MBI at 44.6: The Contraction Continues

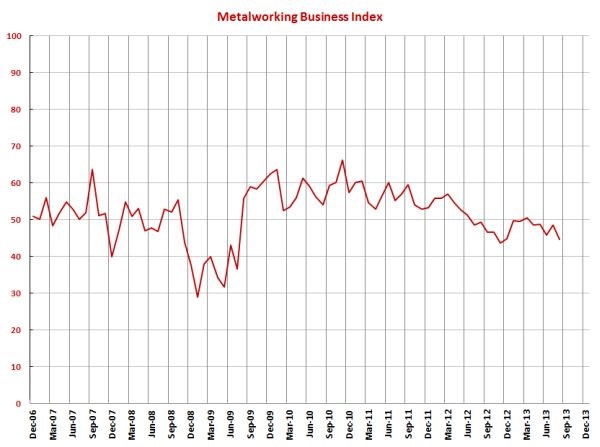

With a reading of 44.6, Gardner’s metalworking business index showed that the metalworking industry contracted at its fastest rate since November 2012.

Share

With a reading of 44.6, Gardner’s metalworking business index showed that the metalworking industry contracted at its fastest rate since November 2012. Since leveling off at the end of 2012 and beginning of 2013, the industry has generally contracted at an accelerating rate since March 2013.

Perhaps the most significant reason for the accelerated contraction in August was the decline in performance at facilities with more than 50 employees. These facilities had been growing throughout 2013. But, in August there was a noticeable drop in business activity. Shops with more than 250 employees contracted for the first time since December 2012. And, facilities with 50-99 employees contracted for just the second time in 2013. The smallest shops, those with fewer than 19 employees, saw their fastest rate of contraction since we expanded the survey in December 2011.

Every single sub-index moved lower in August. New orders and production dropped significantly, almost matching their fastest rates of contraction at the end of 2012. Backlogs have been contracting since March 2012. Employment contracted for the first time since November 2012. Exports contracted at their fastest rate since December 2012. Supplier deliveries were lengthening, but at a much slower rate.

Material prices continue to grow but the rate of growth has slowed from earlier in 2013. Prices received were just below 50 in August. This is the first time prices received have decreased since December 2012. Future business expectations fell to their lowest level in 2013.

All nine regions were below 50 in August. And, all nine regions had a lower index reading in August than they did in July. The best performing region was the West South Central and the worst performing region was the East South Central.

Future capital spending plans were the lowest since February 2012 and almost 25% below the historical average. Compared to one year ago, spending plans have contracted each of the last five months, but the rate of contraction has slowed each month. However, respondents to our capital spending survey, which you can read more about in the December issue, were very positive regarding their 2014 capital spending plans.

Go here for more manufacturing economic news.

Related Content

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

.png;maxWidth=970;quality=90)

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)