Metalworking Activity Reports Slowing Expansion

Will new year see additional price increases? Surveying indicates more shops passing price increases onto consumers.

Share

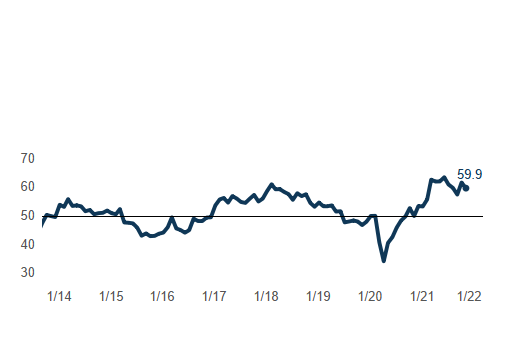

Gardner Business Index: Metalworking

The Gardner Business Index: Metalworking declined by two points to end November at 59.9.

The Metalworking Index moved modestly lower, with most Index components reporting lower November readings.

The modest decline in the overall reading was broad-based with all activity components other than exports reporting expanding activity. Slowing expansion was recorded for new orders, production, and backlog activity. Downward trending readings which remain above 50 indicate slowing expansion for that component of the Index. After posting a three-and-a-half-year high reading in October, the latest employment reading declined by two points, keeping it well above long-run levels. Supplier delivery activity, which proxies for the performance of supply chains, continued to disappoint with a seventh consecutive monthly reading near 80.

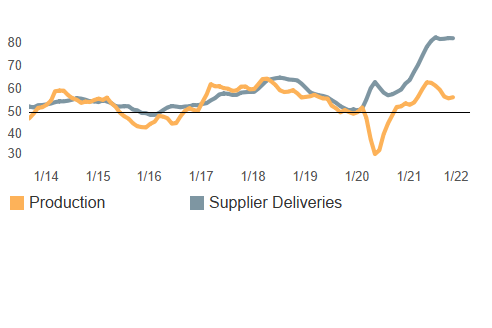

Production Activity Slows as Supply Chains Continue to Stall

Production readings during the second half of 2021 have declined at an accelerating rate as supply chain challenges remain unabated. Chart values are 3-month moving averages.

Nearly 9 in 10 surveyed respondents since May of this year through November reported rising supplier prices. Throughout the middle of 2021, the spread between the proportion of shops citing rising costs and the proportion stating that they were passing price increases onto customers widened to around 27% and has fallen only slightly from this level as we approach the end of the year. Given this, there is strong reason to believe that downstream consumers are in for sticker shock in the new year as 2022 contracts are renegotiated.

Related Content

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)