Industry Shows Fast Growth

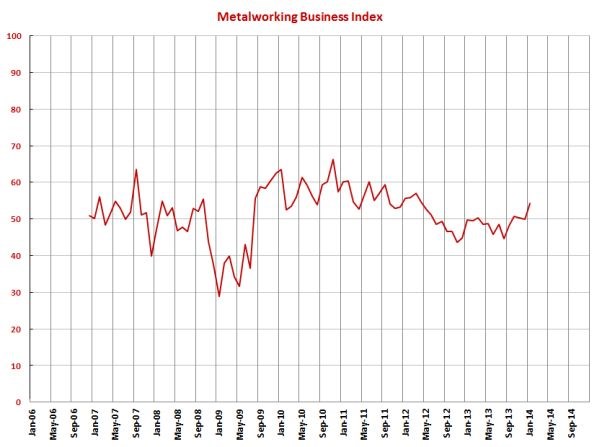

With a reading of 54.2, Gardner’s metalworking business index for January showed that conditions in the metalworking industry have improved dramatically.

Share

With a reading of 54.2, Gardner’s metalworking business index for January showed that conditions in the metalworking industry have improved dramatically. The industry has grown three of the last four months, but January’s rate of growth was the fastest since April 2012. The index was 9.1 percent higher than it was one year ago, the fifth straight month that has happened.

New orders grew for the fourth consecutive month, reaching their highest level since March 2012. Production also has grown for four straight months, reaching its highest level since April 2012. Importantly, the backlog index grew for the first time in nearly two years, and the trend indicates that capacity utilization in the metalworking industry should increase in 2014. Employment is growing at its fastest rate since summer 2012. Exports continued to contract, and at a faster rate in January, likely due to the start of tapering by the Federal Reserve and its effect on many world currencies. Supplier deliveries continue to lengthen at a rate consistent with the last year.

Material prices increased at a notably faster rate in January than they did throughout 2013. Prices received grew significantly faster as well, however not as fast as material prices. Future business expectations have soared since last August and are now at their highest since March 2012.

For the first time since March 2012, plants of all sizes grew. Facilities with more than 50 employees saw their rate of growth jump significantly, while plants with 20-49 employees grew for the first time since last July. Facilities with fewer than 20 workers grew for the first time since March 2012.

Future capital spending plans reached their highest level since February 2013, but they fell just slightly from last January. The annual rate of change of future spending plans has grown for three straight months, indicating that actual capital spending should grow faster in upcoming months.

Related Content

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)

.png;maxWidth=970;quality=90)