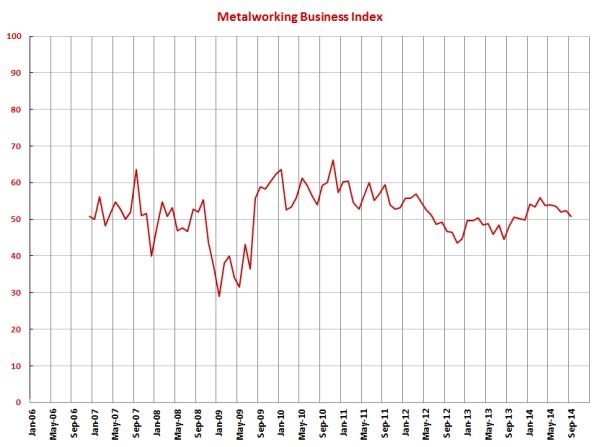

August 2014 MBI Growth Rate Accelerates

With a reading of 52.3, the metalworking industry grew in August for the eighth consecutive month and the 10th time in 11 months.

Share

Go here for more economic news from Gardner Business Media.

With a reading of 52.3, the metalworking industry grew in August for the eighth consecutive month and the 10th time in 11 months. The rate of growth rebounded somewhat from July, which had the slowest rate of 2014. The month-over-month rate has been in double digits five of the last six months, and the annual rate of change has grown faster for six straight months and is at its fastest rate since April 2011.

Both new orders and production increased for the 11th month in a row, and both of their indices grew at a faster rate than in July. Backlogs have contracted for five consecutive months, although this rate slowed in August. Despite the contraction, the backlog index was 33.5 percent higher than it was one year earlier, the fastest rate of monthly growth since July 2010. This indicates that capacity utilization should increase rapidly in the upcoming months and likely will average more than 80 percent in 2015. While employment in metalworking continues to expand, the rate of growth in August was the slowest of 2014. Exports have contracted faster as the dollar has strengthened, and supplier deliveries have been lengthening at a steady rate since September 2013.

Material prices have increased relatively steadily and significantly since August 2013. Prices received increased the last four months, the strongest period of sustained price increases by metalworking facilities since summer 2012. Despite all the good news, future business expectations fell to their lowest level since September 2013.

After contracting in July, future capital spending plans increased 22.6 percent over last August, the fastest month-over-month growth since November 2013. The annual rate of growth accelerated to 6.0 percent, its second fastest rate of growth since March 2013.

Related Content

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)

.png;maxWidth=970;quality=90)