Keep Your Wealth In The Family

It’s sad, but true: Most successful business owners spend a lifetime accumulating wealth, but when they die (or when their surviving spouses die), they lose at least half of their wealth—by law—to the IRS. Do you always have to be a heartbeat away from enriching the IRS? Not if you know what to do and how to do it.

Share

ECi Software Solutions, Inc.

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

Hwacheon Machinery America, Inc.

Featured Content

View More

.png;maxWidth=45)

DMG MORI - Cincinnati

Featured Content

View More

It’s sad, but true: Most successful business owners spend a lifetime accumulating wealth, but when they die (or when their surviving spouses die), they lose at least half of their wealth—by law—to the IRS. Do you always have to be a heartbeat away from enriching the IRS? Not if you know what to do and how to do it. Actually, you can use the same law to get ALL of your wealth intact—with all taxes, if any, paid—to your family.

Did you ever wonder how there can be such a big difference? In one case, the IRS robs half the wealth. In another case the family keeps all the wealth—legally.

Why does the IRS win so often? Based on my experience, here’s the reason: Computers. If you have seen an estate planner recently, you’ll understand. Armed with a computer program, the planner estimates what your wealth will be when you die. The program is driven by estimating your life expectancy, inflation, after-tax earnings and what you might spend. For example, a popular computer program using the typical assumption for a husband (age 61) and wife (age 58) predicts that their $3.5 million in assets, including a family business, will grow to $18 million in 29 years (the life expectancy of the last to die of the couple). The program estimates the estate tax liability at $8.3 million.

Then, using attractive color charts and graphs, the program suggests various tax strategies to reduce (but not to eliminate) that monstrous $8.3 million estate tax bill. The final computer result: About 40 percent of the family’s wealth will be lost to the IRS. Unacceptable!

How do we approach the same type of business-owned estate tax problem? Well, we don’t use computer programs. Instead, we focus on your wealth and how to get it all to your family, with all taxes, if there are any, paid in full. The following is an overview of the five-step approach we use to keep your wealth and your business in the family.

- Freeze estate. We freeze the value of your assets for estate tax purposes. You will continue to control your business and other assets for as long as you live.

- Reduce the value of specific assets for tax purposes: (a) A QPRT (qualified personal residence trust) for your residence; (b) an IDT (intentionally defective trust) for your business; (c) a FLIP (family limited partnership) for other assets such as real estate, publicly held stock, bonds and other investments; and (d) proper valuation of your family business (taking discounts allowed by the tax law).

- Get into a tax-free environment. There are two basic tax-free environments: life insurance (earnings on the cash surrender value of life insurance are tax-free) and charity (a charitable lead trust or a charitable remainder trust). The idea is to get into one or both of these as quickly as possible. Then you ride the tax-free gravy train for as long as you live, and often, your family can continue the ride even after you pass on.

- Create wealth using the government’s money. For example, burn a $100 bill. It’s gone. Out of your estate. If you are in a 55 percent estate tax bracket, you burned $55 of the IRS’ money and $45 of your money. The idea is to buy life insurance (with the IRS paying 55 percent of the premium) and keep the policy proceeds out of your estate (the policy should be owned by an irrevocable life insurance trust). If you have money in a qualified plan—401(k), rollover IRA, pension or profit sharing plan—use a strategy (subtrust) where the IRS pays about 75 percent of the premium. Put another way, you should burn the IRS’ money, not yours.

- Make the final test. Always ask your professional advisor this question: Will my family wind up with ALL my wealth? If the answer is not an unequivocal “Yes,” get a second opinion.

Want to learn more about this fascinating don’t-lose-your-wealth-to-the-IRS subject? Visit my Web site at www.taxsecretsofthe wealthy.com.

Related Content

6 Machine Shop Essentials to Stay Competitive

If you want to streamline production and be competitive in the industry, you will need far more than a standard three-axis CNC mill or two-axis CNC lathe and a few measuring tools.

Read More6 Variations That Kill Productivity

The act of qualifying CNC programs is largely related to eliminating variations, which can be a daunting task when you consider how many things can change from one time a job is run to the next.

Read MoreHow to Calibrate Gages and Certify Calibration Programs

Tips for establishing and maintaining a regular gage calibration program.

Read MoreHow to Determine the Currently Active Work Offset Number

Determining the currently active work offset number is practical when the program zero point is changing between workpieces in a production run.

Read MoreRead Next

5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read MoreRegistration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

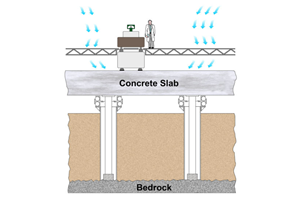

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.png;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)