Why And How The Rich Get Richer

Regular readers of this column know my modus operandi: Discover the tax secrets of the wealthy and then adapt those secrets to the family business owner. As a member of a network of professionals, I regularly run across exciting new tax-saving strategies and wealth building techniques.

Share

Takumi USA

Featured Content

View More

Regular readers of this column know my modus operandi: Discover the tax secrets of the wealthy and then adapt those secrets to the family business owner. As a member of a network of professionals, I regularly run across exciting new tax-saving strategies and wealth building techniques.

One new and unique strategy not only saves taxes but also creates tax-free wealth. The subject is life insurance, friend of the rich and famous—and family business owners, too.

Sorry, but this time you really must be rich to play the game—very rich. So, this column has two purposes: to entertain the majority of us, who like to peek and see what the rich do; and of course, to give some tips if you happen to be rich (or have a rich relative, friend or boss).

Let's start with an insurance example that would work for most successful—but not very rich—business owners. Suppose Joe (age 60 and married to Mary, also 60) needs $1 million of second-to-die insurance. Premium cost per year is $11,169. Joe and Mary would create an irrevocable life insurance trust (ILIT) to own the policy. Assume Mary is the last to die 30 years down the road.

The total premium cost would be $335,070 ($11,169 times 30 years). If Joe and Mary wind up in the 50 percent estate tax bracket, the after-tax cost of the total premium would be only $167,535 (50 percent of $335,070, which was used to pay premiums, is gone and of course, is not subject to estate taxes). Yet, the full $1 million will be received tax-free (protected by the ILIT) by Joe and Mary's heirs.

Now, suppose Joe and Mary become very rich and are worth $40 million and need $20 million of insurance. The premium cost skyrockets to $223,380 per year. Sure, Joe and Mary can afford the premiums, but they would have to sell some assets to pay the premiums. Capital gains taxes would be incurred. Joe says "no" to that idea. He doesn't look kindly at the large gift tax that would be incurred as the premium costs are gifted to the ILIT each year, either. Remember, if done right, that $40 million is tax-free—a worthy goal.

What to do? Premium financing—a new wealth-creation strategy—may be the answer. Here's how the strategy works. Instead of paying premiums, Joe and Mary borrow the premium cost from a bank, and their total out-of-pocket cost is only the interest on the loans. There are no capital gains taxes or gift taxes for Joe and Mary. The bank will wait to collect the premium loans until after the death of both Joe and Mary. In general, annual premiums to use this concept must be about $100,000 or more.

There are two situations in which you don't have to be very rich to take advantage of this premium financing concept:

1. You or a relative (usually a parent or grandparent) have reached an age where the annual premium cost is too high for the amount of the death benefit needed. This concept might allow you to get back into the tax-free insurance game, because the high premium costs are replaced by low interest costs. It's worth taking a look.

2. The premium cost is below $100,000 for one person, but you want to insure two or more people (say for a buy-sell agreement or several key people). The combined premiums will allow you to reach or exceed the $100,000 premium mark.

The variations of this concept are endless. For those with the need, this may be a valuable tax-saving and wealth building option.

Remember, this article does not attempt to cover all uses of this concept or all of the rules, traps and exceptions. Please contact me if you need more information.

Related Content

How to Determine the Currently Active Work Offset Number

Determining the currently active work offset number is practical when the program zero point is changing between workpieces in a production run.

Read MoreHow to Mitigate Risk in Your Manufacturing Process or Design

Use a Failure Mode and Effect Analysis (FMEA) form as a proactive way to evaluate a manufacturing process or design.

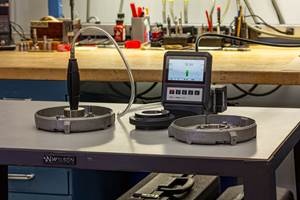

Read MoreHow to Choose the Correct Measuring Tool for Any Application

There are many options to choose from when deciding on a dimensional measurement tool. Consider these application-based factors when selecting a measurement solution.

Read MoreRethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.png;maxWidth=150)

.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)