How To Transfer Your Business Without Losing A Dime

Joe, the 61-year-old owner of Success Company (a C corporation), recently asked me to evaluate two plans designed to transfer his business to his family. Mary, Joe’s wife, is 53 years old, and they have a 31-year old son, Sam.

Share

Joe, the 61-year-old owner of Success Company (a C corporation), recently asked me to evaluate two plans designed to transfer his business to his family. Mary, Joe’s wife, is 53 years old, and they have a 31-year old son, Sam. Success Company is worth about $4 million and has enjoyed about 10 percent profit growth for each of the last 5 years. This growth is expected to continue well into the future. Joe's total net worth is about $9.5 million including a residence, various investments, and $900,000 in a profit sharing plan.

The core of both plans was a $4 million insurance policy on Joe’s life. In the first plan, the life insurance policy would be owned by Sam. Joe would gift Sam the annual premiums. At Joe’s death, Sam would buy Success Co.'s 499 shares from Joe’s estate for $4 million. In the second plan, Success Co. would own the $4 million in life insurance as keyman insurance and would redeem the 499 shares from Joe’s estate.

For either plan, the final results would be the same. Sam would own 100 percent of Success Co. and the estate would have $4 million in cash from the life insurance proceeds instead of $4 million in stock.

Why was this desirable? Because the estate would get a raised basis equal to the fair market value of the 499 shares on the date of Joe’s death. Additionally, no estate tax is due because the $4 million of insurance proceeds will wind up in Mary’s trust and receive the benefits of the 100 percent tax-free marital deductions.

Joe liked what he heard. However, he still had one question: Can we improve the final results of the plan? Either plan is certainly better than no plan at all. As a matter of fact, the plans I just outlined (or some variation of these plans) are the most popular ways of transferring a business to the next generation. However, I always turn down such plans for two reasons. First, the value of the stock will probably continue to grow, and any excess of the original $4 million will enrich the IRS by 55 cents for each dollar of excess (or $550,000 per $1 million). Secondly, when Mary passes on, the IRS is guaranteed 55 percent (using 2011 estate tax rates) of the $4 million in life insurance. The family will receive $1.8 million, while the IRS will take $2.2 million.

Here is the three-step plan we put in place for Joe, one you may want to consider as well:

Step 1. Success Co. elected S corporation status. We recapitalized the company so Joe would end up with 99.5 percent of the voting stock (100 shares). This allows Joe to keep control of Success Co. for as long as he lives. Joe then transferred the nonvoting stock (19,900 shares) to an intentionally defective trust (IDT). The IDT gets about 99 percent of the value of Success Co. out of Joe’s estate.

Step 2. We made appropriate amendments to the profit-sharing plan by creating a subtrust and acquiring $4 million of second-to-die life insurance on Joe and Mary. We also created an irrevocable life insurance trust (ILIT) to acquire $2 million of life insurance on Joe’s life. Because of the subtrust and ILIT, the $6 million in insurance proceeds will not be subject to income tax or estate tax. Every penny will go to Joe and Mary’s family tax free.

Step 3. We created a family limited partnership (FLIP) to hold Joe's investments and started an annual gift-giving program to give limited partnership interests in the FLIP to Joe and Mary’s other two children (who are not in the business).

The three-step plan we substituted for the original proposed plans will increase the amount of wealth that Joe and Mary will leave to their family by an estimated $5.5 million. Best of all, the plan has zero impact on Joe and Mary’s lifestyle, and they have absolute control of all their assets for as long as they live.

Related Content

Tips for Designing CNC Programs That Help Operators

The way a G-code program is formatted directly affects the productivity of the CNC people who use them. Design CNC programs that make CNC setup people and operators’ jobs easier.

Read MoreHow to Mitigate Risk in Your Manufacturing Process or Design

Use a Failure Mode and Effect Analysis (FMEA) form as a proactive way to evaluate a manufacturing process or design.

Read More6 Variations That Kill Productivity

The act of qualifying CNC programs is largely related to eliminating variations, which can be a daunting task when you consider how many things can change from one time a job is run to the next.

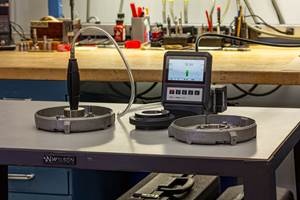

Read MoreHow to Choose the Correct Measuring Tool for Any Application

There are many options to choose from when deciding on a dimensional measurement tool. Consider these application-based factors when selecting a measurement solution.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreSetting Up the Building Blocks for a Digital Factory

Woodward Inc. spent over a year developing an API to connect machines to its digital factory. Caron Engineering’s MiConnect has cut most of this process while also granting the shop greater access to machine information.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More

.jpg;maxWidth=300;quality=90)