Share

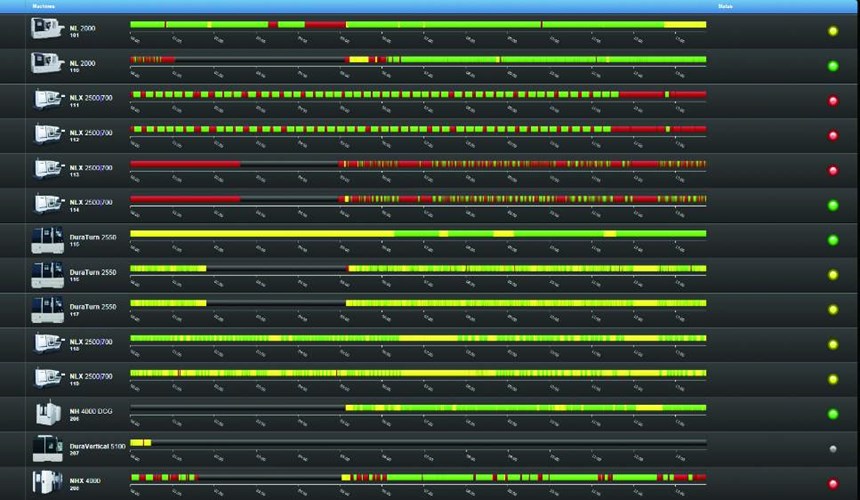

An increasing number of shops are performing machine tool monitoring in some way. In fact, I’m more frequently encountering large, flat-screen monitors in shops I visit that display machines’ operational status in the form of bar graphs containing areas of green, yellow, red and black. In general, the more uninterrupted green, the better, because green time is chip-making time. (You’ll understand why I say “in general” in a bit.)

Such a monitor is found in J&R Machine’s facility in Shawano, Wisconsin, enabling everyone on the shop floor to see, at a glance, the shop’s performance in real time. Plus, that information is accessible to managers via their computers, smartphones or tablet devices through the machine-monitoring software the shop uses. That way, they can remotely check in on a machine’s status at any given moment and receive alerts when a machine shuts down or an alarm is triggered.

While there certainly is value in collecting and displaying this data, identifying and tracking green time is only part of the continuous improvement initiative for J&R Machine. “We didn’t add machine-monitoring capability simply to see how much our machines are running or when they’re up or down,” explains Parker Tumanic, the contract shop’s vice president. “Rather than looking at this data only from an operational standpoint, we look at it from a financial perspective.”

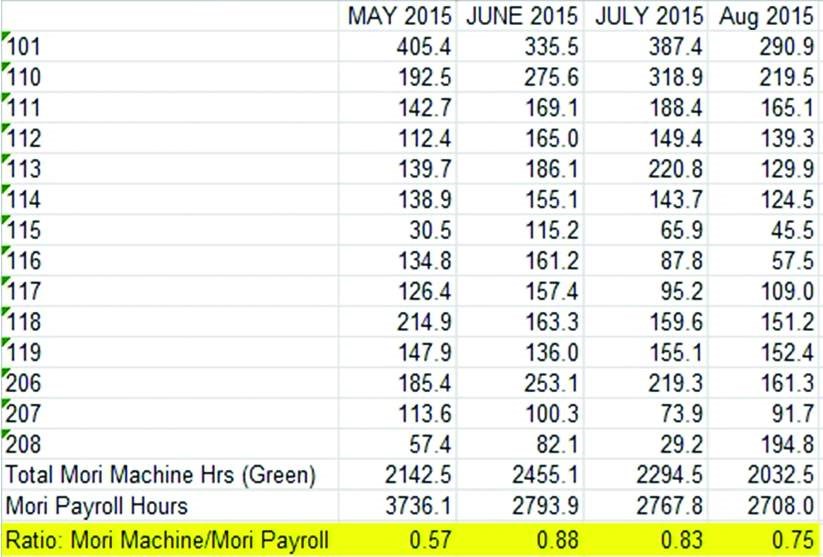

J&R Machine uses the machine data it collects to develop a monthly productivity index: a ratio of machine green hours to the payroll hours of the person tending the machine. In essence, this metric demonstrates how well the shop uses its payroll hours compared to its machine hours.

This helps shape a number of key business decisions, such as what type of equipment the shop should buy (or sell), what job might be better suited for a machine with more automated capabilities, what job seems to require too much operator intervention, what type of work the shop should go after, what type of work it should avoid, if its effective billing rate is appropriate, if it needs to pursue additional business and so on.

Ultimately, it reveals true shop costs and profit.

This metric is also shared with all employees, but it’s not done with the intent to browbeat them when the index for their machine(s) isn’t optimal, Mr. Tumanic says. In fact, the transparency of sharing this with employees serves to motivate them to look for ways to boost the throughput of jobs (thereby reducing the green time for those jobs) so other jobs in queue can be processed sooner.

Why do they do that? It’s because they know that higher company profits mean the chance for higher take-home pay, thanks to the shop’s quarterly employee gainsharing bonus.

Transitioning to Standardization

Founded in 1992, J&R Machine is an ISO 9001:2015-certified shop with a range of capabilities in addition to CNC machining, such as prototyping, engineering, fabrication and assembly. Its customers include some of the largest names in the defense, medical, machinery, hydraulics, oil and gas, and auto racing fields, although it is always on the lookout for opportunities in new, emerging markets.

The 34-person shop looks and operates much differently than it did years ago. Previously, it used a variety of machine types and went after different types of work. Today, it has settled on two machining platforms it will purchase moving forward: live-tool CNC turning centers and horizontal machining centers (HMCs). It has also settled not only on the machine builder, DMG MORI, but the machine models it will purchase: NLX 2500 turning centers and NHX 4000 HMCs. Not all the shop’s 20 CNC machines are these models, but they soon will be. As part of the shop’s business plan, machines must be replaced when they reach 10 years old. Currently, its oldest machine is a still-youthful 2012 model.

J&R Machine has identified precision turning with live tooling capability as its core competency. In fact, the work envelope it has identified for all jobs that the shop will take on ranges from 1 to 10 inches in diameter and as much as 20 inches long to match the capacity of the turning centers. However, machining on its two current HMCs (one an NHX 4000, the other an NH 4000) still represents approximately 20 percent of its business. It uses these machines because either there are some features that can’t be milled on the lathes or a part requires so much milling work that it becomes a bottleneck to mill them on the lathes.

The HMCs enable jobs to be set up on one pallet outside the workzone while the machine is milling on a part loaded in the machine, maximizing spindle uptime. J&R Machine still has one vertical machining center (VMC), but given the HMC’s dual-pallet design, it won’t purchase another VMC moving forward, and the lone remaining VMC will soon be sold to make room for another HMC. However, to maximize unattended run time for that VMC, the shop has developed custom, high-density workholding fixtures that can accommodate a number of parts. The pallets quickly and repeatedly mount in the machine via zero-point, ball-lock systems.

Tim Tumanic, company president and Parker’s father, says the move to standardization is valuable in a number of ways. It’s easier to redeploy people to different machines because the machines and workcenters are pretty much the same. It’s easier to get newly purchased machines online quickly, because they are tooled just like the others. It provides an easily scalable format for either adding capacity or replacing old equipment. It makes scheduling easier, because jobs can run on virtually any machine. It enables continuous improvement initiatives to be easier to roll out throughout the shop because the shop only has to focus on one machine platform. Also, by standardizing the workpiece-size envelope, it directs the shop’s sales team to look for work best suited to the shop’s capabilities and core competency, which means machines won’t be down because the work is not there for them and, ultimately, the company will realize higher profit margins.

Machine, Production Index Monitoring

Parker Tumanic says the shop also values the data-collection software compatible with its common machine tool platforms, which facilitates calculating its productivity index, something it began tracking in 2015.

This starts with determining how much the machines are running over a given period, when they’re not producing because of part loading, when they are down for maintenance and so on. This data is automatically collected via DMG MORI Messenger data-collection software.

The collected machine data then is imported into a spreadsheet Mr. Tumanic developed to calculate the monthly productivity index. This index is simply a ratio of a machine’s run hours to its operator’s payroll hours. “We never had an effective way to measure how many payroll hours were tied to machine hours,” he says. “Our productivity index enables us to easily see the connection.”

The table in the slideshow at the top of the article shows an example of this monthly report from 2015. At that time, the ratio of machine hours to payroll hours was low, with a four-month span ranging from 0.57 to 0.88. This spurred the shop to review the daily performance of individual machines to see why some had more green time than others. This in turn enabled J&R Machine to direct low-hanging-fruit-type improvement efforts.

In some cases, large gaps between green time were due to manual machine loading. This is one reason why the shop purchased its first two subspindle lathes with bar feeders and parts conveyors to enable long stretches of unattended operation. Integrating these machines had an immediate impact for certain higher-volume jobs that could be processed from 3-inch-diameter barstock or less, which is the capacity of the machines’ subspindles. In one case, a job ran over an entire weekend, only requiring an operator to come in two hours each day to check on the two machines, resulting in a productivity index of approximately 10.

“Adding an automated process such as this to gain uninterrupted green time sounds like common sense, but when you’re encountering a flat-screen monitor each day that shows all this data, you become more apt to do something about the yellow interruptions,” Mr. Tumanic says. “It spurs you to make changes to minimize the gaps in machine uptime.”

Examining the index also served to balance cells. The turning centers in the shop are located in one aisle with identical machines facing each other, so one operator can more easily tend both machines. In fact, each time the shop purchases new turning centers, it purchases two at a time for that reason. For the cells with chucker turning centers running one part number, one turning center performs machining on side A of the part, and the other machines side B. By closely looking at the amount of interrupted production for each side due to part loading, the shop was able to better balance the cells. For example, if the cycle time for side A is 10 minutes and side B is 5 minutes, the shop might work to improve the performance of machine A; take features produced on machine A and have machine B produce them; set up both machines to run side A and then once completed, set up both to run side B; or, if the volume was sufficiently high, set up four machines with one pair machining side A and the other pair machining side B (each cell would start and end at a different time).

The productivity index also helps determine what equipment to jettison. The indices for two of the shop’s current turning centers have been low. The problem isn’t that there are issues with programming, tooling or the machining process in general. Instead, it was determined that they aren’t capable of machining the type of complex parts the shop was and is pursuing. There simply hasn’t been enough work to feed them. As a result, these machines will soon be sold and replaced with better-suited equipment.

In reviewing the productivity index for specific machines, the shop asks itself a few questions when that value is low. Is there a process or programming issue? Were there machine alarms, and, if so, why? Are there enough sales for this machine, and does the machine match our core competency? Do the employees have all the hand tools, gages and related equipment they need to effectively run that particular job?

Typically, the result of identifying solutions to those types of issues shrinks the gaps in green time. However, the shop also looks to shrink the overall amount of green time for a job by spurring its machinists to try different cutting tools and/or make tweaks to part programs to reduce cycle times and, in turn, increase the effective billing rate for that machine and profit for those jobs because the machine is being utilized more effectively. This also enables jobs in queue to be completed sooner and/or spurs the shop’s sales department to pursue additional work.

The 4,000-Hour Challenge

Reducing overall green time is an ongoing effort at J&R Machine. It was especially important in 2017, because the company’s backlog forced it to run 24/7 with two 12-hour shifts. In an effort to get away from that, the shop challenged its employees to reduce green time by 4,000 hours that year (which effectively equates to the cost to purchase one new machine). As of last December, it had shaved 3,628 hours with changes such as reduced setup time, as well as part program adjustments and new tooling to increase feed rates and reduce cycle times.

“With our company’s previous culture, employees spurred to help save 4,000 hours of green time might have led them to believe they were essentially working themselves out of a job,” Mr. Tumanic notes. “Now, employees know that saving 4,000 hours so we can complete more jobs in the same time frame means they’ll be paid a higher quarterly bonus.”

What Fun Would Stopping Be?

Today, J&R Machine’s productivity index typically ranges from 1.2 to 1.4. Mr. Tumanic says this speaks to the value of having data that accurately depicts the rate of production on the shop floor in order to make sound, overall business decisions for the company.

Plus, the shop will continue to add and replace machines. Mr. Tumanic says not all the DMG MORI machines have the Celos control, which functions much like a smartphone or tablet and has a variety of helpful apps, but he’d like all machines to have that control. Another advantage is that manuals for ancillary machine equipment, such as the bar feeder and parts conveyor, can be easily accessed via this control, so machinists can order replacement parts on their own when necessary.

J&R Machine is also considering adding machine-loading robots between pairs of turning centers. In theory, this might make it possible for one machinist to tend four machines, resulting in four machine hours per one payroll hour. The operators are on board, because this, too, would result in higher quarterly bonuses.

“We’re a private company that’s profitable,” Mr. Tumanic notes. “We could easily shut down our improvement efforts based on tracking our productivity index and ride it out. However, it has become fun tracking the index and identifying ways to improve those ratios and grow the business at the same time. We see the real numbers and where even small process improvements can be impactful.”

Related Content

How to Mitigate Chatter to Boost Machining Rates

There are usually better solutions to chatter than just reducing the feed rate. Through vibration analysis, the chatter problem can be solved, enabling much higher metal removal rates, better quality and longer tool life.

Read More6 Machine Shop Essentials to Stay Competitive

If you want to streamline production and be competitive in the industry, you will need far more than a standard three-axis CNC mill or two-axis CNC lathe and a few measuring tools.

Read More5 Tips for Running a Profitable Aerospace Shop

Aerospace machining is a demanding and competitive sector of manufacturing, but this shop demonstrates five ways to find aerospace success.

Read MoreInside a CNC-Machined Gothic Monastery in Wyoming

An inside look into the Carmelite Monks of Wyoming, who are combining centuries-old Gothic architectural principles with modern CNC machining to build a monastery in the mountains of Wyoming.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)