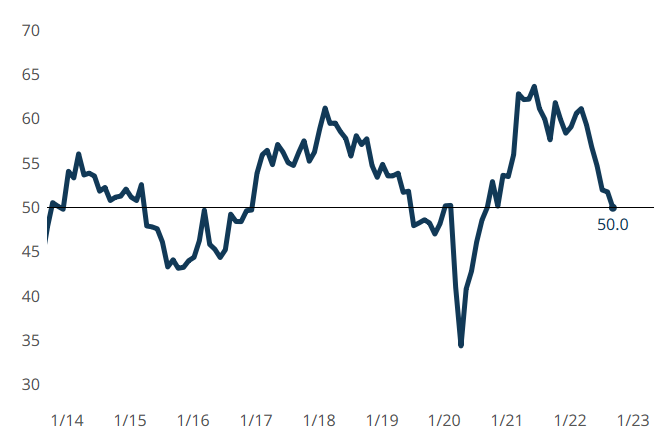

Metalworking Activity Flattens in September

It has been nearly two years since the Gardner Business Index for Metalworking was 50.

Share

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

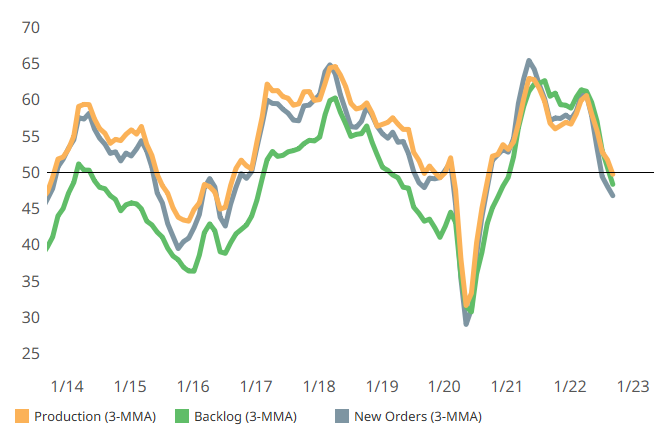

An index of 50 means the average of the six GBI components is equal — components on the upswing are offset by components on the downswing, with some components flat themselves. With the exceptions of supplier deliveries and employment, all metalworking GBI components are flat or contracting in September, and backlog is contracting in September for the first time since the start of 2021. New orders, which started to contract in July, contracted at a faster rate in September.

Production ended the month flat, with the same proportion reporting “more” as reporting “less” production in September relative to August. Employment is the sole component still in genuine growth mode (lengthening of supplier deliveries is an artifact of supply chain issues), inching closer to flat each of the past four months. Export activity continued its path of contraction at about the same rate.

Metalworking GBI is flat in September, with upswings and downswings in activity essentially canceling each other out. Photo Credit: Gardner Business Intelligence

Production is flat for the first time since September 2020. Backlog solidly joins new orders in contracting in September. Photo Credit: Gardner Business Intelligence

Related Content

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)