How to Eliminate Estate Taxes

The goal of a comprehensive estate plan should be to eliminate taxes, not just reduce them.

Share

Takumi USA

Featured Content

View More

Autodesk, Inc.

Featured Content

View More

For years I have been telling readers that if they use the right tax strategies and work with the right professionals (typically a lawyer, CPA and insurance consultant), they can create a comprehensive plan to conquer estate taxes. Every time. Legally. Whether they are young or old, married or single, insurable or not.

Unfortunately, the goal of the typical estate planning advisor is to reduce a client’s estate taxes. My goal is to completely eliminate estate taxes.

Over the years, three types of readers have called me for help: those who have an estate plan but want a second opinion, those who have no plan at all and those who have been working on a plan for years but just can’t seem to get it done for some reason.

In a study of 14 readers conducted last year, eight fell into that first category, including Joe, a 64 year old from Kansas married to Mary, age 63. His gut told him that his existing estate plan needed a second opinion.

Joe started his business, Success Co., from scratch and wanted to transfer it to his son, Sam. Joe’s existing estate plan was a typical, traditional plan with an A/B trust. However, this was really just a “death plan” and couldn’t save him a dime in estate taxes.

Joe laid out both his assets and his goals, and they reflected an almost-perfect cross-section of our 14 survey respondents.

Assets

He basically held five types of assets:

• Two residences—Joe and Mary’s principal home, worth $700,000, and a vacation home valued at $400,000.

• Success Co., which has been professionally valued at $9 million.

• A 401(k) plan and IRA totaling $1.6 million.

• Life insurance on Joe with a $1 million death benefit and cash surrender value (CSV) of $375,000.

• Investments (mostly real estate and a stock/bond portfolio) worth $5 million.

For estate tax purposes, his estate was worth $17.7 million, and his potential estate tax liability was about $2.8 million.

Goals

Joe’s goals were that:

• He and Mary maintain their lifestyle for as long as they live.

• He retain control of his assets, including Success Co., for the rest of his life.

• He transfer ownership of the business to Sam in a tax-effective way.

• All of his assets go to his family after his death, without a reduction for estate taxes.

Strategies

The key to achieving this last goal is reducing the value of Joe’s assets for estate tax purposes, or getting the maximum discounts allowed by the tax laws. The strategy I recommended is asset-based, tackling each type of asset in a different way.

In terms of the two residences, I suggested that 50 percent of the title to each of them be

put into each of Joe’s and Mary’s living trusts, typically identified as Trust A and Trust B.

This would amount to a discount in the value of these assets of 30 percent or $330,000.

To address Success Co., I suggested the creation of 100 shares of voting stock and 10,000 shares of non-voting stock. Joe would retain the voting stock and control of the company, while the non-voting stock would ultimately go to Sam. This would secure a discount of 40 percent or $3.6 million.

Joe created an intentionally defective trust (IDT) and sold the non-voting stock in Success Co. to the IDT for $5.4 million, its discounted value. The company’s cash flow pays the IDT, and the trust pays Joe. Every dollar he receives in principal and interest is tax-free (no capital gains tax and no income tax). After Joe is paid in full, Success Co. will be out of his estate and owned by Sam.

To maximize the benefits of his retirement accounts, Joe also undertook a retirement plan rescue (RPR), whereby he used the funds in his 401(k) and IRA (which is normally double-taxed) to buy $5 million dollars in second-to-die life insurance on himself and Mary. This insurance was set up in such a way that every penny of the $5 million death benefit would be tax-free. Joe cancelled the $1 million policy he had previously purchased and pocketed the $375,000 CSV, also tax-free.

To reduce the value of investment assets for tax purposes, real estate should be held in limited liability companies (LLCs), and interest in these LLCs and other investments should be transferred to family limited partnerships (FLIPs). This would yield discounts of 35 percent or $1.17 million on Joe’s investment assets.

Finally, Joe and Mary are also taking advantage of gift giving programs by gifting $28,000 per

year to their three children and seven grandchildren, in addition to giving a portion of their

$10.68 million wealth.

By capitalizing on the discounts and strategies described here, Joe was able to not only eliminate his estate tax liability but also create additional tax-free wealth for his family.

Related Content

4 Rules for Running a Successful Machine Shop

Take time to optimize your shop’s structure to effectively meet demand while causing the least amount of stress in the shop.

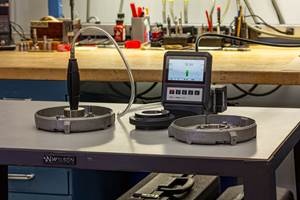

Read MoreRethink Quality Control to Increase Productivity, Decrease Scrap

Verifying parts is essential to documenting quality, and there are a few best practices that can make the quality control process more efficient.

Read More4 Tips for Staying Profitable in the Face of Change

After more than 40 years in business, this shop has learned how to adapt to stay profitable.

Read MoreHow to Choose the Correct Measuring Tool for Any Application

There are many options to choose from when deciding on a dimensional measurement tool. Consider these application-based factors when selecting a measurement solution.

Read MoreRead Next

Registration Now Open for the Precision Machining Technology Show (PMTS) 2025

The precision machining industry’s premier event returns to Cleveland, OH, April 1-3.

Read MoreBuilding Out a Foundation for Student Machinists

Autodesk and Haas have teamed up to produce an introductory course for students that covers the basics of CAD, CAM and CNC while providing them with a portfolio part.

Read More5 Rules of Thumb for Buying CNC Machine Tools

Use these tips to carefully plan your machine tool purchases and to avoid regretting your decision later.

Read More

.jpg;maxWidth=300;quality=90)