Share

Takumi USA

Featured Content

View More

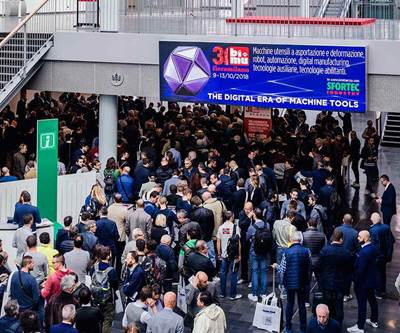

BI-MU 2022 occupied four exhibition halls at Fiera Milano, with five pavilions: RobotHeart, Metrology and Testing, BI-MU Logistics, BI-MU Digital and piùAdditive. The trade show also shared visitors with Xylexpo, a co-located woodworking trade show that took place in two exhibition halls opposite BI-MU. Photo courtesy of UCIMU-Sistemi Per Produrre.

Even beyond the RobotHeart exhibition area sponsored by SIRI, the Italian Robotics and Automation Association, automation cast a large presence at the 33rd iteration of BI-MU, the Milan, Italy-based metalworking trade show that drew almost 700 exhibitors and 50,000 attendees — myself included — from October 12th to 15th, 2022. More understated but equally important was a commitment to flexibility that I heard from companies across the show floor. Together, these two trends suggest a shape for the future of not only Italy’s industrial sector, but the world’s.

Automation at the Robot and Beyond

Demand for robots and automation equipment is increasing in Italy, just as it is across the globe. According to Barbara Colombo, president of the Italian machine tool, robot and automation manufacturers’ association UCIMU-Sistemi Per Produrre, 73% of robots sold in Italy are designed for part placement — and it is this use which took much of the spotlight in the RobotHeart pavilion, with pick and place demonstrations from Hiwin, ABB and more.

Robot integrator Technorobot was one of several companies exhibiting at the FANUC booth. While most of Italy’s robotics market centers around part-picking robots, Technorobot demonstrated other uses for cobots, such as marking.

Technorobot, a FANUC integrator whose booth formed part of the larger FANUC exhibition, demonstrated some of the wider purposes for robotics. The company prides itself on meeting a vast range of customer needs, using simulation software to prove out its FANUC robots for bespoke situations and different tasks, including welding and marking applications. The company’s booth provided examples of cobots performing the latter task at the show.

The emphasis on automation extended beyond robots themselves, too, with exhibitors around the show floor demonstrating technology for facilitating automation. For example, Schunk demonstrated its automation-compatible quick-change workholding, which Andreas Kuehl, general manager of Schunk Italia, says is well-suited to the high-mix, low-volume nature of most Italian job shops. Avoiding downtime is vital to these shops, especially as the one-two punch of rising inflation and the European energy crisis have increased operating costs and required shops to prioritize efficiency to remain within cost on jobs.

Modularity and Customizability

Kuehl spoke to another common theme around the BI-MU floor, one which Technorobot had also addressed: that of customer-centric solutions and modular catalogs. While these points may sound like buzzwords, in practice many of the exhibitors could point to examples. Adriano Salvi, sales and marketing manager at Sunnen Italia, and Alberto Cassinari, technical engineer at Mandelli, provided insights based on their respective positions as employees at a distributor and a local OEM.

Schunk’s quick-change workholding devices make use of software to determine whether the part is loaded. Relying on this software rather than manual input improves the devices’ suitability for automation.

On the distribution end, Salvi notes that Sunnen Italia acts as a consultant to customers, offering machines as solutions — and has thus tried to expand its catalog as widely as possible. This has resulted in the subsidiary offering products from both its parent company and multiple other international brands, with Hardinge mills and Benzinger lathes and turn-mills among its product lineup.

On the OEM front, Cassinari says that Mandelli’s smaller size relative to larger international companies makes for a smaller machine lineup — but one which the company can customize to meet the needs of its local clientele, offering the same machine in different configurations of heads and loading methods. Mandelli also increasingly meets the needs of more cash-strapped shops by restoring older machines, upgrading the mechanical and electrical components while keeping the original metal structure.

Comparing the Views from Italian and American Shops

The heavy presence of multinational brands (whether headquartered in the US, Italy or elsewhere) also provided a good chance to learn about the differences between how these companies service different markets.

From a logistical standpoint, service can be a problem for companies like Mandelli, which currently operates from a single service center in the US, as opposed to four locations in Italy. Many potential North American customers ask about local service centers, and the smaller local operation can turn them away — though Cassinari hopes that the company’s recent acquisition by Allied Group will enable Mandelli to bolster its presence in the US. Emco meets with the same conundrum, servicing its US customers out of a single facility in Novi, Michigan, whereas the Austrian machine tool maker can support three different divisions in Italy.

While recent years have mostly seen Emco receive attention in the US on account of its large-format machines, the company’s Italian branches also see success with smaller machines, such as the UMill 630.

Interfacing with Emco’s US customers has given Davide Adorno, the company’s export sales director, insights into key differences between the operating habits of the European and North American markets. For one, he notes that American aerospace companies rely on a greater share of third-party manufacturing contracts than their European counterparts, thus opening aerospace manufacturing to a wider array of shops. He also sees a difference in shops’ purchasing habits on both sides of the Atlantic: In Adorno’s experience, US shops tend to order machines to perform an imminent job, while European shops tend to plan for long-term use.

Additive manufacturing technology provider EOS has also seen major differences in the way its US and European customers leverage its technology. While assembly consolidation is a selling point for its machines worldwide, the company sees greater demand for metal additive machines with larger build platforms in the US, a situation EOS’ EMEA regional director Davide Iacovelli attributes to the country’s larger market for space parts. Conversely, European manufacturers skew toward polymer additive machines to create parts for a wider variety of sectors.

Additive manufacturing’s ability to combine multiple machined parts into a smaller number of 3D printed parts saves time, material and storage space. Advances in postprocessing techniques also enable EOS to offer additively manufactured polymer parts in a wide variety of pigments, increasing the technique’s suitability for commercial use.

Countering Crises

A report from UCIMU-Sistemi Per Produrre indicates that exports made up 50.5% of Italy’s machine tool, robot and automation sector production in 2021. This high level of exports means that the country is heavily affected by swings in global demand — and thus the global inflation crisis and European energy crisis are likely to have a large impact on the Italian metalworking industry.

Yet shops’ increased demand for automation equipment and OEM and distributors’ increased focus on solution-based approaches to providing customizable equipment suggest a flexibility and resilience that could weather these challenges. Even potentially tricky issues like the strength of the US dollar against the euro have silver linings for companies able to make use of them: Adorno says that the dollar’s strength has enabled Emco to offset increased transportation costs when shipping its machines to the US.

Related Content

Managing Coolant with Skimmers, Refractometers and More

Bacteria-infected coolant harms machines and sickens machinists. Coolant management technologies like skimmers and automated systems counter this tendency.

Read MoreInside the Premium Machine Shop Making Fasteners

AMPG can’t help but take risks — its management doesn’t know how to run machines. But these risks have enabled it to become a runaway success in its market.

Read MoreInvesting in Automation, Five-Axis to Increase Production Capacity

To meet an increase in demand, this shop invested heavily in automation solutions and five-axis machines to ramp up its production capabilities.

Read MoreWhich Approach to Automation Fits Your CNC Machine Tool?

Choosing the right automation to pair with a CNC machine tool cell means weighing various factors, as this fabrication business has learned well.

Read MoreRead Next

Building Capacity Through Automation

Stecker Machine, a production shop that specialized in runs of a couple hundred parts, needed to develop highly automated cells to produce tens of thousands of complex parts from castings every year.

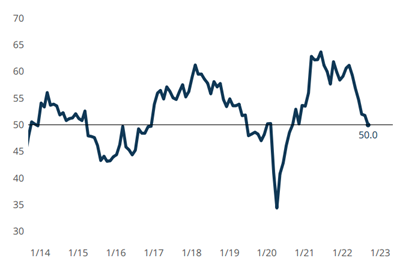

Read MoreMetalworking Activity Flattens in September

It has been nearly two years since the Gardner Business Index for Metalworking was 50.

Read MoreItalian Machining Technology at BI-MU 2018

The 2018 edition of the Italian machine tool trade show emphasized start-ups, additive manufacturing and the automotive industry.

Read More

.png;maxWidth=150)