

While a 2-percent reduction might not seem terribly impressive, it shows that a number of the Top Shops are making strides to reduce overall energy consumption. Conversely, the median value for the rest of the surveyed shops was 0 percent for this question, suggesting that those shops either do not see value in curbing energy consumption or aren’t proactively taking steps to do so.

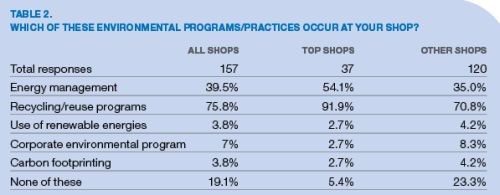

As noted in Table 2, virtually all of the Top Shops actively recycle, and more than half have energy management programs in place. That said, it’s interesting to see that compared to the rest of the surveyed shops, the Top Shops are less likely to have a formal, corporate environmental program. The same is true in terms of establishing carbon footprint values and integrating renewable energy sources such as wind and solar power (although just a very small percentage of shops seem to be looking closely at these measures.)

Perhaps the most telling feedback related to this topic is found at the bottom of Table 2. Approximately 5 percent of the Top Shops report they do not perform any of the environmental measures listed in the table. What’s more discouraging is that 23 percent of the rest of the surveyed shops don’t either. All of those shops are clearly missing out on opportunities to recoup manufacturing costs—via recycling, for example—not to mention opportunities to reduce their environmental impact.

SPECIFIC PRACTICES

The final survey question related to this topic was open-ended. It asked shops to briefly cite a specific environmental initiative from which they’ve benefitted the most. What follows is a summary of those responses. While this in no way is a comprehensive guide to becoming a more environmentally responsible machine shop, it does indicate where leading shops are focusing their efforts.

Recycling programs—Most respondents to the open-ended question cited the importance of recycling. In addition to being conscientious from an environmental perspective, recycling can also bring in money. Many surveyed shops recycle the chips created during machining. Some even integrate equipment to maximize the return on their recycling efforts, which can range from briquetters to centralized, facility-wide systems for chip handling and processing.

Fewer shops reported that they recycle used cutting tools, however, which is unfortunate. Shops can realize a good return, especially when selling back used carbide inserts and solid carbide tools. Many cutting tool suppliers offer carbide recycling programs that make it easy to sell back spent tools. With carbide scrap ranging from $11 to $13 per pound, it makes sense to have such a formal recycling program in place to recover this valuable material, notes Jeff Solomon, owner of Globe Metal Recycling Services Inc. Mr. Solomon says a good carbide recycling program begins with effective inventory control of both new and used tooling. One reason a formal program is important is to prevent theft. Because carbide is small and dense, employees can easily pocket a few pounds of it and walk out the door. Effectively tracking tooling assigned to each employee and securely storing both new and used tools helps prevent this from happening.

Mr. Solomon notes that there’s also value in recycling high speed steel tools. Some scrap dealers are not familiar with the tool steel grades and may pay just $0.15 or so per pound for it, as they would for regular steel scrap. However, scrap tool steel is currently worth more than $1.25 per pound, so it makes sense to separate and collect those tools as part of a shop’s recycling program in addition to carbide.

Coolant management—When coolant is properly maintained, its effective life can be indefinite and disposal costs can be eliminated. Some of the surveyed shops have such coolant management procedures in place. Other advantages to maintaining coolant versus disposal/replacement include reducing the amount of coolant concentrate to be purchased, achieving longer cutting tool life, improving part quality and minimizing machine downtime. Some coolant management companies even offer a mobile service in which they come directly to a shop’s location to recycle spent coolants or cutting oils.

A few surveyed shops have also switched to biodegradable, vegetable-based cutting oils. These oils provide an added level of safety because of their very high flash point, and their low mist formation means less product is consumed compared to similar mineral oils.

Minimum quantity lubrication—Approximately 10 percent of all surveyed shops perform some machining using minimum quantity lubrication (MQL). MQL delivers a very small amount of coolant to a cutter’s edge in the form of an oil mist or aerosol, as opposed to traditional techniques of flooding the workpiece and tool with a substantial volume of liquid coolant. It permits dramatic cuts in coolant costs, while protecting workers and the environment. And for the right applications, it can deliver improved tool life and surface finish for machined components.

More efficient machines—Simply put, modern machine tools are more energy efficient than their predecessors. In fact, one surveyed shop noted that the total amount of power it consumed at its facility decreased each time it replaced an old machine with a newer, more efficient model.

Machine tool builders continue to integrate design elements to minimize energy consumption. Some models stop the spindle motor, servo motors and fans inside the control panel during standby. In addition, more efficient LED lighting is increasingly common. Improved efficiency is being built into elements such as guideways, hydraulics and drive systems, too. In fact, some drive systems offer power source regeneration capability that transforms kinetic energy from decelerating servo and spindle motors into electrical power. Real-time monitoring of energy usage is also becoming more popular as managers seek to identify the prime drivers of energy costs during machining operations.

Right-sized machines—Lean operations focus on eliminating waste. As some surveyed shops noted, one way to do this is to purchase machines that are properly sized for the types of parts the shop will produce. Right-sizing equipment makes maximum use of floor space and consumes less energy than equipment that’s too big for the application.

Facility considerations—HVAC systems can represent a significant portion of facility operational costs. While some surveyed shops have changed to more efficient, controllable systems, others have benefited by a simpler change: raising or lowering (depending on the season) the thermostat temperature slightly during operating hours and more so during off-hours to reduce electricity used for heating and cooling.

Similar steps can be taken for lighting systems. Surveyed shops noted that savings can be realized by simply turning off lights when an area is not in use or by using timers or motion detecting devices. Other surveyed shops have completely revamped their lighting system. Old fluorescent systems that use T12 lamps can be upgraded by using the existing fixtures and replacing the T12 lamps and magnetic ballasts with T8 lamps and electronic ballasts. In addition, some surveyed shops have found that high-intensity fluorescent lighting is more efficient than the conventional metal halide systems they replaced.

Compressed air—A number of surveyed shops examined their compressed air systems and optimized them for reduced energy consumption and operational costs (the sidebar on the previous page lists tips for doing that). Also, control technology for new compressed air systems has improved to enable compressors to draw power only when needed. One surveyed shop says state energy credits allowed it to upgrade its HVAC and air compressor systems and realize a three-year investment payback.

Four-day work week—Something as basic as changing from a five-day work week to a four day week with 10-hour days can be beneficial. Since doing that in late 2009, one surveyed shop has experienced close to a 2 percent increase in productivity as well as a 5 percent reduction in energy costs.

Related Content

Top Shops 2024 Is Now Live

The Top Shops 2024 survey for the metalworking market is now live, alongside a new homepage collecting the stories of past Honorees.

Read MoreBenchmarking: An Invaluable Business Tool

Modern Machine Shop’s Top Shops program shows shops their strengths and opportunities for improvement, and provides recognition for high-performing businesses.

Read MoreJob Shops Can’t Do Everything, And That’s OK

Deciding to narrow down its jobs and customers was a turning point for 2023 Top Shops Business Strategies honoree Manda Machine that has led to improvements in the front office and on the shop floor.

Read MoreSame Headcount, Double the Sales: Successful Job Shop Automation

Doubling sales requires more than just robots. Pro Products’ staff works in tandem with robots, performing inspection and other value-added activities.

Read MoreRead Next

See How You Stack Up

“Top Shops” benchmarking data sheds light on what it takes to be one of the nation’s leading machining businesses.

Read MoreEach Shop’s One Big Thing

Top Shops tend to be good all around, achieving excellence or better-than-average ability in almost all of the activities or processes they perform, yet several technologies or strategies stand out as the most influential.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More

.jpg;maxWidth=300;quality=90)