Machining in the Era of the Electric Car

The COO of a machine tool builder that specializes in automotive production comments on the implications of greener transportation.

Share

“When the winds of change are blowing, one can build a wall or a windmill.”

Cited by Heller Group COO Manfred Maier at a recent Heller Machine Tools press event, this adage speaks to the value of changing one’s approach in the face of new challenges. It also seemed particularly fitting for the occasion. Heller builds machine tools, not windmills, but the world’s continued evolution toward a greener future—namely, anticipated declines in the production of traditional internal combustion engines—has this 120-year-old automotive machining specialist thinking hard about how best to adapt.

And yet, Mr. Maier clarified that in one sense, there’s also room for wall-building. Speaking July 27 to the trade press in the hours before a biennial open house event at the German company’s North American headquarters in Troy, Michigan , he emphasized that the combustion engine isn’t going extinct anytime soon. Even in the long term, there’s no guarantee that cars will be fully electric. Hybrids, which still employ cylinders and pistons, are catching on, too. Even fully electric vehicles might still employ a transmission to ensure a smooth ride, he points out, adding that estimates vary as to how many and what types of vehicles may be on the road at any given point during the next few decades. In short, Heller has no plans to abandon its focus on the kinds of high-volume production lines and heavy engine components that have been its specialty for decades and remain the focus of its off-IMTS-year open house events.

Still, whatever the future holds, the evolution of the powertrain continues to follow the same trend: toward lighter, mostly smaller parts that require less metalcutting. For Heller, this will mean the following:

Fewer Sales, More Service

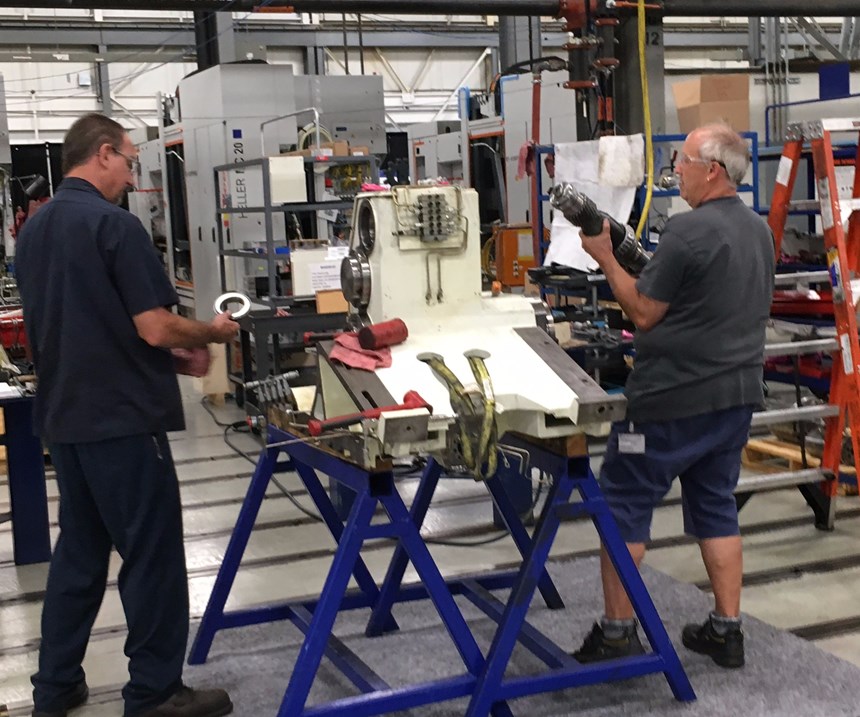

Heller may not be abandoning its focus on dedicated, high-volume production lines for heavy-duty engine components, but that focus is changing. Although new equipment was also highlighted, this year’s open house event heavily emphasized retrofit and refurbishing services, and rightly so. Uncertainty about the future direction of the powertrain is making customers more interested in giving older machines “second life” or refitting them for new work than purchasing new ones, Mr. Maier says. That’s the case even though price tags can sometimes amount to as much as 75 percent of the cost of newer, more efficient technology. In essence, these customers are doing whatever they can to build proverbial windmills—to prepare themselves as thoroughly as possible for an uncertain, but likely inevitable, future.

Adapting and Expanding the Portfolio

Heller has already adapted to that future somewhat. Machine designs are modular, with various options for size, spindle specifications and more, enabling automotive manufacturers to specify just the right kind of machine. By extension, modifications to existing platforms could make certain models more viable for the new paradigm. Moving forward, Mr. Maier says, the company will place even more emphasis on ensuring next-generation platforms share as many components as possible to ensure out-of-the-box versatility while easing customization for specific needs.

These platforms don’t necessarily need to originate with Heller, either. Consider five-axis vertical machining centers (VMCs) from Wenzler, a builder the company acquired about five years ago. This equipment offers the high spindle speeds and steep acceleration ramps desired for fast, light machining—say, on chassis components for hybrid or electric cars.

Pivoting to Different Markets

Some machines have already proven themselves in markets that can provide a hedge against the potential of declining automotive machine tool sales. For instance, the H, F and C lines of horizontal four- and five-axis milling and turning machining centers that are popular in the automotive, agricultural and construction machinery market have also been employed for oil and gas and general industrial applications. Moving forward, Heller aims to focus more on sectors like aerospace and power generation while reducing its dependency on automotive, which currently accounts for more than 75 percent of its business.

Focusing on New Process and Technology Development

Mr. Maier made clear that Heller’s true competitive edge isn’t just its technology; it’s extensive experience and expertise in setting up entire, customized production systems, including material-handling automation, quality control technology and more, that keep per-part costs as low as possible. Applications and service know-how is considered a core competency.

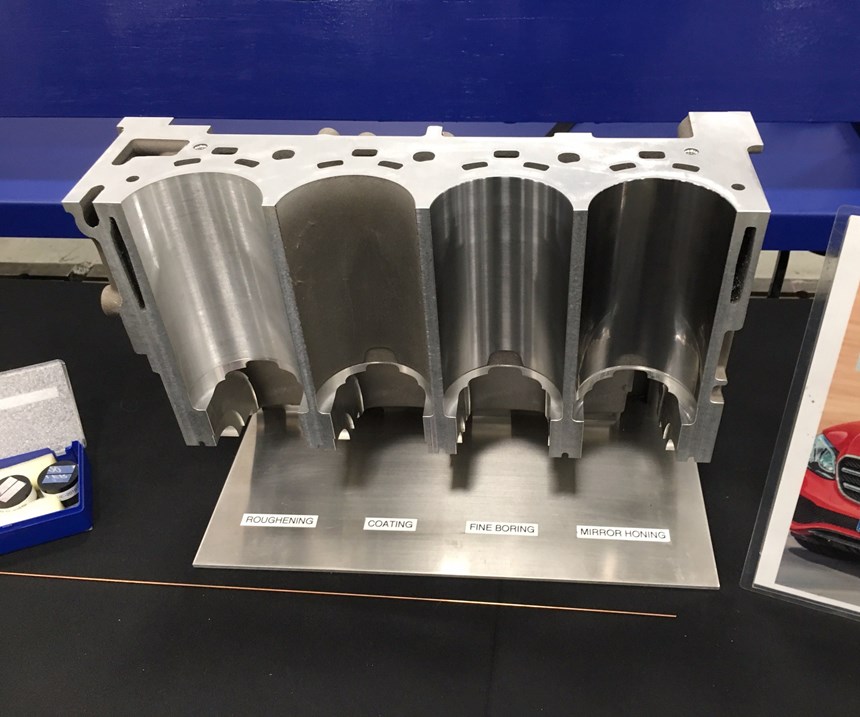

The company also has a track record of developing complementary technologies beyond machining, as exemplified by its cylinder bore coating process. More recently, it’s been exploring the possibilities of additive manufacturing and technology for processing new materials, such as CFK (carbon fiber).

Automotive work accounts for enough machining globally that these implications could very well go beyond companies like Heller that have carved a specific niche in that market. In fact, it’s so impactful that machine tool consumption closely tracks the production of light-duty vehicles (LDV), Mr. Maier says. Although forecasts call for continued increase in LDV production, the number of combustion engines for those vehicles could decrease from 90 million this year to 75 million by 2030, while the number of E-powertrains could rise to more than 45 million. Mr. Maier says this likely means that global consumption of machine tools will slow. Continued technological development and efforts to implement data-driven manufacturing technology will make those machine tools more efficient, even as alternative materials like composites and complementary technologies like additive become more important.

Despite all this, he says the consumption of machine tools will continue to grow, even if the slope of that growth is flatter. That’s due to a rising global population and the associated demand for new goods—particularly the planes, trains and automobiles that are essential to human mobility, and, by extension, to modern work and leisure activities alike. Chinese manufacturers will likely gain significant market share due to that country’s increasing living standards, which are more stagnant in the West, and the global machine tool industry will likely see more consolidation.

Related Content

The Role of Surface Finishing in Modern Manufacturing: Trends and Best Practices

You’re attending IMTS to advance your business. Regardless of your role in the manufacturing process, considering how your parts will be finished is crucial. This article can help you understand trends in surface finishing and better communicate with your finishing partners.

Read MoreThe Best of IMTS24 In Photos (We Saved the Best One for Last!)

From quadruped robot dogs, to an in-booth putting green where you can test out a new golf putter, to a 3D-printed car and more, attendees enjoyed cutting-edge technology and innovations all week long. Take a look to see what (or who!) you might have missed this week!

Read MoreJIMTOF 2024 Report: EVs, AI and Autonomous Robots Abound

The 2024 Japan International Machine Tool Fair (JIMTOF) showed how the manufacturing industry is adapting to the needs of electric vehicle manufacturing and adopting new technology including AI and autonomous robots.

Read MoreEliminating Automotive Defects Per Million With Automated Visual Inspection

This automotive manufacturer virtually eliminated PPM defect complaints after implementing an automated visual inspection system at its facility.

Read MoreRead Next

Setting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More