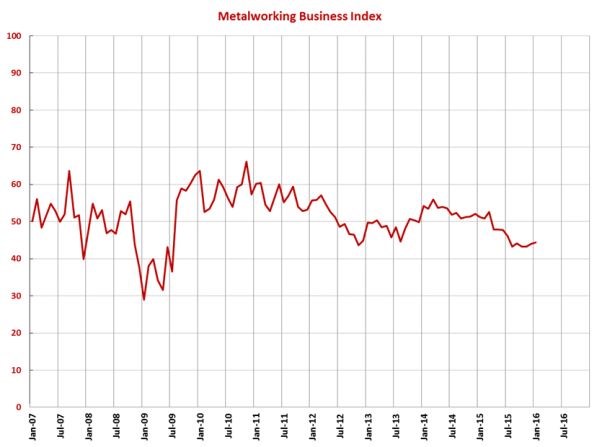

GBI: Metalworking for January 2016 – 44.4

Industry continues its slow upward trend.

Share

With a reading of 44.4, the Gardner Business Index showed that the metalworking industry improved in January for the second month in a row. While the industry was still contracting in the month, the index reached its highest level since July 2015 and has slowly trended up since August.

New orders contracted for the 10th month in a row, but this subindex was at its highest level since July. Production also contracted for the seventh month in a row, although this subindex has improved noticeably since October. The backlog index, however, contracted for the 22nd consecutive month. It has steadily declined since early 2014, but there are signs the backlog index may be breaking out of its downward trend. In the months ahead, it still indicates falling capacity utilization, however. Employment contracted for the sixth straight month, although this subindex has improved since August. The export index contracted at a faster rate in January after contracting a steadily slower rate the previous five months. Supplier deliveries shortened for the fourth time in five months. Shorter delivery times indicate that suppliers aren’t as busy and can more easily meet the demands of customers.

The material prices index decreased at a faster rate in January and was at its lowest level since May 2009. Material prices have decreased since September 2015, and prices received have decreased since June, although their rate of decrease accelerated in January. Material prices were falling faster than prices received, however. While future business expectations had been steady over the previous four months, in January they weakened to their lowest level since November 2012.

Future capital spending plans fell to their lowest level since July 2015. Compared with one year earlier, they were down 24.3 percent. The annual rate of change has contracted at a fairly constant rate since November, but it does appear that it will contract at a slower rate in the upcoming months, indicating that the weakest part of the capital spending cycle may be over.

Go here for more economic news from Gardner Business Media.

Related Content

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

.JPG;width=70;height=70;mode=crop)