Why Did GE Aviation Acquire Morris Technologies?

Located in the Cincinnati area near GE Aviation’s Evendale, Ohio, headquarters is a leading supplier of contract additive manufacturing services—Morris Technologies. In order to secure this company’s capacity for its own use, GE Aviation acquired Morris Technologies and sister company Rapid Quality Manufacturing (RQM).

Share

ECi Software Solutions, Inc.

Featured Content

View More.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Randy Kappesser, composites technology leader with GE Aviation, was involved in the Morris/RQM acquisition and will continue to be involved as these companies are integrated into GE. He recently responded to questions about this acquisition and what it signifies.

Peter Zelinski: Describe how Morris and RQM will now change. Will all of the companies’ additive manufacturing capacity be dedicated to GE Aviation production? If so, how quickly will this occur?

Randy Kappesser, GE Aviation: Morris and RQM will be fully dedicated to GE Aviation and other GE businesses. The companies will meet their obligations to their non-GE customers. After they are met, Morris and RQM will be fully focused on GE work. The transition to a fully GE-dedicated operation will take about a year. However, RQM and Morris have done a great job working with many leading companies, which could mean the continuation of certain opportunities, assuming all parties are in agreement.

PZ:Will the Morris and RQM names remain? Will the equipment relocate to the Evendale campus?

RK: That is to be decided. At least for the short-term, the names will remain. As for the equipment, at this point there does not appear to be reason to disrupt the operations and move to the Evendale campus.

PZ: Characterize the importance of additive manufacturing to GE Aviation. Give a sense of the amount of production to be done in this way in the years to come.

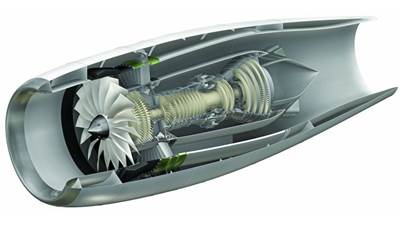

RK: GE clearly views additive manufacturing as a game-changing technology. Morris and RQM are already committed to providing components within the combustion system of the LEAP jet engine currently under development by CFM International (a 50/50 joint company of GE and Snecma of France). CFM has received orders for more than 4,000 LEAP engines. Additional components for the LEAP engine as well as for other GE engines under development are being explored for additive production. By 2020, well over 100,000 end-use parts in GE/CFM engines will be produced through additive manufacturing. That’s a huge change, and we believe a competitive advantage. With the acquisition, work on identifying and developing GE’s other additive applications can be accelerated.

PZ: Component-making processes are often outsourced. Is additive manufacturing an exception that argues in favor of having the production in-house?

RK: Additive manufacturing is a significant technology GE wants to keep in-house. It is comparable to other capabilities GE is keeping in-house, such as the production of carbon fiber composite and ceramic matrix composite components. As more advanced materials are developed for the jet propulsion and aerospace industry, producing large and small engine parts with these materials increasingly requires proprietary, highly sophisticated manufacturing processes that will be retained in-house.

PZ: How does this acquisition fit within the context of what GE Aviation sees looking forward? Why does this move make sense?

RK: Additive manufacturing gives GE Aviation opportunities for both cost and weight reduction on jet engines. Meanwhile, the acquisition will allow all GE businesses the opportunity to better understand the breadth and potential of new additive manufacturing applications. As manufacturing technologies and materials progress within the aerospace industry, jet engine suppliers are increasingly moving capability in-house. Pratt & Whitney, for example, has recently announced that it is moving its geared technology capability in-house. GE, for its part, has made strides in producing non-metallic parts, with GE Aviation leading the jet propulsion industry in the production of composite components. The additive manufacturing acquisition is another example. Jet propulsion represents one of the most attractive sectors of the aerospace industry, and the main suppliers will continue to build upon their internal capability.

Related Content

6 Variations That Kill Productivity

The act of qualifying CNC programs is largely related to eliminating variations, which can be a daunting task when you consider how many things can change from one time a job is run to the next.

Read MoreHow to Determine the Currently Active Work Offset Number

Determining the currently active work offset number is practical when the program zero point is changing between workpieces in a production run.

Read MoreTips for Designing CNC Programs That Help Operators

The way a G-code program is formatted directly affects the productivity of the CNC people who use them. Design CNC programs that make CNC setup people and operators’ jobs easier.

Read More4 Rules for Running a Successful Machine Shop

Take time to optimize your shop’s structure to effectively meet demand while causing the least amount of stress in the shop.

Read MoreRead Next

The Future of Manufacturing

According to engineers with GE Aviation, the challenges of additive metal manufacturing—serious as they are—are small compared to the promise that this technology holds. How else can you make a plane engine 1,000 pounds lighter?

Read MoreVideo: Additive Manufacturing at Morris Technologies

A company that is advancing additive manufacturing as a production technology discusses why additive manufacturing is important right now.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)