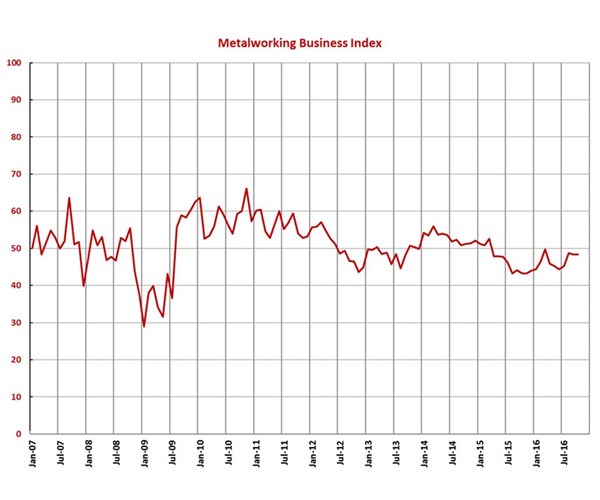

GBI: Metalworking October 2016 – 48.4

The trend in backlogs indicates capacity utilization at shops should begin improving.

Share

With a reading of 48.4, the Gardner Business Index showed that the metalworking industry contracted in October at the same rate as the previous month, remaining virtually unchanged for the third month in a row. Other than a spike this past March, the index is noticeably higher than it has been since February 2015.

The new orders subindex contracted rather slowly for the second straight month, and production was flat after growing the previous two months. The backlog subindex has contracted since April 2014, but it bottomed in November 2015 and has trended up ever since, indicating that capacity utilization at machine shops should begin improving very soon if it has not already. Employment increased for the first time since July 2015. While exports continued to contract, this subindex reached its highest level since November 2014. Supplier deliveries lengthened for the eighth consecutive month, although at a somewhat slower rate.

While material prices have increased since March, the rate of increase has slowed since June to a slower rate than in 2014. Prices received generally have decreased at a slower rate since November 2015, but that rate of decrease has been accelerating the last two months. Future business expectations have steadily improved since June and are clearly up from the low in January.

In October, the electronics, pumps/valves/plumbing and military industries recorded an index above 60, which was quite strong growth. The only other industries to grow in the month were machinery/equipment and primary metals. Job shops contracted at a minimal rate but have trended up sharply since May. Automotive metalworking facilities have contracted since October 2014, while forming/fabricating and industrial motors/hydraulics/mechanical components have trended down for several months.

The Southeast was the fastest growing region in October, having grown for three straight months. The only other region to grow was the North Central-East, which also grew for three consecutive months. The North Central-West continued to contract at a slower rate, while the Northeast and West seem to have bottomed out. The South Central was clearly contracting at a slower rate than previous months but was still the weakest region.

Mid-size facilities, those with 20 to 249 employees, grew in October and have trended up for several months. Companies with more than 250 employees also grew but remained on a downward trend that began in May. Shops with fewer than 20 employees continued to contract.

Related Content

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)