The Yankee Clipper Got Clipped . . . By The IRS

Joe DiMaggio, unquestionably one of the real baseball legends of all time, has gone to the big ballpark in the sky. He knew how to use his arm and his glove, but mostly his bat, to win countless ballgames.

Share

Hwacheon Machinery America, Inc.

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

Joe DiMaggio, unquestionably one of the real baseball legends of all time, has gone to the big ballpark in the sky. He knew how to use his arm and his glove, but mostly his bat, to win countless ballgames.

But his last time at bat (with the IRS pitching) was a disaster. I'm sure he didn't know the rules of the estate tax game. Certainly the person who drew his last will and testament didn't know them either.

A great book by Richard Ben Cramer, titled The Loneliest Hero, is a fun read about the life and style of Joe. A few quotes: "Joe DiMaggio . . . spent his last years obsessed with money and privacy. Taxes had driven him out of San Francisco . . . Joe . . . changed his residence to Hollywood, Florida . . . (where) there was no income tax, no estate tax."

But Joe's estate got clobbered by the federal estate tax. Here's the part of the story you should know.

Joe had normal desires as to where he wanted his wealth to go: to his family. He died single and left the bulk of his estate to his two grandchildren and four great-grandchildren. About 60 percent of the estate passed to his two granddaughters. The great-grandchildren are beneficiaries of trusts (created in the will) ranging in amounts from $250,000 to $500,000, a total of $1.5 million. Not only was there a significant estate tax problem because of the 55 percent estate tax bracket, but the gifts to his grandchildren and great-grandchildren were also subject to the generation skipping tax (GST) on transfers in excess of $1 million.

Now, follow the heavy hitter numbers the IRS rolls up. Assuming that the $1 million GST tax-free exemption applies to the transfers to the granddaughters, for each greatgrandchild to receive $250,000, the estate will be hit by estate and GST taxes of $611,111. For each great-grandchild receiving $500,000, the estate will be pounded for $1.2 million.

How does the IRS get to such outrageous numbers? Here is the sad formula for each $10,000 hit by their double-play tax: First, 55 percent estate tax ($5,500) leaves $4,500, and second, 55 percent of $4,500 ($2,475) for GST tax leaves a paltry $2,025.

There are dozens of strategies Joe could have used to out-hit the IRS. Instead of listing them here, I'm going to direct you to my Web site, www.taxsecretsofthewealthy.com.

How To Win The Tax Rate Game

Do you think the current 39.6 percent highest income tax rate is high? I do. But it's all relative. Following is a little chart that shows you the highest income tax rates at various times in our yo-yo income tax history:

- 1914— 16%

- 1952-1954— 92%

- 1980— 70%

Yes, looking back, it could be worse. The real question is how do you save income taxes? The best strategies revolve around the word "divide." That is, divide your income. Divide among as many taxpayers that you have or can create (such as multiple corporations). Even if the tax brackets are lowered, division is your tax friend.

The ultimate tax enemy is the estate tax. It can rob you of up to 55 percent of your wealth. But an organized plan can get all of your wealth to your heirs and completely finesse the estate tax. Center stage are such strategies as a grantor retained annuity trust or a defective trust to transfer your business, yet keep you in control for as long as you live; a family limited partnership for most of your other assets; and an irrevocable life insurance trust to create tax-free wealth.

Your estate plan must use strategies that are implemented now, while you are alive. A will and a trust guarantee the IRS a large payday when you go to the big business in the sky.

Now, the final question: What's the highest rate in the present tax system? It's a double-barreled shotgun blast aimed straight at your qualified-plan (such as a profit-sharing plan, 401(k) or rollover IRA) funds. The shocking rate is a sky-high 73 percent.

Here's how the robber-baron tax works: take $1 out of your plan, and 40 cents goes to the IRS for the 40 percent income tax. Die with the 60 cents, and the IRS grabs 55 percent, or 33 cents. To summarize: The IRS gets 73 cents out of every dollar, and your family only 27 cents. But take heart, you can legally take the heart out of the IRS's game by using a strategy known as the "subtrust." This strategy allows you to win both the income tax game and the estate tax game.

My goal for 2001 is to show every reader of this column how to win the tax game. But you must be proactive. Sorry, we don't know how to eliminate the income tax. But with proper planning we can cut deep into the IRS's share.

Related Content

What are Harmonics in Milling?

Milling-force harmonics always exist. Understanding the source of milling harmonics and their relationship to vibration can help improve parameter selection.

Read More4 Steps to a Cobot Culture: How Thyssenkrupp Bilstein Has Answered Staffing Shortages With Economical Automation

Safe, economical automation using collaborative robots can transform a manufacturing facility and overcome staffing shortfalls, but it takes additional investment and a systemized approach to automation in order to realize this change.

Read More4 Commonly Misapplied CNC Features

Misapplication of these important CNC features will result in wasted time, wasted or duplicated effort and/or wasted material.

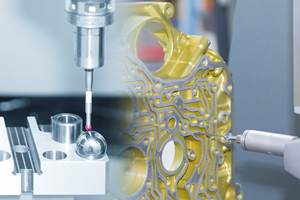

Read MoreRethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read MoreRead Next

Building Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read More

.png;maxWidth=150)

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)