How A $476,550 Investment Can Yield The Same Wealth As Earning $7.4 Million

How much must you earn to leave your family $1 million? . Roughly $3.

Share

Autodesk, Inc.

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

Takumi USA

Featured Content

View More.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View MoreHow much must you earn to leave your family $1 million? ... Roughly $3.7 million. The IRS gets $2.70 for every $1 your family keeps. Here's how to beat this tax confiscatory game.

The business owner, Joe, is 60 years old. His wife, Mary, is also 60. Joe and Mary's wealth will be left to their two sons, Hack and Jack. The estate tax liability is estimated at $2 million. First, buy a $2 million second-to-die life insurance policy. These policies do not pay off until the second insured dies. The premiums are low, and often set up to vanish in 15 years. For Joe and Mary the premium cost will be $31,770 per year. Okay, after 15 years Joe and Mary will have paid in $476,550. Then, the earnings on the cash surrender value will pay all future premiums for year number 16 and each year thereafter.

The proceeds are tax-free income under the Internal Revenue Code.

Now trick two-for sure, the IRS will collect estate tax on the life insurance proceeds, unless the proceeds are left to your spouse. When the second of Joe and Mary die, if the proceeds are paid to the kids-Hack and Jack-the IRS will get their pound (55 percent of $2 million or $1.1 million) of estate tax flesh. Now the trick. Don't own the policy. One way (and we think the best way) is to have the policy owned by an irrevocable life insurance trust. Since neither Joe nor Mary will own the policies at their deaths, Hack and Jack get the entire $2 million estate tax free.

To sum up, $476,550, paid at the rate of $31,770 per year for 15 years will do the work of earning $7.4 million ($3.7 million times 2) for Joe. Some trick! (You see, $4.4 million is left after $3 million in income in tax on the $7.4 million in eamings.) Now watch again-55 percent times the $4.4 million for estate taxes robs Joe's family of another $2.4 million leaving $2 million. The exact amount of the insurance! Yes sir, $476,550 (the exact amount of the insurance cost) is the equivalent of earning $7.4 million.

Now you know why the wealthy call life insurance a tax-advantaged investment and why life insurance often is the anchor of every wealth transfer (including the transfer of your business) plan.

How To Turn A Golf-Outing Tax Bogie Into A Tax Birdie

If you like to swing a golf club-particularly to entertain and get a tax deduction, gather 'round. There are sand traps. And there are tax traps. This sad tale involves both. You won't lower your golf score, but you will lower your tax bill. Here's the story.

A company-let's call it Promo Corpromoted a three-day golf outing at a resort. The festivities were enjoyed by 49 employees of Promo and 108 representatives of customers. The promo employees documented discussions of a general nature with the customers. Can Promo deduct the cost of the outing: food, lodging, golf fees, prizes and transportation? The law clearly does not allow a deduction if the entire entertainment occurred under circumstances where there was little or no possibility of engaging in the active conduct of business.

The activity was business related and of a general economic benefit to Promo. Even the IRS conceded that. But the fact remains, such general activities are considered nondeductible goodwill ...a common tax trap.

Could the deduction have been saved? Yes. If the agenda had included bona fide and substantial business discussions before or after the fun-time activities, the golf outing expenses would have been 100 percent deductible.

Related Content

What are Harmonics in Milling?

Milling-force harmonics always exist. Understanding the source of milling harmonics and their relationship to vibration can help improve parameter selection.

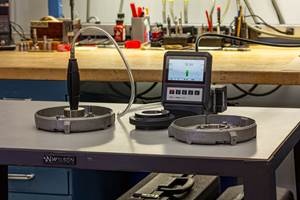

Read MoreHow to Choose the Correct Measuring Tool for Any Application

There are many options to choose from when deciding on a dimensional measurement tool. Consider these application-based factors when selecting a measurement solution.

Read MoreHow to Calibrate Gages and Certify Calibration Programs

Tips for establishing and maintaining a regular gage calibration program.

Read More4 Steps to a Cobot Culture: How Thyssenkrupp Bilstein Has Answered Staffing Shortages With Economical Automation

Safe, economical automation using collaborative robots can transform a manufacturing facility and overcome staffing shortfalls, but it takes additional investment and a systemized approach to automation in order to realize this change.

Read MoreRead Next

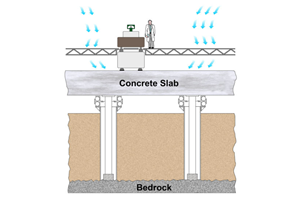

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.png;maxWidth=300;quality=90)