December Metalworking Results Extend Recent Trends

The December 2021 Metalworking Index reflects ongoing supply chain disruption, with four of the six Index components registering slowing expansion.

Share

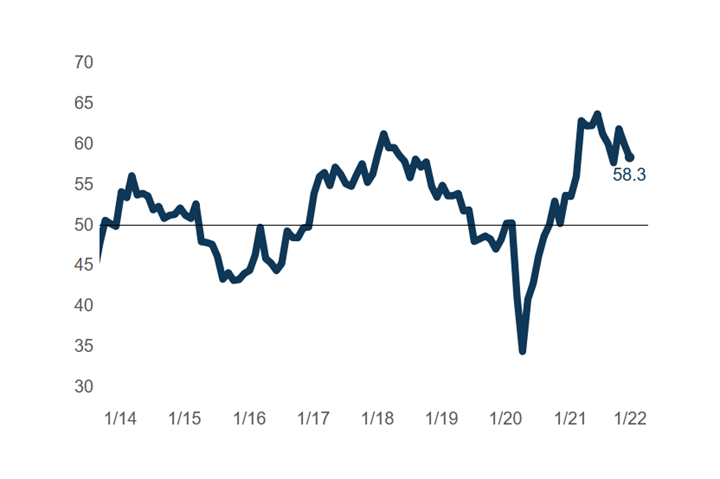

The Gardner Business Index (GBI): Metalworking declined by fewer than 2 points to end 2021 at 58.3.

The Metalworking Index ended 2021 both well below it’s 2021 high but well above where it started the year. This could signal that, while the industry is finding its post-COVID footing, there is still much work to be done.

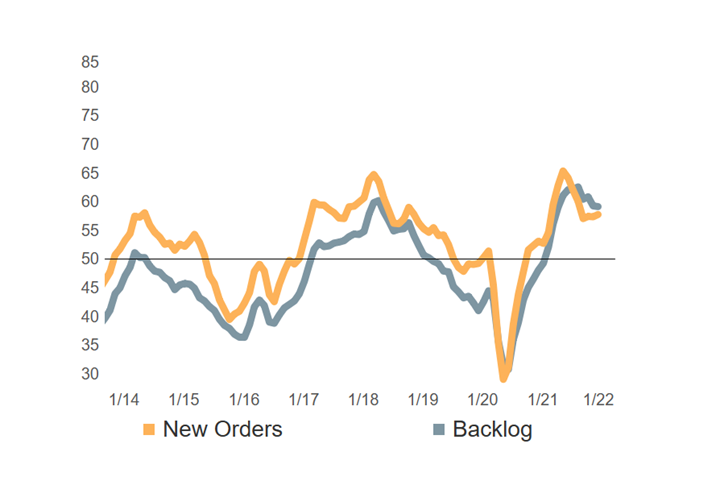

Four (new orders, production, supplier deliveries, employment) of the Index’s six components registered slowing expansion during the month. In contrast, backlog activity rose slightly during December and remains near historically high levels. Inflated backlog readings as previously reported have been sustained in part by the relative difference between strong new orders and struggling production activity levels. Throughout 2021, production readings fell below those of new orders in every month except for July. This contrasts greatly with the past decade’s trend in which production readings regularly exceeded those of new orders.

New Orders Reading Sustains Higher Backlogs

New order activity outpaced production throughout 2021; this helped send the average 12-month backlog reading to an all-time high by the end of the year.

Supplier delivery activity ended the year with a reading of just under 77, about 7 points below its all-time peak from October yet 10 points higher than its year-ago value. The average 2021 supplier delivery reading at 78.4 was over 20 points above its long-run average and represents just how much work has yet to be done to solve manufacturing’s supply chain challenges in 2022 and beyond. Until more can be and is done to resolve the industry’s supply chain problems, Gardner expects production activity to remain below desired levels which will place upward pressure on backlogs.

Related Content

-

Metalworking Activity Contracted Marginally in April

The GBI Metalworking Index in April looked a lot like March, contracting at a marginally greater degree.

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)