Metalworking Index Posts ‘No-Change’ Month in September

Metalworking posted a ‘no-change’ (reading of 50.0) month in September thanks to expanding production and new orders activity for the first time since COVID-19 began disrupting the global economy.

Share

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Takumi USA

Featured Content

View More

ECi Software Solutions, Inc.

Featured Content

View More

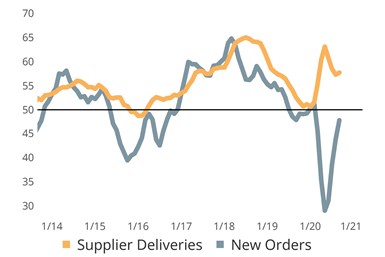

Metalworking Business Index: The Metalworking Index reached an inflection point in September with a reading of ‘50’. This marks the first time since February that the Metalworking Index has reported a reading of 50 or higher.

The Gardner Business Index (GBI): Metalworking posted a ‘no-change’ (reading of 50.0) month in September thanks to expanding production and new orders activity for the first time since COVID-19 began disrupting the global economy. Export and backlog activity both reported slowing decline in September as well, further helping the Metalworking Index to shift from slowing contraction in recent months to no-change. Upward trending readings which in absolute terms are below ‘50’ indicate slowing contraction in business activity; this means that a shrinking proportion of survey respondents each month are reporting that conditions are worse now as compared to the prior month. A reading of exactly ‘50’ indicates that business conditions between two consecutive months did not change, for this reason, the ‘50’ line in our charts serves as an important inflection point.

Mid-Size Firms Report Third Consecutive Month of Expanding New Orders: New order activity in the second quarter of 2020 varied greatly by company size. Mid-size firms of between 100 and 250 employees reported significantly better new orders activity compared to their peers of other sizes. Conversely, Gardner’s data indicate that supply chain disruptions have been generally uniform with regard to firm size.

When segmented by company size, the data distinctly indicates that “mid-size” metalworking firms of between 100 and 250 employees have done far better since at least June than both their larger and smaller peers. Gardner’s analysis into the reason for this division indicates that unlike their peers of other size categories, these firms have experienced significantly better new orders and production activity in recent months. Lastly, supply chain readings through YTD2020 have been similar across all firm sizes, suggesting that large and complex supply chain have not been disproportionately impacted by COVID-19.

Related Content

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)