Striving To Be Partners, Not Shops

The two divisions within this business machine complex parts for the medical and aerospace industries. So in that sense they’re shops. However, in order to grow with their customers, they realized they had to be more than just providers of good parts. They needed to serve as their customers’ manufacturing partners.

Share

The management teams of Trust Technologies and Miltronics & Skye (M&S) don’t consider their shops to be shops. Rather, these two Kilroy companies are set up to be “strategic manufacturing partners,” says Chris Rawlins, sales manager for M&S.

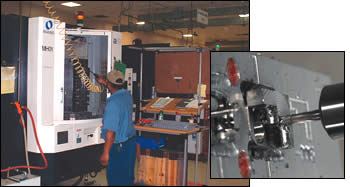

The two companies, which share a clean facility in Mentor, Ohio, do machine complex components from tricky materials. Trust Technologies focuses on aerospace and industrial-turbine-engine components that are often made from high-temperature alloys. M&S delivers intricate implant parts to the medical industry. The companies produce these components using advanced equipment such as 13-axis Swiss-type lathes and five-axis multitasking machines in cells.

But while intricate machining is their core competency, these two companies believe that machined parts suppliers to aerospace and medical markets must be more than “shops” nowadays. That means staying in very close communication with their customers and involving themselves in the early stages of their customers’ part design processes. That way, their engineering expertise allows them to suggest ways to make machining easier (i.e., less expensive). In addition, they offer services such as vendor-managed inventory (VMI) systems, component assembly, prototyping and repair work. Plus, the companies have brought key non-machining processes in house, which saves on transportation costs and eliminates inherent communication hassles and shipping delays when using multiple vendors. Over the years, they have added processes such as passivation, electropolishing, heat treating, laser marking, electrochemical etching, welding and packaging services.

I recently met with Mr. Rawlins and Frank Jones, director of sales and marketing for Trust Technologies, to hear about a few of their companies’ efforts to “partner” with their customers. I also learned about some of the in-house improvements that have helped streamline and support those efforts. As you read the following paragraphs, reflect upon your own situation and ask yourself if you might be able to offer your customers more to help them achieve their manufacturing goals, thereby positioning your shop higher in your customers’ supply chains.

Product Focus Teams

Trust Technologies and M&S benefit by offering product design and engineering capabilities. However, they no longer have a single general engineering department that serves all industries and customers. The companies recently created individual product focus teams for four of their prime markets—medical, aerospace, turbine parts rebuild and industrial turbine (this last team is located at a facility in Greenville, South Carolina). Having multiple, market-specific support teams that include engineering, design, quality control and production planning capabilities allows the companies to best serve the differing needs of those customers.

Customers with questions want to speak with vendor representatives that are industry experts. These product focus teams allow that to happen. Now, customers no longer have to first contact the person who quoted the job (which is often the case with conventional shops), who would then have to track down the proper contact for an answer. Going straight to the appropriate focus team ensures questions are answered promptly even though the two companies have many customers.

This direct communication also allows the companies to anticipate future customer needs that might require additional machining capacity or the reconfiguration of their existing equipment into cells for new families of parts. Open communication allows the companies to stay ahead of their customers and help ensure that they’re ready to quickly react to customers’ new production needs or delivery schedules.

Prototyping With Production In Mind

Neither Trust Technologies nor M&S are prototype shops—their focus is on production work. However, prototyping often opens the door to new customers or builds upon relationships they’re cultivating with existing customers. They consider prototyping to be a value-adding service to their customers.

What the two companies do is to look at prototyping from a production standpoint. They don’t dash off a prototype using a manufacturing method that would be unpractical for production of that part. Although this may mean that prototype development takes slightly more time to complete, customers will know exactly what the true cost of a final part will be during a production run. Knowing the true price eliminates possible surprises that can occur if the customer takes a final part design to a shop that was not intimately involved in the prototyping phase. For instance, a shop might offer a low-ball quote on an initial part run only to greatly increase the per-part price of a subsequent run when it realizes the difficulty of the job.

During the prototyping stage (which often requires multiple re-quotes because of design or material changes), the companies are able to examine a part design, identify the prime manufacturing cost drivers and then suggest design changes to make part production more cost effective. This not only helps customers hit their component price targets, but also allows the customers to go from prototype to product launch much faster than likely possible when using a shop that can’t offer such advice during the early stages of product development. Oftentimes, too, customers realize the amount of information the companies gained about how to effectively machine a part during the prototyping stage, so they are more likely to win the production work.

Inventory Management

Mr. Rawlins and Mr. Jones estimate that 80 percent of their medical and aerospace customers want their companies to manage parts inventory. Customers appreciate VMI capability because it takes the cost and hassle of inventory management out of their hands. Some of their customers present weekly VMI demand sheets. Anticipating order volume based on past demands allows the companies to start the production run for a particular order as early as one week in advance.

The companies might not necessarily produce the exact order amount each run. Instead, they determine optimal lot sizes based on optimal machining cycle times, setup times and related parameters for a given machine. For example, the optimal lot size for one of their Mazak Integrex multitasking machines was determined to be 100 pieces for a particular repeat job. So, that machine will produce 100 pieces at time, even though the customer’s order may only be for 60 or 80 pieces. The companies will store the extra pieces in inventory for delivery with a future order.

Shop Communication

Communication within the companies is also important to remain versatile in adapting to changing customer needs. Trust Technologies and M&S have monthly “shop talks” where employees and managers talk frankly about possible ways to make employees’ jobs easier. And even though the shops have separate setup personnel and machine operators, oftentimes all are consulted for suggestions about how to improve machining efficiency when a new customer’s job is ready to hit the floor.

The companies also are proactive in learning about employees’ desires to take on new roles or learn how to operate additional equipment. Both companies offer and promote cross-training on a variety of equipment so that employees have the versatility to be easily redeployed as needed.

Maintaining a visual workplace (a staple of lean manufacturing) facilitates clear communication on the shop floor. For instance, each cell contains a dry-erase takt time board that lists the target part quantities per shift, actual part counts and (when necessary) comments about what occurred during a part run to affect the final part count. The companies also have implemented 5S techniques (another important lean practice) to maintain workplace organization and cleanliness.

Keeping The Good People

All U.S. shops currently have difficulty finding good employees. However, that is only one part of the workforce struggle. It can be equally difficult to retain good employees. This is especially the case for employees with experience in the turbine engine rebuild market. That business is booming, and there’s a big push from many shops to recruit people who have experience with that work. Trust Technologies and M&S use a variety of incentives to make it less enticing for an employee to leave for another job that pays just a few bucks more. They offer significant benefits such as profit sharing, a 401(k) retirement plan and good medical insurance policies. But they’ve also found that the small things are also important to limiting turnover and boosting morale, such as employee golf outings and company picnics.

Related Content

German Project Yields Three New Medical Machining Processes

Trends to Watch at IMTS: Recent research has resulted in a new mix of high-speed turn whirl milling, polygon turning and rotational turning for manufacturing medical bone screws and out-of-round nails.

Read MoreEDM, Laser Micromachining and More at GF Medical Demo Center

At GF’s Medical Center of Competence, the company shows off EDM and laser features that could make a large impact on medical manufacturing — and elsewhere.

Read MoreMikron Milling Tool Suppresses Machining Chatter

IMTS 2024: The CrazyMill Cool CF milling tool features chatter suppression during machining, especially on thin-walled parts, which enables smoother cutting.

Read MoreAmetek EMC Laser Cutting System Offers Through-Part Cooling

The new laser cutting system offers comprehensive Swiss machining capabilities, as well as through-part cooling and automatic part-handling options.

Read MoreRead Next

An Analytical Approach To The Outsourcing Decision

The decision to manufacture in-house or send work overseas should not be based solely on labor cost. After an honest evaluation of its machining processes, this OEM found it was more profitable to bring work back in-house.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)