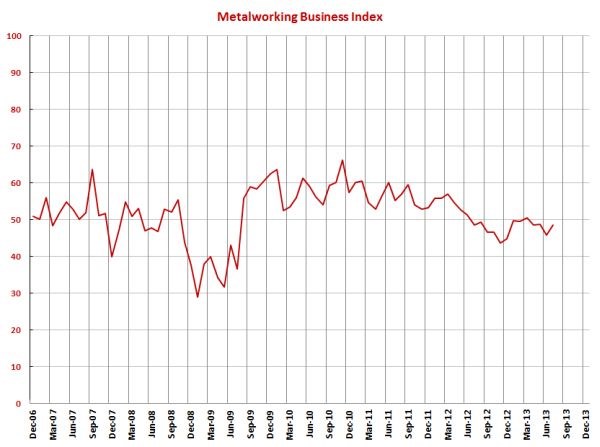

June MBI at 48.5 – Contraction Slows Significantly

With a reading of 48.5, Gardner’s metalworking business index showed that the metalworking industry contracted at a much slower rate in July compared to June.

Share

With a reading of 48.5, Gardner’s metalworking business index showed that the metalworking industry contracted at a much slower rate in July compared to June. While the industry has contracted every month but one since July 2012, the trend line of the index has been moving up since November 2012. The index is improving because better business conditions are spreading to smaller facilities.

Throughout 2013, I have highlighted that business conditions were split between large and small shops. Metalworking facilities with more than 50 employees have been growing while those with fewer than 50 employees have been contracting. In July, facilities with 20 to 49 employees began growing for the first time since March 2013 and only the second time since October 2012. These shops grew at their fastest rate since August 2012. Therefore, in July the index showed significant growth in all facilities with more than 20 employees. But, shops with fewer than 19 employees are still mired in contracting business conditions. In fact, business conditions at these small shops contracted at the second fastest rate since April 2012 when this cycle of contraction began.

Two of the sub-indices, employment and supplier deliveries, indicated expanding business conditions in July. Employment has been growing since December 2012 while supplier deliveries have been lengthening every month but one since at least December 2011. All of the other subindices that make up the metalworking business index continued to contract in July but all of them contracted at a slower rate, which is a positive sign. The index level for new orders, production, and backlog made a significant jump in July compared to June. The improvement in the index level for exports was more modest.

Material prices continue to grow faster and faster each month while prices received are growing at a relatively constant rate. However, the growth in materials prices is much faster than the growth rate for prices received, which puts pressure on profits. Future business expectations continue to move in a generally upward direction.

While all nine regions contracted in June, three regions expanded in July. The fastest growth was in the West South Central followed by the Mountain and West North Central. The West North Central has been the strongest region in 2013, growing in five of the last seven months. All other regions contracted with the poorest performance in the Middle Atlantic. This region has been the poorest performing region throughout 2013.

Future capital spending plans remained relatively modest. Compared to one year ago, spending plans have contracted each of the last four months, but the rate of contraction has slowed each month.

Related Content

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

.JPG;width=70;height=70;mode=crop)