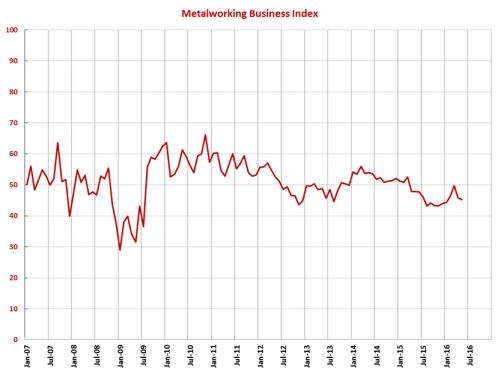

GBI: Metalworking May 2016 – 45.3

Capital spending plans continue to outpace year-ago numbers.

Share

With a reading of 45.3, the Gardner Business Index showed that the metalworking industry contracted in May at a similar rate as in April. Although the index showed a bit of a surge in the first quarter of this year, it has slowed down in the second quarter so far. The trend since last November is still somewhat positive, however.

New orders and production both contracted in May for the second month in a row, and while production took the larger hit the previous month, new orders contracted faster than production in May. The backlog index also contracted faster for the second month in a row. Overall, backlogs have contracted since March 2014. Employment contracted for the 10th month in a row with the rate of contraction accelerating somewhat the last two months. The export subindex has contracted at a decelerating rate since August 2015 as the rate of increase in the dollar has slowed, if not stopped altogether. Supplier deliveries lengthened in May for the third month in a row.

The material prices index has increased sharply in 2016, jumping to 59.4 in May from 41.9 in January. Some of this surge is more likely due to the leveling off of the dollar than to a strengthening world economy. This subindex was at its highest level in May since November 2014. Prices received have decreased since June 2015, but the rate of decrease generally has decelerated since November 2015. Future business expectations were unchanged from April, remaining above their level of the second half of 2015.

Every region contracted in May, although the Southeast remained the strongest with a very moderate contraction, having grown three of the last five months. It was followed by the Northeast, which has contracted the last two months, the North Central-West, the West, the North Central-East, and the South Central region. The South Central has had an index above 40 two of the last three months, which is a significant improvement over its level since November 2015.

While they are still well below the historical average, May’s future capital spending plans were at the second highest level since February 2015 (only April was higher). This also was the second month in a row that spending plans were higher than they were a year earlier. This has caused the annual rate of change to contract at a slower rate for three months. These last couple of months could be the beginning of a rebound in capital equipment spending.

Related Content

-

Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

.JPG;width=70;height=70;mode=crop)