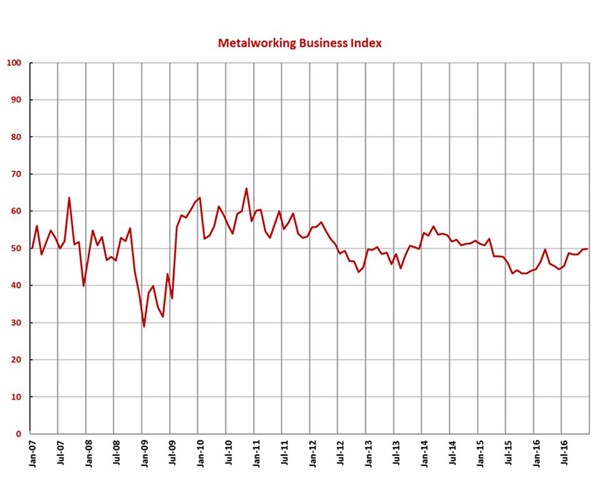

GBI: Metalworking December 2016 – 49.8

Contraction slows and index reaches its highest level since June 2015.

Share

With a reading of 49.8, the Gardner Business Index showed that the metalworking industry contracted in December, but at a slightly slower rate than the previous month. And despite the continued contraction, this was the index’s highest level since June 2015, its last month of growth. The industry has clearly improved since November 2015.

New orders increased for the second straight month, and production grew for the fourth time in five months. While still contracting, the backlog subindex continued its steady improvement that began last June. This trend in backlogs shows that capacity utilization should increase in 2017. Employment increased in December for the second time in three months and at its fastest rate since July 2015. Exports continued to contract, and supplier deliveries continued to lengthen.

Material prices increased at a dramatically faster rate in December as this subindex climbed to its highest level since November 2014. Prices received increased for the first time since May 2015 and at the fastest rate since December 2014. After a huge spike in November because of the results of the presidential election, future business expectations increased again in December.

The forming/fabricating industry grew for the first time since last June 2016, and aerospace increased for the second month in a row. Moldmakers continued a torrid pace of growth that they have been experiencing for five months. Electronics grew for the second time in three months, and job shops grew for the third time in four months.

Among all regions of the country, the North Central-West grew at the fastest rate, increasing for the first time since April 2015. The Northeast expanded for the second straight month, and the Southeast grew for the fifth month in a row.

Plants with more than 250 employees and those with 50-99 workers both grew for the fourth time in five months, and those with 100-249 employees expanded for the third time in four months. After two months of growth, shops with 20-49 employees contracted, and even though shops with fewer than 20 employees continued to contract, they did so at their slowest rate since June 2015, their last month of growth.

Related Content

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)