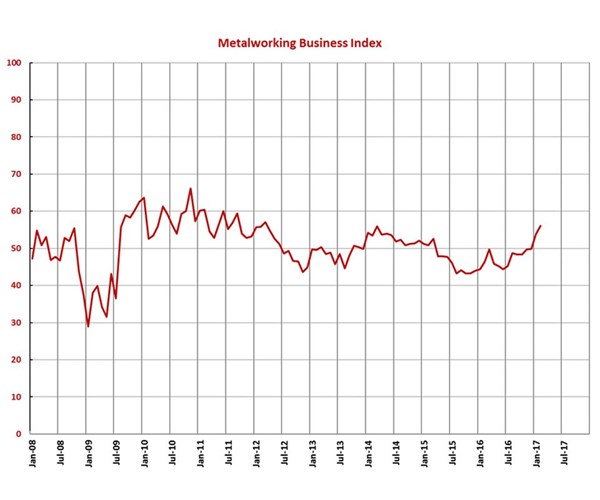

GBI: Metalworking February 2017 – 56.0

As expansion continues, the metalworking industry has hit its highest point in five years.

Share

With a reading of 56.0, the Gardner Business Index showed that the metalworking industry grew at a rapidly accelerating rate in February for the second month in a row, reaching its highest point since March 2012.

New orders increased for the fourth straight month and at their fastest rate since March 2014. The same was true for the production subindex. The backlog subindex increased for the first time in nearly three years, shooting up to its highest level since March 2012. The trend in the backlog subindex indicates that capacity utilization should increase in 2017. Employment increased for the fourth time in five months and at its fastest rate since June 2014. Exports continued to contract, but this subindex did reach its highest level since December 2014. Supplier deliveries continued to lengthen at a slightly accelerating rate.

Material prices increased at a similar rate to January. In each of the first two months of the year, material prices increased at their fastest rate since February 2012. Prices received also increased at a rapidly accelerating rate for the third straight month and at their fastest rate since March 2012. Future business expectations continued to climb above 80 for the second month in a row, although their rate of increase has slowed.

The primary metals sector grew for the fifth time in six months and at its fastest rate since September 2014. This is a positive sign for the metalworking industry, since all its manufacturers need metal to cut. Pumps/valves/plumbing products grew for the first time since October 2016, and machinery/equipment grew at a very strong rate for the third time in four months. Metalcutting job shops grew at their fastest rate since the survey expanded to cover individual industries in December 2011.

The North Central-West was the fastest growing region of the country. It grew at an accelerating rate for the third straight month and was closely followed by the Southeast, which grew for the seventh month in a row. The North Central-East, South Central and Northeast also grew at strong rates, and the West grew for the second time in four months and at its fastest rate since May 2015.

Shops of all sizes expanded again in February. Those with more than 250 employees grew for the fifth month in a row; facilities with 100-249 workers expanded at their fastest rate since the survey began in December 2011; companies with 50-99 grew for the sixth time in seven months; shops with 20-49 grew for the fourth time in five months; and those with fewer than 20 employees expanded for second month in a row.

More news from Gardner Business Intelligence can be found on this Economics Blog.

Related Content

-

Market Indicators Continue to Soften in Metalworking

The overall metalworking index is down more than a point, but future business is up slightly.

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

.JPG;width=70;height=70;mode=crop)