Metalworking Index Turns Expansionary After 6-Month Slump

Index to report first expansion since May, driven by production and new orders.

Share

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

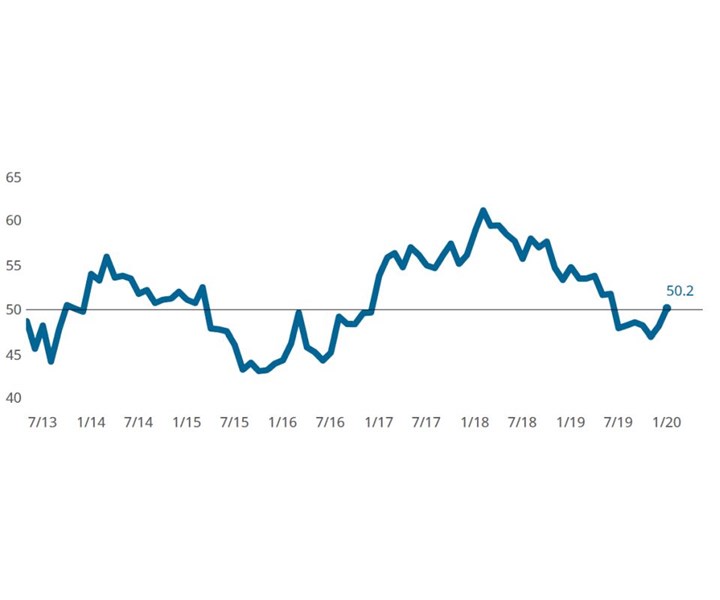

Gardner Business Index: Metalworking

The Metalworking Index posted its first expansionary reading since June of 2019. The latest reading was supported by expanding production and new orders activity.

The Gardner Business Index (GBI): Metalworking began 2020 with a reading of 50.2 — its first expansionary reading since June 2019. Index readings above 50 indicate expanding activity while values below 50 indicate contracting activity. The further away a reading is from 50, the greater the magnitude of change in business activity. Gardner Intelligence’s review of the underlying index components observed that the Index, which is calculated as an average of its components, was supported by an expansion in production and new orders. No change in export activity and contractionary readings for supplier deliveries, employment and backlogs held the Index back, yet most components moved several points higher during the month. In fact, backlogs saw a seven-point increase while remaining below 50.

This decelerating contraction in backlog activity was welcomed news after reporting accelerating contraction since 2016. January’s expansion in both production and total new order activity coupled with no change in exports activity and a sharply slowing contraction in backlogs implied that domestic demand expanded and that metalworking manufacturers greatly slowed the pace at which they reduced their backlog levels.

Larger Firms Report Expanding Business Conditions, Others Slowing Decline

Firms in excess of 250 employees reported quickening expansion at the start of the year. Firms of all other sizes reported slowing contraction in total business activity.

January’s results indicated that firms of all size categories reported improved month-over-month readings for the first time since mid-2018. Large firms in excess of 250 employees reported accelerating business activity for a 37th consecutive month. Firms of all other sizes reported slowing deceleration in business activity during January with firms between 100-250 employees reporting the smallest amount of deceleration. In contrast, firms with fewer than 50 employees reported the most challenging business conditions.

Related Content

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.jpg;width=70;height=70;mode=crop)