Deliveries, Production and New Orders Lead Index Expansion

Weakness in exports seems to have little effect on total new orders.

Share

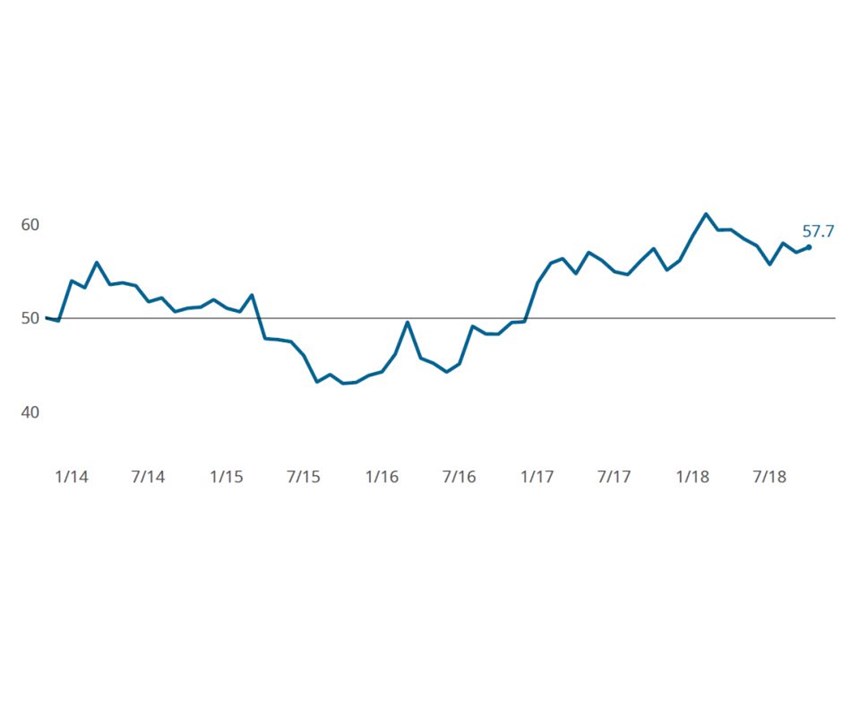

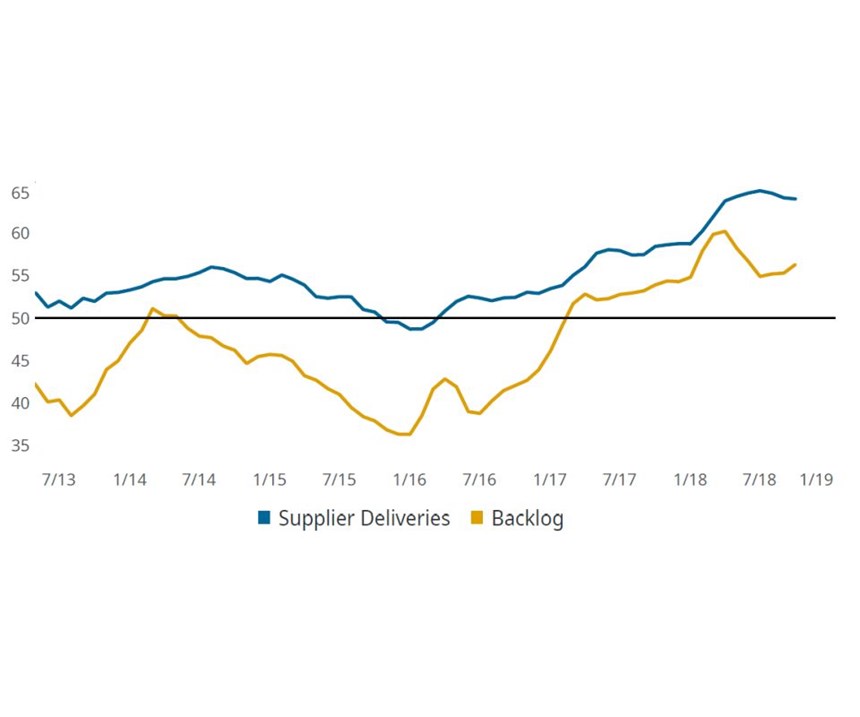

Registering 57.7 for October, the Gardner Business Index (GBI): Metalworking extended its accelerating growth trend since its recent July low. It seems 2018 is likely to achieve the highest average index reading of any calendar year in recorded history. (The current record of 55.8 set in 2017, beat by a wide margin the prior record of 52.8 set in 2014.) For a sixth consecutive month, supplier deliveries continued to be the leading component driving the total index higher, followed by new orders and production. The readings for employment, backlogs and exports, however, lowered the index’s average-based calculation.

The latest readings of supplier deliveries, production and new orders do not indicate that an immediate change of course in metalworking manufacturing has or is taking place. In fact, the latest readings continue to be within the same elevated range of readings that were first recorded in early 2017. Furthermore, there is a long-running positive trend in backlog growth between early 2017 and continuing through the present, which further suggests that demand is still outstripping the available supply of output.

Despite contractionary export readings in both September and October, total new orders growth has expanded faster in each month since taking an unexpected dip during the second quarter of the year. Chinese tariffs on U.S. exports to China, a strengthening U.S. dollar in foreign currency exchange markets and changing regulations that have acutely affected automotive production across the United States, Mexico and Canada are some of the many factors that may be slowing U.S. export volumes.

Related Content

-

Metalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)