Business Activity Accelerates Thanks to New Orders and Employment

Slow supply chains and rising prices are still challenges in the near-term.

Share

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

Takumi USA

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

The metalworking manufacturing industry registered quickening expansion in February according to the Gardner Business Index (GBI): Metalworking with a 56.0 reading, up 2.5-points from January. The upward gains made by the overall index were driven by the growing proportion of metalworking shops which reported increasing new orders and employment. Strong new orders activity coupled with a relatively modest expansion in production activity since 4Q 2020 may explain the strong expansion now being witnessed in the latest backlogs reading.

Metalworking Business Index: The Metalworking Business Index reported expanding activity during February. Rising new orders, employment and backlog activity pushed the index higher. Slowing order-to-fulfillment times sent the supplier delivery reading to a new all-time high.

Production challenges may also be a result of challenging supply chain conditions. February’s supplier delivery reading -in excess of 71- places it well above the prior all-time high reading of nearly 66-points. Such elevated supplier delivery readings indicate that an overwhelming majority of metalworking shops are experiencing slowing order-to-fulfillment times for upstream goods and thus a restrictive cap on productivity.

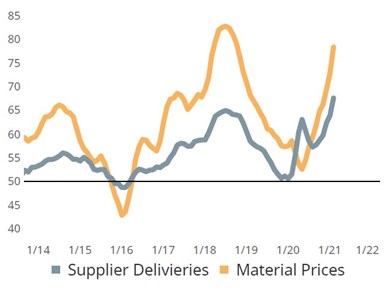

Supply Chain Impairment is adding to the rise in material costs: The history of the GBI suggests that slowing supply chains can have an amplified effect on material prices.

Challenging supply chain conditions not only are impacting production but also input materials costs. The history of the Gardner Business Index (GBI) bears out this critical insight as manifested by the highly correlated movement of supplier deliveries and material prices readings. This relationship suggests that even limited disruptions to supply chains can result in significant price changes for upstream goods.

Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Metalworking Index serves as a great tool for making data-driven decisions. Thank you to everyone who has previously completed our GBI surveys. Your participation helped increase response counts by 15% in 2020, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

Related Content

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

.jpg;width=70;height=70;mode=crop)