Getting Credit Where Credit Is Due

Although current economic climate is by no means conducive to securing a lease or loan for a new machine or other equipment, shops with the right plan in place can still obtain the financing they need. One expert offers some advice for manufacturers seeking to obtain equipment financing amid the downturn.

Share

ECi Software Solutions, Inc.

Featured Content

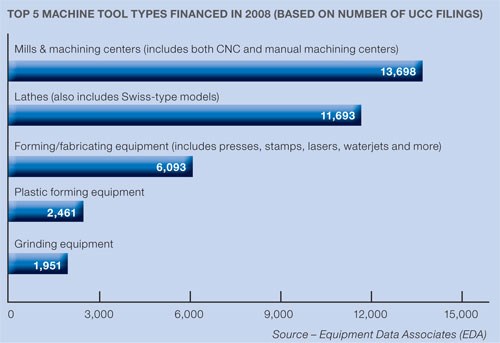

View MoreWith the economy roiling in the grip of a worldwide recession and the credit crisis in full force, obtaining financing for new equipment purchases may be frustrating for many manufacturers. Despite a series of bailouts and other government efforts to stabilize the financial sector, many businesses are finding it increasingly difficult to obtain the capital infusions they need to compete. We recently spoke with Ken Rector, head of the machine tool finance division at U.S. Bank Equipment Finance, about how manufacturers should think about financing capital equipment purchases in the current economic environment.

A Different Kind Of Recession

Economists and pundits continue to cite the unprecedented nature of the downturn, and predictions about when the economy will reach its nadir and begin to tick up again are vague at best. This uncertainty has caused a great deal of hesitation in the marketplace, Mr. Rector says, leading companies to rein in spending and approach business decisions more cautiously. "I liken it to a hurricane," he explains. "We see it on the radar, but until it passes, we don’t know whether it will be a Category 1 or a Category 5."

While all this suggests a less-than-rosy scenario for at least the immediate future, Mr. Rector says there are still reasons for manufacturers to be optimistic. During the last recession from mid-2000 to early 2003, manufacturing was particularly hard-hit and was among the last economic sectors to recover. The current downturn has led to similar issues, including layoffs, reduced demand and rampant uncertainty. However, delinquencies, while on the rise, are nowhere near levels reached in the last recession.

When demand took a nosedive in the early 2000s, machine tool builders struggled to sell off excess equipment inventories produced during the ‘90s, a period of unprecedented growth. Attempts to stimulate demand via continually lowering prices soon led the value of used equipment to plummet as well. In anticipation of future downturns, many OEMs have taken the lessons of this period to heart and moved to just-in-time (JIT) production and other strategies to better control inventories. Thus, equipment values may be more secure this time, Mr. Rector says.

Additionally, many manufacturing sectors today remain stable or are even experiencing growth. The energy industry, especially alternative energy such as wind power, continues to attract investors. So far, the medical, aerospace and defense markets have also proven to be somewhat resilient to the downturn, Mr. Rector says.

Justifying Equipment Purchases

Nonetheless, Mr. Rector cautions that purchasing activity has significantly decreased across the board as manufacturers adopt a "wait and see" approach to business. "From a psychological standpoint, people don’t feel very good right now about how things are going, and I think that’s driving a lot of the hesitant behavior we see out there," he notes.

Still, transitioning to markets such as those mentioned above can be a welcome opportunity for shops in the automotive, construction or other sectors that continue to spiral downward, and shifting gears in this way often requires equipment upgrades. Likewise, shops that are sufficiently stable may need automation equipment to head off an anticipated shortage of skilled labor or to simply increase efficiency. Others are seeking to refinance existing equipment to reduce their debt load, Mr. Rector says.

While reasons for seeking financing abound, Mr. Rector says securing a loan or lease boils down to one primary factor—a shop’s ability to justify the risk involved to the lender. Despite the economic climate, capital is still available for manufacturers that have been in business for a while and have historically demonstrated the propensity and ability to repay their debt, he says. Such shops might qualify for "application-only" financing, which can be secured relatively quickly and easily by filling out a one-page form. In fact, as many as half of all transactions financed in the manufacturing sector are via an application-only process.

Manufacturers that don’t qualify for application-only financing must pursue capital through standard underwriting. This requires companies to submit a full financial package, including the past few years of tax returns, profit and loss statements, balance sheets and other such documents, Mr. Rector says.

It goes without saying that companies seeking to secure financing through standard underwriting would be well-served by keeping comprehensive, up-to-date financial statements. Additionally, presenting a marketing plan with specific strategies for generating revenue could help shops justify new equipment purchases. Mr. Rector also advises companies to thoroughly explain the measures they have taken to protect themselves against the loss of business. "Has (the potential borrower) laid off people? Has it reduced salaries? How is it cutting expenses to make it through the current downturn? Have any contracts have been lost, and if so, what is the plan to replace them? The answers to those kinds of questions would be very critical for any lender to understand when evaluating whether it’s prudent to provide capital," he explains.

Rethinking Refinancing

At the same time that lenders are becoming more averse to risk given the state of the manufacturing sector and the overall economy, increasing numbers of shops are seeking to refinance equipment in order to reduce monthly payments, Mr. Rector says. So, while refinancing looks like a no-brainer for borrowers, things might not be so simple from the lender’s perspective. That’s because depreciation may have reduced the value of the machine to less than what the borrower owes.

This is more likely if a transaction has been on the books for only a short time. That’s because depreciation reduces the value of a new machine more quickly during the first few years of use before the drop in value begins to taper off. "If you went into a deal with 100-percent financing and wanted to refinance only 18 months into the contract, the value of the equipment might be much less than the outstanding amount on the loan or lease," Mr. Rector explains. "Today, most lenders are not going to be quick to lend into an existing collateral hole, whether from another lender or their own contracts, and ‘roll the dice,’ if you will—particularly on a company that is showing a downward trend in terms of sales revenue, profitability and so forth."

However, Mr. Rector says this doesn’t necessarily mean refinancing is not worth pursuing. Rather, companies may need to offer additional collateral to offset risk to the lender. "It doesn’t necessarily have to be a 1:1 ratio with collateral, but the lender will definitely want sufficient coverage in case something happens and the company is unable to meet its obligations," he says.

"There’s no question that the lender community as a whole is being more conservative to protect against unforeseen difficulties," Mr. Rector concludes. But although credit may be harder to come by these days, he emphasizes that there continues to be plenty of capital available for the acquisition of manufacturing equipment. With the right plan in place to justify purchases to lenders, shops can still obtain the equipment they need to move forward and weather the economic storm.

Choosing The Right Financing Structure

A variety of financing structures are available for equipment purchases. Here are some of the most common arrangements:

• Loans

With a typical loan, the debtor borrows money to purchase an asset and offers collateral in case of default. Loans enable manufacturers to reap all the benefits of owning the asset, including the ability capitalize it (that is, use depreciation and deduct the interest expense) on their financial statements. Loans typically require a significant down payment, however. Mr. Rector says most shops choose to pursue fixed-rate financing rather than variable-rate products.

• Finance Leases (Nominal Buyout Leases)

Most equipment purchases are financed through some form of leasing, and a variety of lease structures are available depending on the specific circumstances of the manufacturer. The majority of small- and medium-sized shops choose lease structures with nominal buyout options, Mr. Rector says. With these types of leases, companies finance the amount of the purchase—sometimes as much as 100 percent of it—and can buy the equipment for a nominal fee (typically $1 or $101) at the end of the term.

These structures are most useful for companies that want to own the equipment at the end of the contract. These leases typically require higher monthly payments than other types of leasing structures. However, finance leases enable companies to own (for tax purposes) the equipment throughout the term of the financing.

• Fair Market Value (FMV) Leases And Tax Lease Purchases (Early Buyout Leases)

While most shops use $1-buyout leasing structures, increasing numbers are choosing leases that provide options for paying a larger residual at the end of the term or at a certain point in time, Mr. Rector says. These products are attractive to companies that may be able to rent equipment, but not necessarily buy it. This could be the result of a capital budget constraint.

Typically, tax leases result in lower monthly payments than nominal purchase option leases or loans. Additionally, some shops opt for a tax lease structure because they have no intent of purchasing the asset and want to pay as little as possible before returning it at the end of the term. Continually using this strategy can enable producers of complex parts requiring high tolerances to purchase new machines every few years and utilize the latest technology.

An FMV lease enables the borrower to buy the equipment at the end of the term for its FMV at that point in time, return the equipment or renew the lease.

A tax lease purchase (early buyout lease) is similar to an FMV lease, except that it establishes a mid-term purchase option. That is, the buyer can choose to purchase the equipment for a set amount at a specific point in time, reducing uncertainty compared to other structures in which the purchase option price is determined at the end of the term. If the lessee decides not to purchase the equipment at the mid-term option, the lease reverts to an FMV lease.

Related Content

Workholding Fixtures Save Over 4,500 Hours of Labor Annually

All World Machinery Supply designs each fixture to minimize the number of operations, resulting in reduced handling and idle spindle time.

Read MoreHow to Pass the Job Interview as an Employer

Job interviews are a two-way street. Follow these tips to make a good impression on your potential future workforce.

Read MoreFinding Skilled Labor Through Partnerships and Benefits

To combat the skilled labor shortage, this Top Shops honoree turned to partnerships and unique benefits to attract talented workers.

Read MoreBuilding Machines and Apprenticeships In-House: 5-Axis Live

Universal machines were the main draw of Grob’s 5-Axis Live — though the company’s apprenticeship and support proved equally impressive.

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)