How To Eliminate The Estate Tax

Transferring the wealth that took you a lifetime to accumulate is one of the most complicated and perplexing problems you must solve. Why? Because of the estate tax monster.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

Takumi USA

Featured Content

View More

Transferring the wealth that took you a lifetime to accumulate is one of the most complicated and perplexing problems you must solve. Why? Because of the estate tax monster.

We are talking real money—about $550,000 out of every million. If you are unlucky enough to be in the top estate tax bracket, you will lose up to 55 cents out of every dollar to feed the monster.

Most of the readers who call me seeking estate planning advice have a spouse, a family and a business. Common problems are how to: 1) “Transfer my business to the business kids”; 2) “Treat the non-business kids fairly”; 3) “Value my business”; 4) “Make sure my spouse and I can maintain our lifestyle for as long as we live”; and 5) “Control my wealth—including my business—for life.” What do you think is the number one question and concern? Yes, you guessed it: “How do I eliminate the estate tax?”

It sure would make life easier if the estate tax would go away forever! But let’s face it: That is not likely (because of the huge budget deficits) in the near future. Even if the Republicans—by some miracle—could pull off an estate tax repeal, the Democrats would simply reincarnate the tax when given the opportunity. (For your trivia file, the current estate tax is the third reincarnation.)

What’s my answer to the estate tax question? All of us must take matters into our own hands and start a crusade—a crusade to permanently destroy the impact of the estate tax. Agreed, killing the estate tax beast by repealing the law would be a great starting crusade strategy. But my fear is that the tax-greedy hands of our “friends” in Washington would make a kill-the-estate tax victory only a battle won, and we would ultimately lose the war (when the estate tax, once again, would become the law of the land).

The fact is that we already know how to totally avoid the impact of the current estate tax law. Actually, we have known how to get around the estate tax—legally—for years. That’s what many of my columns have preached.

So, what’s the goal (both short-term and long-term) of “Irv’s Crusade?” Well, the initial and continuous goal is and will be to get members—lots of ’em. Of course, you are invited to join and become a “ Crusader.” There are only two steps.

First, you must agree to honor, and pass on to all you meet, the Crusader’s Creed: “Without delay, I will start the process of creating a wealth transfer/succession plan that keeps all my wealth (every dollar of it—including my business) in my family, instead of losing it to the IRS. The plan will eliminate the impact of the estate tax. I will ensure the plan is completed. It is my right to control my wealth for as long as I live.”

The second step to becoming a Crusader is to actually start creating your wealth transfer/succession plan. Once you start the planning process, you are entitled to the rights of a Crusader: To have a plan created—for you (and your spouse), your family and your business—that bestows upon you every benefit described in the Crusader’s Creed.

My job is to help all Crusaders (who need help) start, create and complete their plans. So, if you want to join Irv’s Crusade, please send the following information to the address listed. (Send copies, not original documents.)

- For your business: Your last year-end financial statement.

- Personal: A current personal financial statement for you and your spouse.

- A family tree: Your name, age and birthday; the same for your spouse, kids and grandchildren.

- Other documents or information you think would be helpful.

Call me if you have questions. Crusaders, start the planning process today!

Related Content

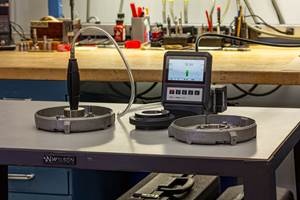

How to Calibrate Gages and Certify Calibration Programs

Tips for establishing and maintaining a regular gage calibration program.

Read MoreHow to Choose the Correct Measuring Tool for Any Application

There are many options to choose from when deciding on a dimensional measurement tool. Consider these application-based factors when selecting a measurement solution.

Read More4 Rules for Running a Successful Machine Shop

Take time to optimize your shop’s structure to effectively meet demand while causing the least amount of stress in the shop.

Read MoreCustom Workholding Principles to Live By

Workholding solutions can take on infinite forms and all would be correct to some degree. Follow these tips to help optimize custom workholding solutions.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)