Share

With broken supply chains resulting from the coronavirus, the opportunity for a sustainable domestic manufacturing surge has perhaps never been greater.

Cost-cutting measures put in place by U.S. companies over the past 20 years have resulted in manufacturing practices that appear regularly in this publication — practices that include automation, lean manufacturing and increased deployment of enterprise resource planning (ERP) and machine monitoring systems. But the downward pressure on U.S. companies to reduce costs during the past two decades has also resulted in the massive off-shoring of manufacturing operations to plants in China and other countries throughout Asia, a phenomenon that has helped China attain roughly 16% of today’s world gross domestic product. For domestic companies that rely on parts produced in China, the result has been a massive supply chain risk, most dramatically seen recently as the latest coronavirus shut down most of the country.

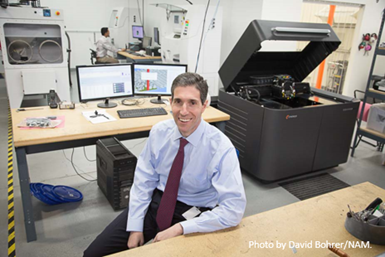

To discuss this and other disruptions resulting from the pandemic — as well as the potential long-term domestic manufacturing benefits that may result from it — I talked to Randy Altschuler, CEO of Xometry, the Maryland-based online platform that connects customers and suppliers of custom manufactured parts. While tough times lie ahead for many small manufacturers in the near-term, the opportunity for a sustainable domestic manufacturing surge has perhaps never been greater.

Modern Machine Shop (MMS): I imagine that Xometry has a unique 360-degree perspective on the impact of the coronavirus on U.S. manufacturing since your company doesn’t produce parts, but rather connects companies that need parts with a global network of suppliers, including domestic suppliers located in 46 states. What impact of the pandemic are you seeing right now on both the supply and demand sides?

Randy Altschuler (RA): I would tell you that it’s an emerging situation, but the fallout from this — and I'm not talking about just the human or health fallout, which is obviously first and foremost for everybody — but the business fallout will be devastating. I think the impact on small companies, the small manufacturers that make up the bulk of our network, is that there will be very tough times. For these men and women, their machine shop is sort of melded into their lives. They're not working for a third party. It's part of their livelihood, and their family is involved with it. Maybe a spouse works in the financial department or on the machines with them. That intersection of life and business — even for larger machine shops in our network — work and personal life blend together. They're so dedicated to making parts for their livelihood that they're working through this.

MMS: I feel like a “but” is about to happen.

RA: Well, so far from a demand perspective, we are surprisingly seeing strong demand. A lot of our industries, like aerospace, defense and robotics, those industries are less sensitive to consumer demand, at least in the short term. So demand has continued to be strong. And for the most part, our manufacturers, despite the headwinds here, seem to be doing well. Some of that demand may be because people are anticipating further shutdowns. And I think some companies, some engineers, some procurement people are trying to get ahead of the curve, fearing the worst. So that's why we are actually seeing surges in some areas.

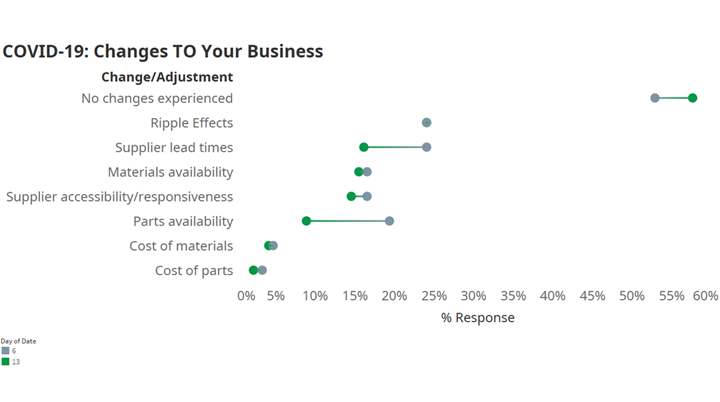

In the latest Gardner Intelligence survey on COVID-19, manufacturers reported fewer changes to their business with less severe impact on their supplier lead times and parts availability with the lone exception of travel-related activities. Fewer manufacturers reported major impacts to travel, tradeshow attendance or participation, and budgets. Significantly more manufacturers reported major impacts to the adjustments in their training.

MMS: That anticipation, do you feel like it will extend beyond this particular crisis? I think it’s safe to say that most multinational companies have no idea who manufactures parts for their direct suppliers. What is your sense of how the pandemic will influence supply chain decisions for businesses that rely heavily on parts produced in lower-cost countries?

RA: For companies whose work may have gone to Asia because it was the low-cost option, I think people are rethinking that. I think they are taking into account the risk in which these calamities, in this case a virus outbreak, can cause huge delays and uncertainty of delivery. I think people are rethinking their supply chains and saying, hmm, maybe costs shouldn't be the only driver here. Maybe I need to take down all this risk. And that's a serious change for people who have in many instances shifted away from North America and gone to lower-cost areas.

MMS: Part of the reason why I wanted to talk to you was because of Xometry’s unique position as a matchmaker between machine shops and customers looking for manufacturing capacity. Are you literally seeing companies that already want to move manufacturing operations back to the U.S. because of the coronavirus?

RA: Yes. I mean, even yesterday there was a $50,000 order where the customer said, “You know what, we've done this in China, but everything we've got there right now is simply too far backed up because of the work shortages. We don't have confidence in it. I need to get out of this place immediately. I need do it right away.”

MMS: And this company said that they need to make this change because their existing supply chain is not reliable.

RA: Exactly. I should note that Xometry itself has a China option for our customers. And so as the China news unfolded and there were delays, we went back to our customers who ordered from us in China and said, “Hey, we've got a whole domestic network. Are you interested in switching back to the United States?” And we had a bunch of customers do so. I think that trend will either accelerate, or people will run their models and the numbers will no longer be only about cost.

MMS: What about when things settle down? Won’t the tendency to revert to the mean — in this case low production costs — go back into play? Do you really see meaningful change happening?

RA: I think absolutely. Look, I think there's a recognition for the security of the United States and for the health of our economy. We need to have capabilities domestically as well, as it's become clear from this terrible event that entire continents can potentially be shut down. You know, in spite of the virus, American people still have to live their lives and have important goods. So if our supply chain shuts down because 20% of it can only be sourced in another continent, that's simply not acceptable. So I think after it's all said and done, there is going to be some reflection and understanding that we have to have redundancy. At the very least, we have to have those capabilities within the United States and people need to start bringing back some of this work so, God forbid, if there are more outbreaks like this or issues where continents or countries get shut down, we have a supply here and we can amp that up. So I think that is a huge positive for American manufacturers.

MMS: Which opens up a wholly different challenge: workforce.

RA: Yes. The flip side of that is we need to make sure that those manufacturers can operate. That means better investment in our infrastructure. It means we need to train more people to be machinists and operators of these machines. All of us proudly saying that we want our children to go into manufacturing — that’s something the government needs to help with now. That's a standard we need to make a reality, now. It literally will help our lives.

Randy Altshuler, CEO, Xometry.

You know, I think it's very interesting — and rightfully so — that if your child becomes a police officer or a firefighter or a doctor or nurse, we recognize the social good that they're doing there. Teachers who help all of us — a noble cause. I don't think you have that respect for manufacturers. But if people aren't making things, the rest of us cannot survive. And somebody has to make the trucks that are carrying food that's going to the supermarkets while a lot of people stay home. Our infrastructure, our national security — all of these different things that require actual fabrication of parts. We need to trumpet that and make manufacturing a heroic profession. We need it. We need to give it recognition. And we need to excite our girls and boys to grow up and to be manufacturers.

Related Content

German Project Yields Three New Medical Machining Processes

Trends to Watch at IMTS: Recent research has resulted in a new mix of high-speed turn whirl milling, polygon turning and rotational turning for manufacturing medical bone screws and out-of-round nails.

Read MoreLyndex-Nikken Collets Enable Accurate Small-Diameter Cutting

The MMC Mini-Mini collet chuck is well suited for high-speed machining applications where clearance is needed, such as die mold, aerospace and medical parts.

Read MoreArch Cutting Tools Acquires Custom Carbide Cutter Inc.

The acquisition adds Custom Carbide Cutter’s experience with specialty carbide micro tools and high-performance burrs to Arch Cutting Tool’s portfolio.

Read MoreFive-Axis Turnkey Machine Halves Medical Shop’s Cycle Times

Horizontal five-axis machines cut cycle times in half at ARCH Medical Solutions – Newtown. But its leadership gives equal credit to a surprising factor: the OEM’s service department.

Read MoreRead Next

How PLM Helps Manage Global Supply Chains

Product Lifecycle Management (PLM) can make it possible to capture information from all stages of manufacturing and production. Here are a few examples of how PLM can help optimize production processes that are spread around the world.

Read MoreHow Part Data Control Will Expand and Simplify the Supply Chain

Digital rights management for manufactured part files will enable OEMs to enforce manufacturing requirements at a distance, as an alternative to in-person certification of suppliers.

Read MoreHow Is Digitalization Affecting the Manufacturing Supply Chain?

Leaders across the supply chain offered their thoughts during a recent panel presentation.

Read More

.jpg;maxWidth=300;quality=90)